To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

We’ve had another volatile 24 hours. Bitcoin has tried to push higher but failed, and has since turned bearish on the day. Altcoins continue to struggle, with most down over 4%. The crypto market remains in a fearful state, with heightened volatility following the weekend’s events that wiped out leveraged positions and cleared large chunks of bids from exchange order books.

Although the bears currently have control and fearful sentiment dominates, Bitcoin is still in a strong position to make a run at new all time highs before the end of the month. But we need to see the bulls step in soon and drive price higher.

Traditional markets are in earnings season, and momentum there is being dictated by results from major sectors. Yesterday, the S&P 500 and Nasdaq both closed higher off the back of strong earnings from the banks. Gold gained over 1.5% and broke through $4,200 an ounce for the first time in history. Silver added 3% and is now just 1% away from all time highs again.

It feels a lot like September, where crypto is pulling back while every other asset class pushes higher. And yes, that is the current picture. But to put things in perspective, Bitcoin and the broader crypto market just had their worst day in history five days ago. Zooming out, we are still less than 15% from all time highs. Once bullish momentum returns and the market clears the sour sentiment left by Saturday’s sell off, Bitcoin could push for all time highs within days. Stay smart, remain resilient and continue to accumulate when opportunities present themselves, which they are doing now.

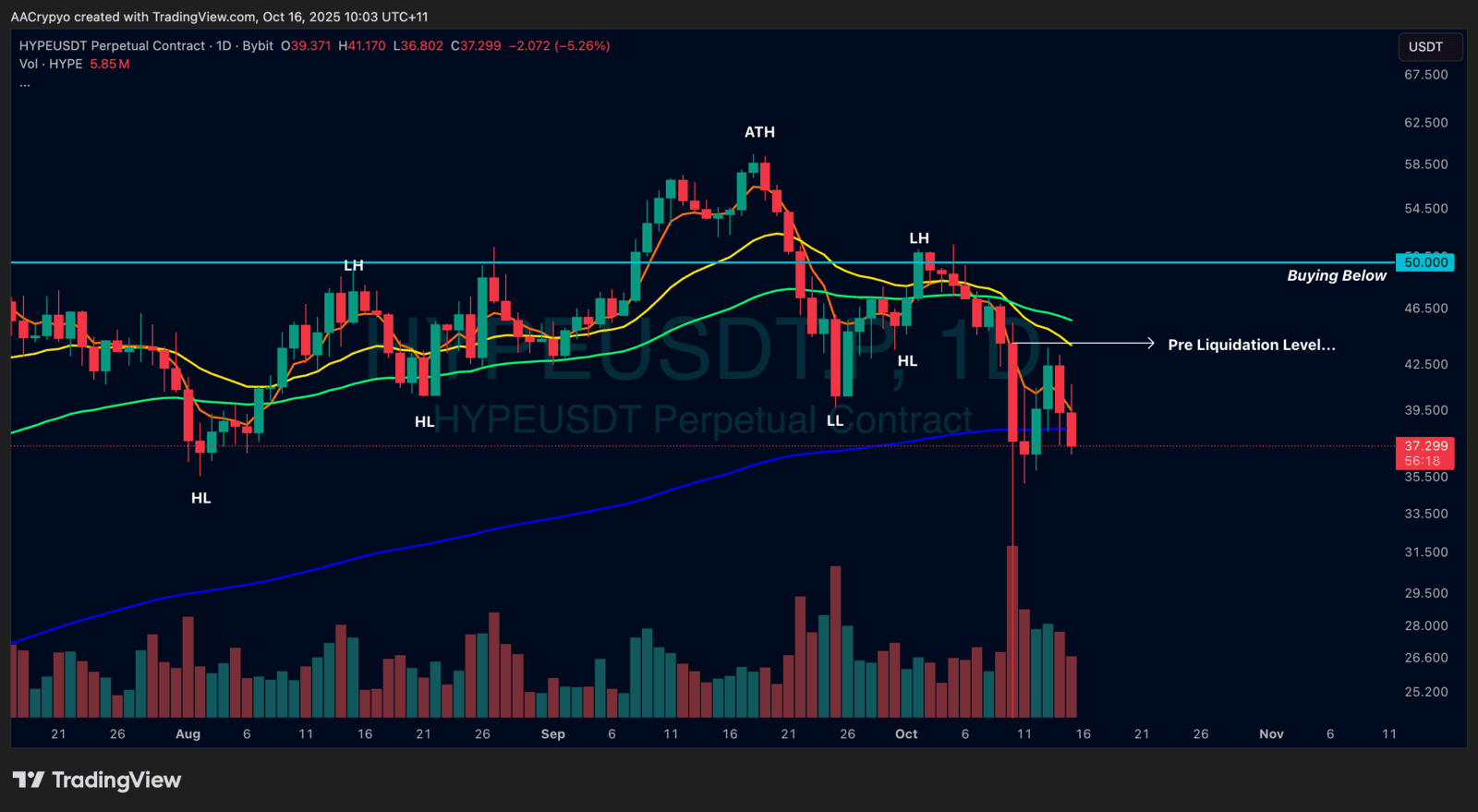

Stormrake Spotlight: Hyperliquid (HYPE) ($37.27)

Stormrake Spotlight: Hyperliquid (HYPE) ($37.27)