To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The price action noise over the weekend may have caused some people to miss Trump’s nomination for the next Federal Reserve Chairman, Kevin Warsh. He is set to replace Jerome Powell once his term expires in May.

We all know Trump wants interest rates lower. He has been extremely vocal about this, but Powell has not followed suit, which has led to sustained tension between the two. The US has trillions of dollars of debt to refinance this year, and doing so in the current environment of higher interest rates significantly increases borrowing costs.

Warsh, however, has historically been viewed as a traditional hawk when it comes to monetary policy. He has long leaned towards tighter policy and higher rates to combat inflation, so his nomination may come as a surprise to some. Under current macro conditions, though, his stance appears to have shifted. Warsh has recently adopted a more dovish tone on short term interest rates, publicly advocating for lower rates. He has cited productivity gains from AI, deregulation, and stronger growth potential as factors that could allow easing without reigniting inflation.

There are two more Fed meetings before Warsh steps in, but probabilities currently favour no cuts at either meeting.

Now that we have some context on Warsh, what does this mean for Bitcoin specifically?

In the short term, Bitcoin has sold off over the past few days following his announcement. This triggered a $2.5 billion liquidation day, pushing price to current levels. But that is three days of price action. Warsh will serve as chairman for four years, so it is important not to get caught up in short term volatility. It is very unlikely that a three day move is indicative of his tenure as chair.

Warsh is not an unknown figure in finance. He has been around for years and has spoken extensively about Bitcoin in interviews and public discussions. In fact, he should be viewed as broadly pro Bitcoin. Some notable quotes from past interviews include:

“If you’re under 40, Bitcoin is your new gold.”

“Bitcoin does not make me nervous.”

“It can often be a very good policeman for policy.”

“It’s the newest and coolest software that will provide us an ability to do things that we could have never done before.”

“Bitcoin [is] a sustainable store of value, like gold.”

These are just a handful of pro Bitcoin comments from the incoming Fed Chairman. While Trump has been erratic at times in his second term, and much of the crypto market has turned red since his return to office, he has successfully assembled a pro Bitcoin administration. Trump himself is supportive of Bitcoin, alongside SEC Chair Paul Atkins, key advisors such as Crypto Czar David Sacks, US Treasury Secretary Scott Bessent, CFTC Chair Michael Selig, and now the incoming Federal Reserve Chairman.

Despite the bearish price action over recent months, the most powerful government in the world has established an openly pro Bitcoin and crypto administration, while rolling out new regulation designed to benefit the space. They also hold Bitcoin, whether personally or through the Strategic Bitcoin Reserve established last year. Bitcoin has backing from the largest possible institutional power.

It is unlikely that current price action persists indefinitely. Investors have sold Bitcoin and commodities amid fears that Warsh’s historically hawkish reputation could strengthen the dollar, which has already bounced since his nomination. These periods create major opportunities for those actively looking to accumulate undervalued, proven assets such as Bitcoin. BTC is down 37% from its October all time high, and opportunities like this are extremely rare. Be smart with positioning. You want to be on the same side as one of the biggest powers in the world.

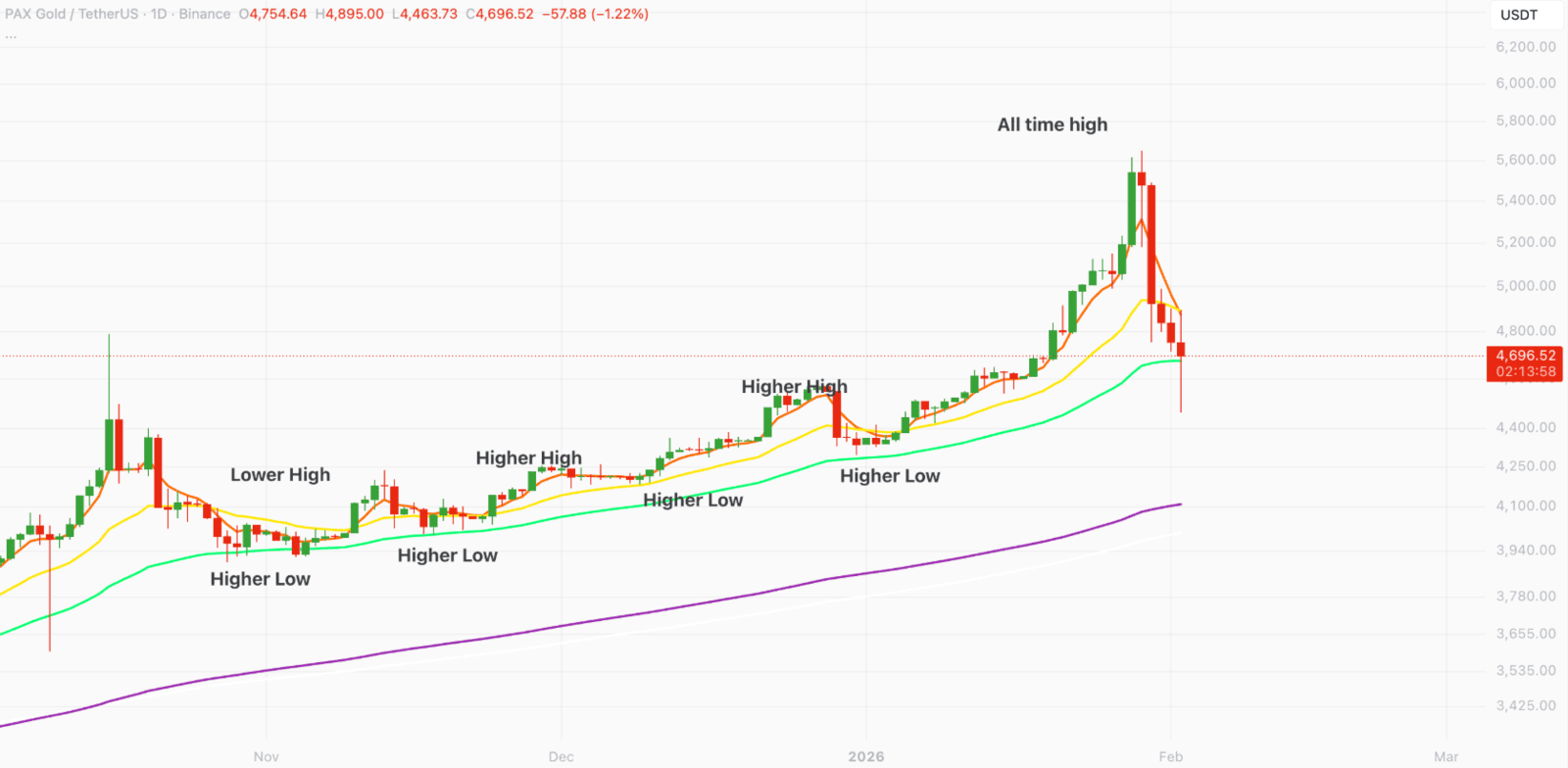

Stormrake Spotlight: Pax Gold (PAXG) ($4,695)

Stormrake Spotlight: Pax Gold (PAXG) ($4,695)