To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Yesterday we covered how the current situation in Venezuela, and the US intervention there, is likely to impact Bitcoin, specifically from the perspective of the United States and how its actions may lead to either increased liquidity or rising inflation. But there is more to this conflict and how it could ripple out into others.

We are not geopolitical commentators and do not claim to be experts in that field, but it is important to be aware of the potential fallout this move could trigger across other global tensions.

Over the past few years, we have seen a series of conflicts unfold across the world. Last year it was Israel and Iran, in 2022 it was Russia and Ukraine, and the China and Taiwan situation has remained an ongoing point of pressure. One thing all of these conflicts have in common is that they tend to weigh on risk-on assets. When the US intervened during the Israel-Iran tension last year, Bitcoin dropped. In early 2022, when Russia invaded Ukraine, Bitcoin fell again. But in both cases, it was not long before Bitcoin recovered and moved higher.

It was February 2022 when the conflict between Russia and Ukraine began. Bitcoin was trading around $38K and dropped 10% in a single day to a low of $34K. However, it closed that day in the green and rallied over 40% in the following month, coming just shy of $50K. Last June, the escalation between Israel and Iran saw Bitcoin fall 10% over two weeks. But, as has been the theme with conflict-driven pullbacks, it was short-lived, Bitcoin went on to rally 25% over the next two months and reached a new all-time high. These periods of geopolitical stress tend to be short-term bearish but often present high-conviction opportunities for active buyers.

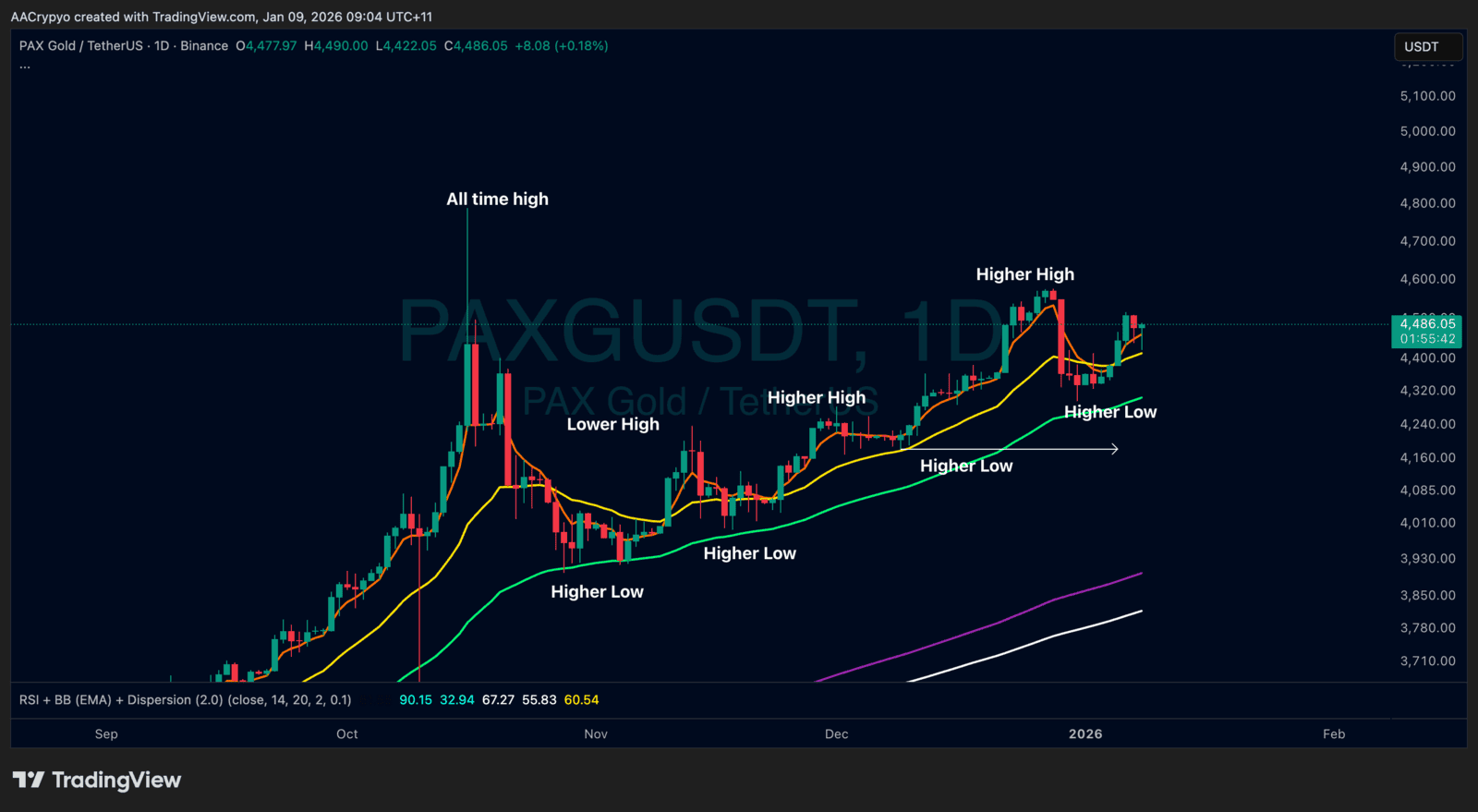

Stormrake Spotlight: Pax Gold (PAXG) ($4,486)

Stormrake Spotlight: Pax Gold (PAXG) ($4,486)