To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Now when I say altcoins left Bitcoin behind, I’m specifically referring to the weekend. We all know Bitcoin is still far ahead of even the strongest altcoins, and they have miles to go before catching up. That said, Bitcoin has remained extremely steady over the last two days, trading within a few hundred dollars of where it was during Saturday’s morning note. It continues to hover around $118K. Meanwhile, altcoins have pushed higher, led by the number two in the space, Ethereum.

Ethereum briefly reclaimed the $3,800 level for the first time since the opening week of the year, and is currently up over 4% on the day. It’s set to notch its seventh consecutive green day and 13 out of the last 15. It’s not just Ethereum, the broader altcoin market has rallied too. While the weekend gains across most coins have ranged between 1% and 5%, this consistent upside helps reinforce the current market stance: we’re in altseason.

What do we look for to confirm altseason?

I’ve said it, others have said it, but how do we know when we’re in altseason? What signals do we look out for?

Altseason refers to the period when capital rotates out of Bitcoin and into altcoins, to the point where altcoins begin leading the market and significantly outperform. Historically, we’ve seen this flow begin with Bitcoin, then move into Ethereum, then into large-cap altcoins, and finally into smaller caps. This doesn’t mean that other altcoins aren't rallying while Ethereum leads, they are, and we’re seeing it now, but the focus remains on Ethereum and protocols built around it at this stage.

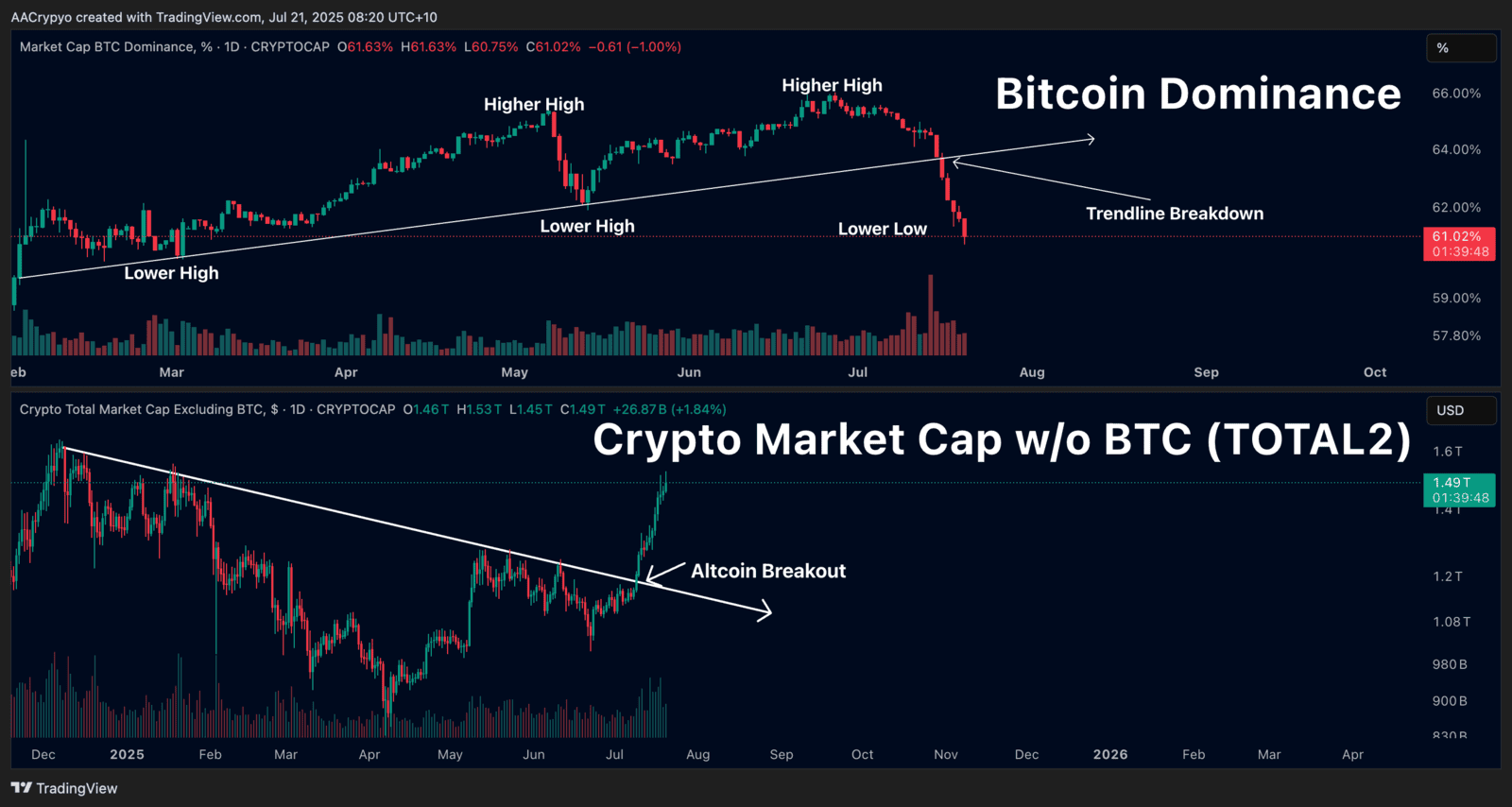

The first major signal is a breakdown in Bitcoin dominance. If you look at the chart below, you can clearly see Bitcoin dominance has lost its bullish structure and broken below the trendline. This signals funds are flowing out of Bitcoin. But where are they going? That brings us to the second signal: the total altcoin market cap. It has broken out simultaneously, showing that capital is rotating into altcoins.