To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

As we enter the final stretch of the year and the Christmas and holiday period sets in, market volumes, liquidity and order book depth typically decrease. This has been clearly reflected in price action, but we may now be seeing signs of volatility returning. Bitcoin briefly reclaimed $90K yesterday, gaining over 2% intraday, but once again closed around $88K which has acted as a magnet for over a month.

Looking ahead to the end of the week, there are three key price levels to keep an eye on. Yesterday we discussed max pain for Bitcoin options which currently sits near $96K. For those unfamiliar, max pain refers to the strike price at which the largest number of option contracts expire worthless. This creates an incentive for bulls to push the price higher in an attempt to minimise losses. At the same time, the yearly open at $93.5K remains a major area of resistance that bears have successfully defended throughout the entire consolidation period.

To the downside, support remains around $83K to $84K. This area not only aligns with the recent higher low defended by bulls last week, but also matches the average entry price of spot Bitcoin ETF buyers, according to Glassnode. This likely explains why bulls have been so determined to protect this zone from further declines.

In summary, the levels to watch over the coming sessions are $93.5K and $96K to the upside, and $83K to $84K to the downside. These represent the key zones that align with market structure, ETF positioning and option expiry pressure. Although volumes and liquidity are low during this time of year, it gives either side more opportunity to step in and makes it easier to push price in their desired direction.

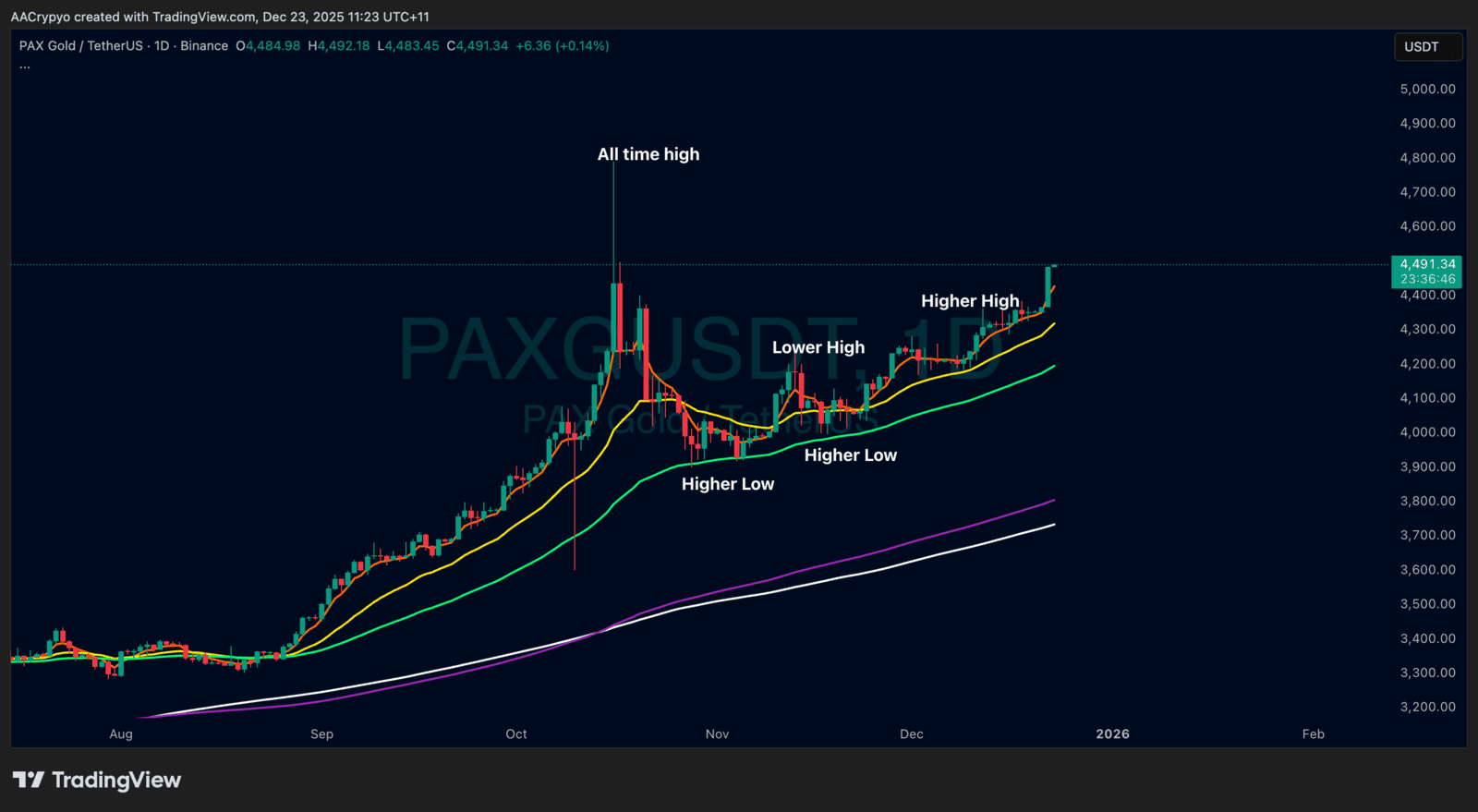

Stormrake Spotlight: Pax Gold (PAXG) ($4,491)

Stormrake Spotlight: Pax Gold (PAXG) ($4,491)