To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

October had all the promise of a strong month. ‘Uptober’ had everything lined up for new all-time highs and bullish continuation. While that played out briefly with a new high at $126K, the excitement was short lived. A major liquidation event sent Bitcoin lower and the rest of the month struggled to regain any momentum for the bulls.

Traditional indices all closed higher to end the month. Gold dipped slightly but remains above $4,000. The US Dollar has now seen three straight days of buying following Powell’s hawkish comments.

Bitcoin bounced yesterday, up just over 1%, but still ended the month in the red. A nearly 4% drop puts a dampener on the ‘Uptober’ narrative.

We now look to November, which historically brings strong returns with the average move sitting at 40.5%. While US-China trade talks have eased some tensions, uncertainty still hangs over markets with interest rate policy and inflation in focus after Powell’s recent hawkish stance. The US government shutdown has now lasted over 30 days, making it the second longest on record. Many estimate it could stretch another two weeks, which would make it the longest ever. With no key data being released during the shutdown, policymakers are essentially flying blind. The sooner it ends, the better.

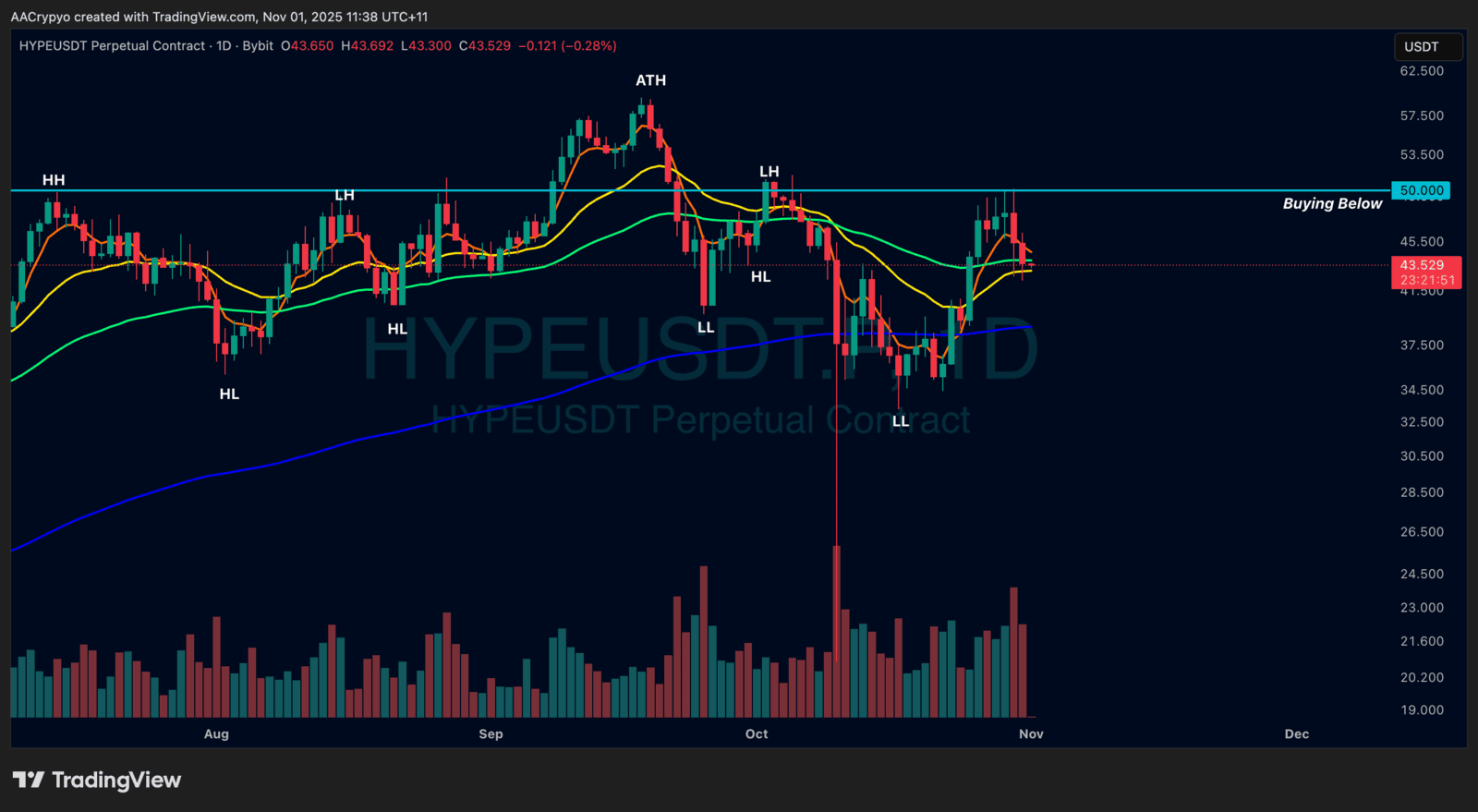

Stormrake Spotlight: Hyperliquid (HYPE) ($43.49)

Stormrake Spotlight: Hyperliquid (HYPE) ($43.49)