To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Silver just had its worst day since 2020, pulling back 9%. It opened its first trading session since Boxing Day by flying up to $84, but within 70 minutes it had fallen over 10%, dragging the entire metals complex down with it. After a sharp pullback, it is now trading at $72. While that is an incredibly large single day retracement, silver still remains up over 140% year to date.

Yesterday we discussed the potential rotation of capital from commodities into risk on markets. Almost on cue, the shift seemed to begin just hours after the morning note was published.

As silver and metals started to pull back, Bitcoin began its move. It rallied quickly back above $90K, a run that looked like it could finally break free from the $88K magnet that has held it in place for the past month. But that strength was short lived. In a surprising twist, Bitcoin coupled itself to silver’s weakness, dropping 4% over the next eight hours and even briefly dipping below $87K. It is now consolidating just above $87K once again.

It has been the same story for Bitcoin for over a month now and looks set to continue until we see a sustained breakout in either direction. Until then, expect more consolidation, but that also opens the door for accumulation at what could be undervalued Bitcoin levels.

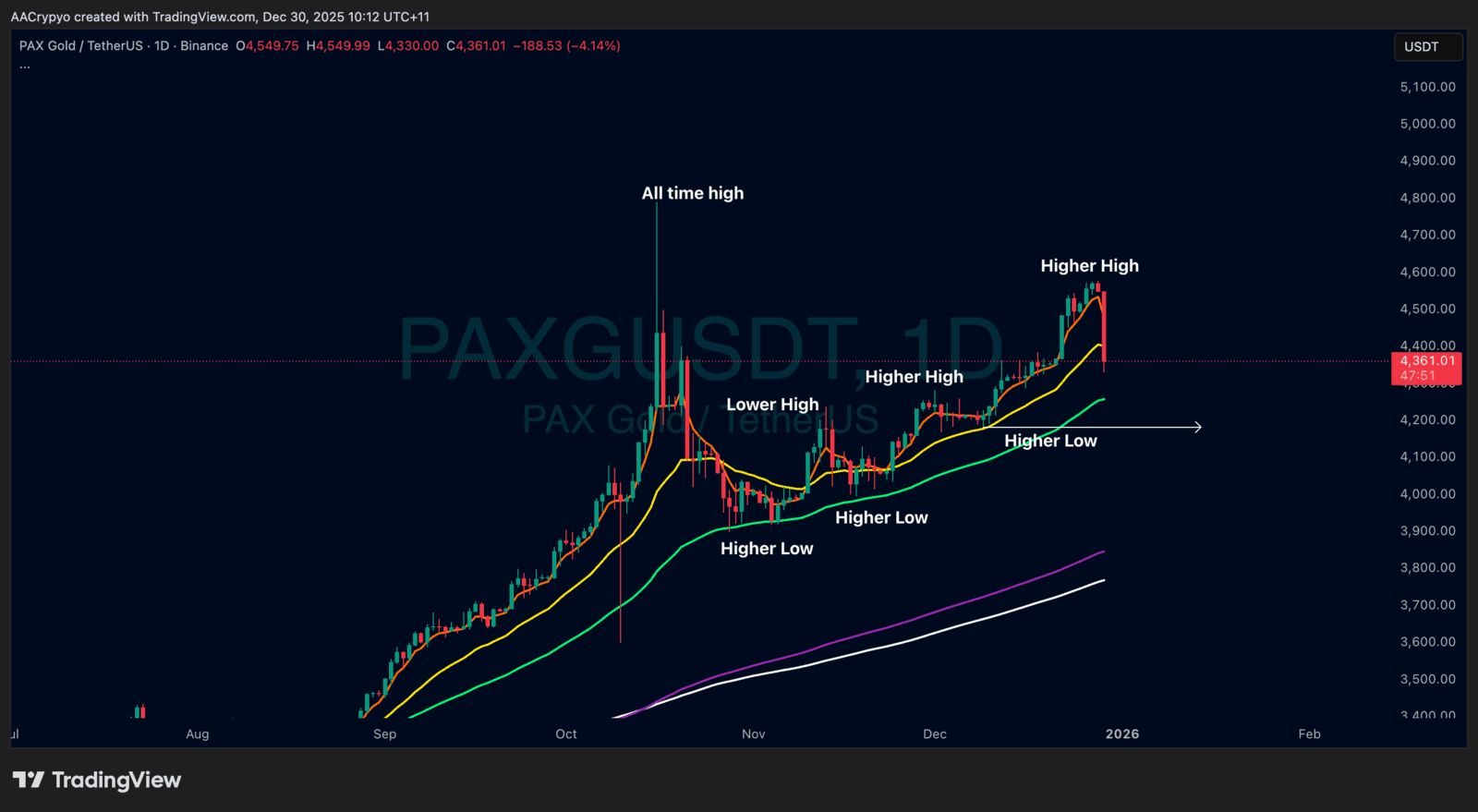

Stormrake Spotlight: Pax Gold (PAXG) ($4,362)

Stormrake Spotlight: Pax Gold (PAXG) ($4,362)