To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin has almost fully retraced Saturday morning’s rally, which was driven by Jerome Powell hinting that rate cuts are expected next month. However, the pullback hasn’t been mirrored across the wider crypto space, with Ethereum and Solana holding up remarkably well in comparison.

While Bitcoin is currently down nearly 4% from Saturday’s high, Ethereum hit yet another all-time high overnight, just shy of $5,000. Solana also remains strong, continuing to post higher highs over the weekend. This divergence reinforces where we are in the cycle. Bitcoin is looking tired, Ethereum is fresh, and Solana seems to just be getting started. It’s altseason.

Historically, Bitcoin tends to consolidate while other majors extend their rallies. This isn’t a signal to rotate out of Bitcoin entirely, but rather an opportunity to focus more on alts while they move. Once profits are realised in alts, rotating back into Bitcoin can be a powerful play.

Bitcoin traded as low as $110,680 this morning. Why? An old holder sold 24,000 BTC worth $2.7 billion, which caused the price to drop $4,000 within minutes. The selloff triggered major liquidations, wiping out over $300 million in leveraged long positions in under an hour. That address reportedly still holds over 150,000 BTC.

This wasn’t the only notable whale movement. Another large holder sold over $1 billion worth of Bitcoin and rotated part of it into Ethereum long positions on Hyperliquid. It’s another sign of the phase we’re in within this bull cycle.

The fact that Bitcoin reversed the entire Powell rally is obviously a concern, but the context matters. A whale selloff and rotation into alts is not a sign that the run is over. Bitcoin has already bounced over 2.5% from this morning’s low, showing strong demand from buyers. Absorbing a 24,000 BTC sale and moving to reclaim the drop is a positive sign.

Expect Ethereum and Solana to continue leading the market while Bitcoin consolidates. Once Bitcoin resumes its move, Ethereum, Solana, and other majors are likely to outperform in a big way.

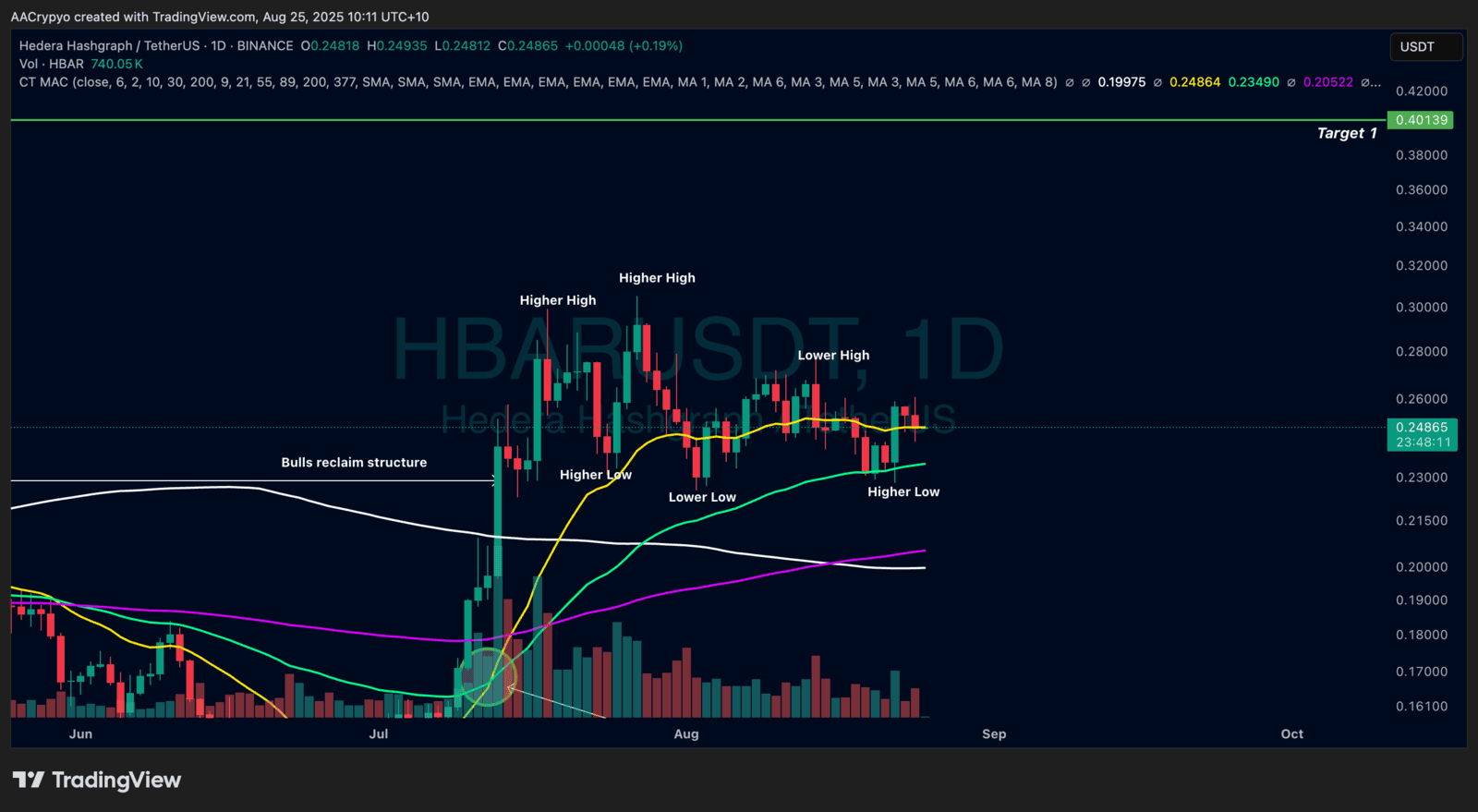

Stormrake Spotlight: Hedera (HBAR) ($0.248)

Stormrake Spotlight: Hedera (HBAR) ($0.248)