To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Overnight we received a key data figure that typically plays a major role in central bank decision making: unemployment. Both inflation and employment data are considered when deciding whether to cut, hold or hike rates. So why are we getting employment figures now after the Federal Reserve already cut rates last week?

As many of you would know, the US government recently experienced its longest shutdown in history, lasting 43 days from late September to early November. During that period, the Bureau of Labor Statistics was closed, meaning key data releases were delayed. The employment data released overnight was from November and should have been published 11 days ago.

The figures showed the unemployment rate rising to 4.4% from the forecasted 4.3%, matching the September figure. While a rise in unemployment may appear negative, it actually helps in the fight against inflation. Fewer people in work generally leads to reduced consumer spending, which can ease inflationary pressure. This type of data supports the Federal Reserve’s broader goal of cooling the economy, giving them more confidence to cut interest rates if inflation continues to trend lower.

Had this data been released on time, it likely would not have altered the Fed’s decision. If anything, it could have increased the probability of the rate cut we saw last Thursday.

Looking ahead to the next interest rate decision in late January, this delayed figure will no longer be relevant as a fresh employment report will be released next month. That is why the market reaction overnight was muted, even though such data would typically create some volatility.

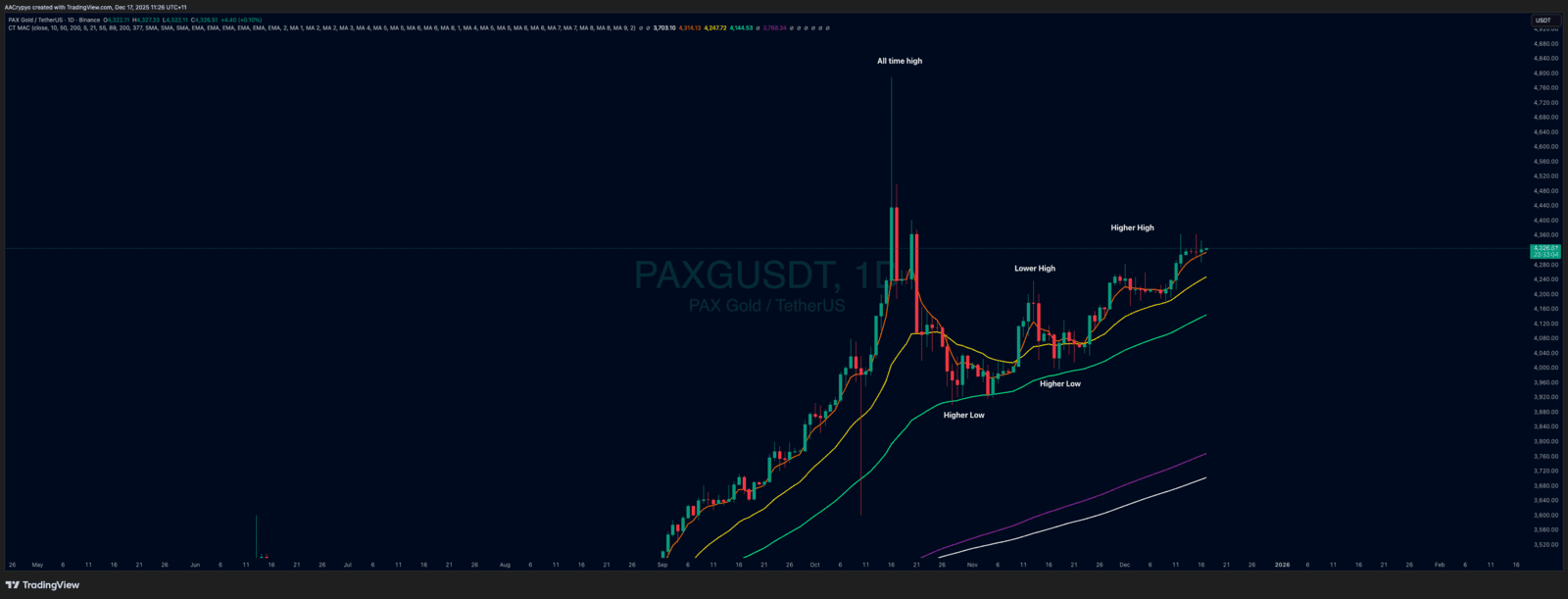

Stormrake Spotlight: Pax Gold (PAXG) ($4,326)

Stormrake Spotlight: Pax Gold (PAXG) ($4,326)