To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The record breaking US government shutdown appears to be coming to an end within the next few days, as the Senate has finally agreed to pass the bill to reopen the government. After 40 days, the longest shutdown in history, the vote has cleared the Senate and now heads to the House of Representatives. Once passed, it will land on President Trump’s desk for signing, expected to occur during Thursday’s US session.

The deadlock, largely driven by disagreements over Medicare spending and short term funding measures, has finally been broken. This comes as welcome relief to many Americans who rely on government contracts, jobs or benefits. With the government reopening, income streams should resume, easing pressure on households.

During the shutdown, it is presumed many were forced to dip into savings or sell assets to cover daily expenses, especially as the Treasury General Account remained shut. This created sell pressure on liquid assets such as cryptocurrency. Now that the shutdown is ending, we could see a reversal, with those who had to sell now looking to reaccumulate, potentially supporting prices.

The Treasury General Account alone holds over $1 trillion, ready to be redistributed into the economy. Risk on assets are already responding to this injection of liquidity.

Markets have reacted sharply. The S&P 500 climbed over 1.5% yesterday to kick off the week, the Nasdaq jumped more than 2%, and gold rallied back above $4,100, up nearly 3%. Bitcoin also closed green again, up over 1% and currently battling to stay above $106K. Even if today turns red, it is not a concern — we have seen a near 6% move higher without any real pullback.

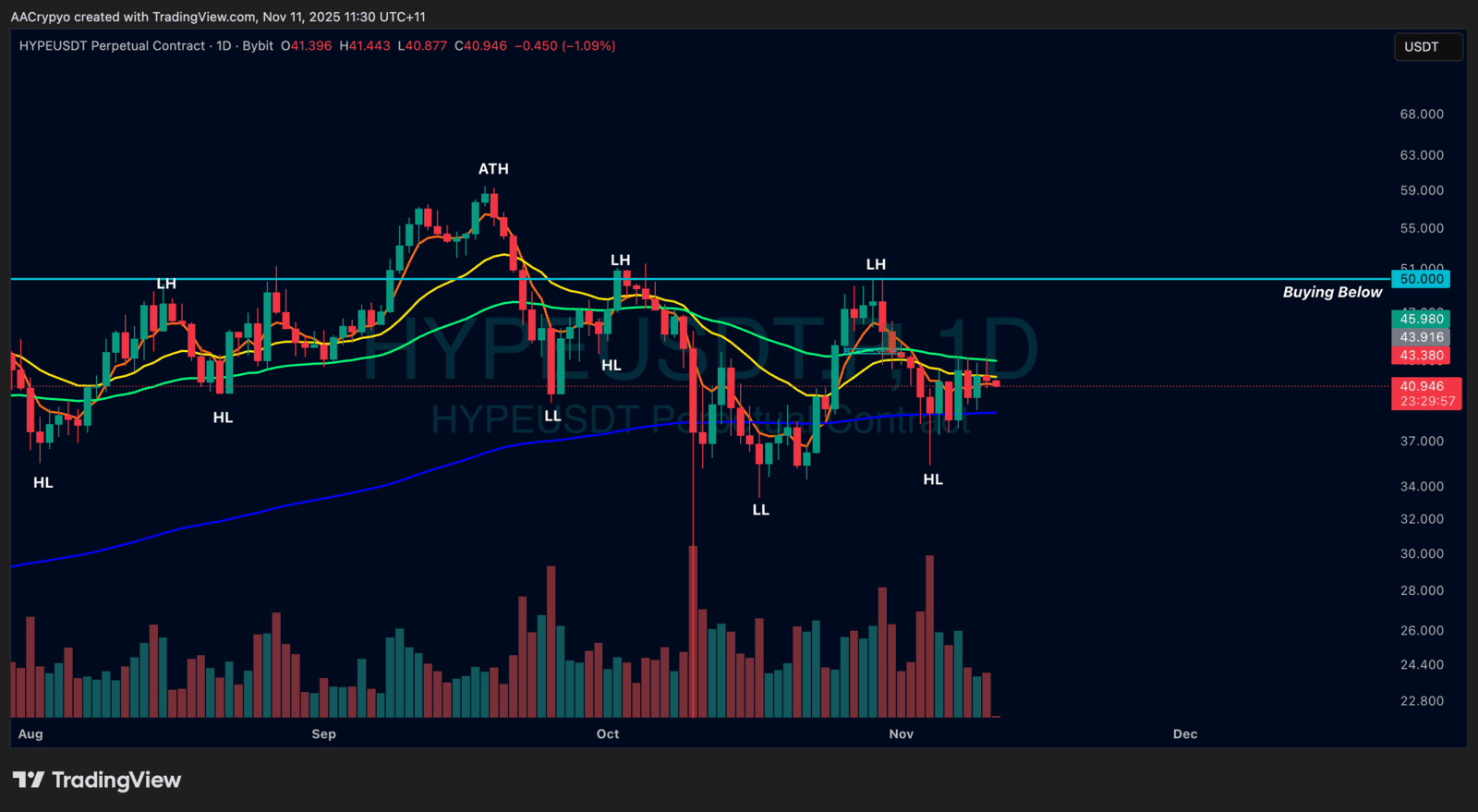

Stormrake Spotlight: Hyperliquid (HYPE) ($40.94)

Stormrake Spotlight: Hyperliquid (HYPE) ($40.94)