To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

A green day across markets offered bulls some much-needed relief following the recent sell-off. All eyes were on the FOMC meeting minutes overnight, with traders anticipating volatility, and they got it across the board in risk-on assets.

The US session opened poorly. Within the first hour, the S&P 500 dropped 1%, the Nasdaq lost over 1.5%, and Bitcoin nearly dipped to $112K. However, risk assets rebounded strongly throughout the session. While traditional markets still closed red, they managed to recover most of their early losses. Bitcoin is now up over $2K from its session low. Ethereum and Solana are neck and neck, each up around 6.5%, while Binance Coin (BNB) continues its impressive run, pushing to fresh all-time highs at $880. Chainlink remains the standout performer, up over 12% and extending its lead as the top mover of the month.

Turning to the FOMC minutes, they provided more clarity on where policymakers stand. Most remain more concerned about persistent inflation than a softening labour market. While the majority are confident in the current policy approach, expectations for a September rate cut have cooled. The probability of a 25bps cut now sits at 81%, down from over 95% just last week. There is still plenty of time and a number of key data points ahead, so the first cut of the year remains uncertain.

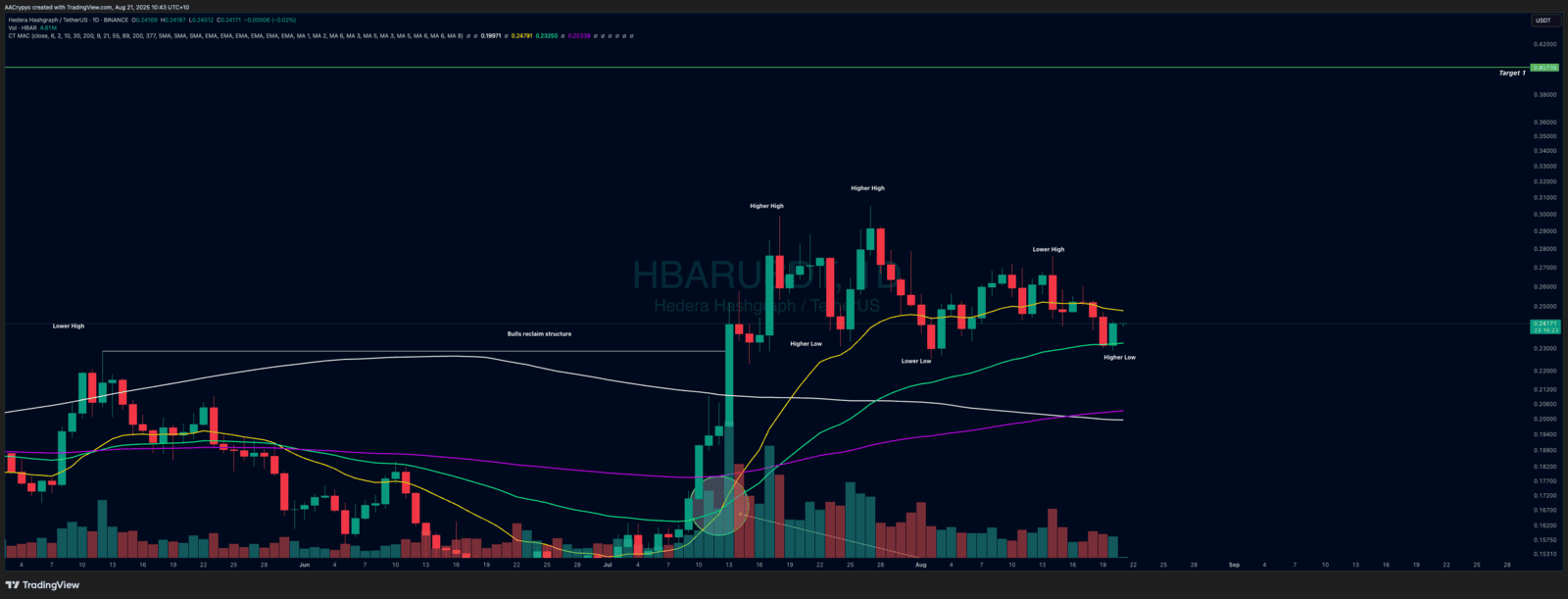

Stormrake Spotlight: Hedera (HBAR) ($0.241)

Stormrake Spotlight: Hedera (HBAR) ($0.241)