To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

On Saturday we warned of the volatility ahead of one of the biggest macro events this month: the US interest rate decision set for Thursday morning. This, along with the Bank of Japan’s decision later in December, marks a key moment for global markets.

Bitcoin has already started to reflect that anticipation. After spending most of the weekend consolidating around $89K, the market saw a sharp breakdown late last night. Bears appeared to take control as Bitcoin dropped nearly 2% within the hour, falling back below $88K. This move was triggered by a sudden wave of whale-driven selling. Analysts believe it was a coordinated effort as around 15,565 BTC, roughly $1.39 billion, hit the market in just one hour. Major players including Wintermute, Binance, BitMEX and Fidelity were all active sellers during that period, strongly suggesting a coordinated move.

But the downside was short lived. Bitcoin rebounded almost immediately, rallying nearly 5% over the next four hours. It was a swift reversal and a clear bear trap. However, bulls did not gain much ground either. Price has since pulled back nearly 2% from the early morning high and is now hovering just above $90K.

It was a wild night and possibly just a taste of the volatility to come. The move highlights how thin liquidity currently is and reinforces that market manipulation remains a real risk. On the bright side, this volatility did not result in major liquidations. Throughout 2025 we have seen several days where over $1 billion in leveraged positions were wiped out and October’s $20 billion flush is still fresh in many minds. In contrast, last night saw less than $450 million in liquidations which suggests significantly reduced leverage across the system compared to a month or two ago. That is a healthy sign.

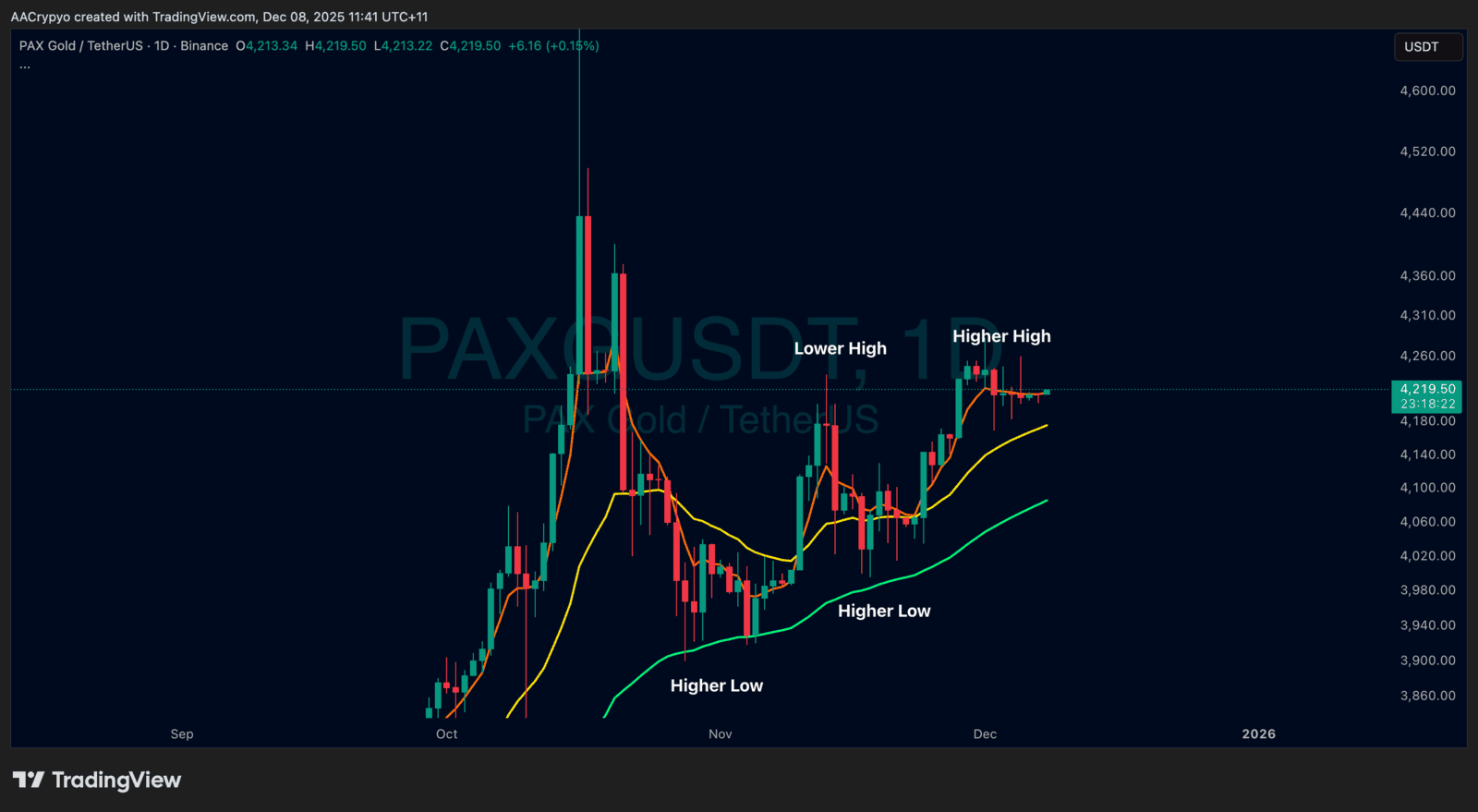

Stormrake Spotlight: Pax Gold (PAXG) ($4,219)

Stormrake Spotlight: Pax Gold (PAXG) ($4,219)