To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

One of the key events we mentioned yesterday was the US Supreme Court’s upcoming ruling on the Trump tariffs, a policy suite that has been aggressively reintroduced since his return to office. How will Bitcoin be affected by all of this?

To understand the potential impact, we need to take a closer look not only at the tariffs themselves but also at the Supreme Court’s involvement.

Trump has been unapologetically heavy-handed when it comes to tariffs, whether in response to trade negotiations, alliances with US adversaries, or even personal disputes with world leaders. Since his inuaguration in January last year, exactly one year ago, he has imposed some form of tariff on nearly every country exporting goods to the United States. From the so-called Liberation Day tariffs to migration-related duties and renewed restrictions on China, tariffs have become a defining theme of his second term.

In late May, lower courts stepped in to assess whether these tariffs were legally justified, questioning whether Trump had overstepped presidential authority in unilaterally imposing them. That move kicked off a dramatic standoff between the White House and the judiciary. The formal Supreme Court involvement began in early September with the case ‘Trump v. V.O.S. Selections’ after the US Court of Appeals upheld an earlier ruling that the president had indeed exceeded his powers.

As of today, markets are on edge, awaiting the Supreme Court’s decision which is expected any day now. Prediction markets currently give just a 35% chance of a ruling in favour of Trump’s tariffs, implying a widely expected rejection. But even if the Court rules against them, that does not mark the end of the matter.

US Trade Representative Jamieson Greer has already stated that the administration of President Donald Trump would enact new tariffs almost immediately if the Supreme Court struck down sweeping global tariffs the president launched under an emergency law. Rather than bring clarity, a ruling against the tariffs could actually increase uncertainty, and markets do not respond well to that.

Bitcoin, as a risk-on asset, typically struggles during periods of heightened uncertainty. So the market’s reaction will likely hinge on Trump’s response following the Court’s decision. Volatility is almost guaranteed. The direction is less clear.

If the Court deems the tariffs unlawful, there is also the possibility of a mandated refund, effectively reversing the revenue collected on tariffs since 20 January 2025. That scenario could be seen as bullish, as the original tariff applications were bearish. Still, Trump remains a wildcard, and the full market impact will only be clear once the ruling lands.

Historically, Trump-related political shocks that spook risk-on assets tend to be short lived. For active investors, these periods often provide attractive dip-buying opportunities, with markets typically recovering and trading higher within months. Of course, past performance is not indicative of future results.

As of writing on 21 January, the Supreme Court has yet to issue its opinion. Prediction markets now expect the decision to land before 1 March, with a 75% probability priced in and a 19% chance of it occurring before February 1.

Meanwhile, market jitters continue. Fallout from renewed tariff threats around Greenland is mounting. US Treasury Secretary Scott Bessent insists the volatility has nothing to do with tariffs or Greenland, pointing instead to soaring Japanese bond yields which we highlighted yesterday. Realistically, it is a combination of both. Bond yields in Japan are rallying again, fuelling global fears, while geopolitical tensions over Greenland are fanning trade war concerns.

Risk-on markets are pulling back. The S&P 500 is now negative on the year after a 2% drop overnight. Bitcoin has slipped back below $90,000, while gold and silver continue to catch a strong bid as investors rotate into safer havens.

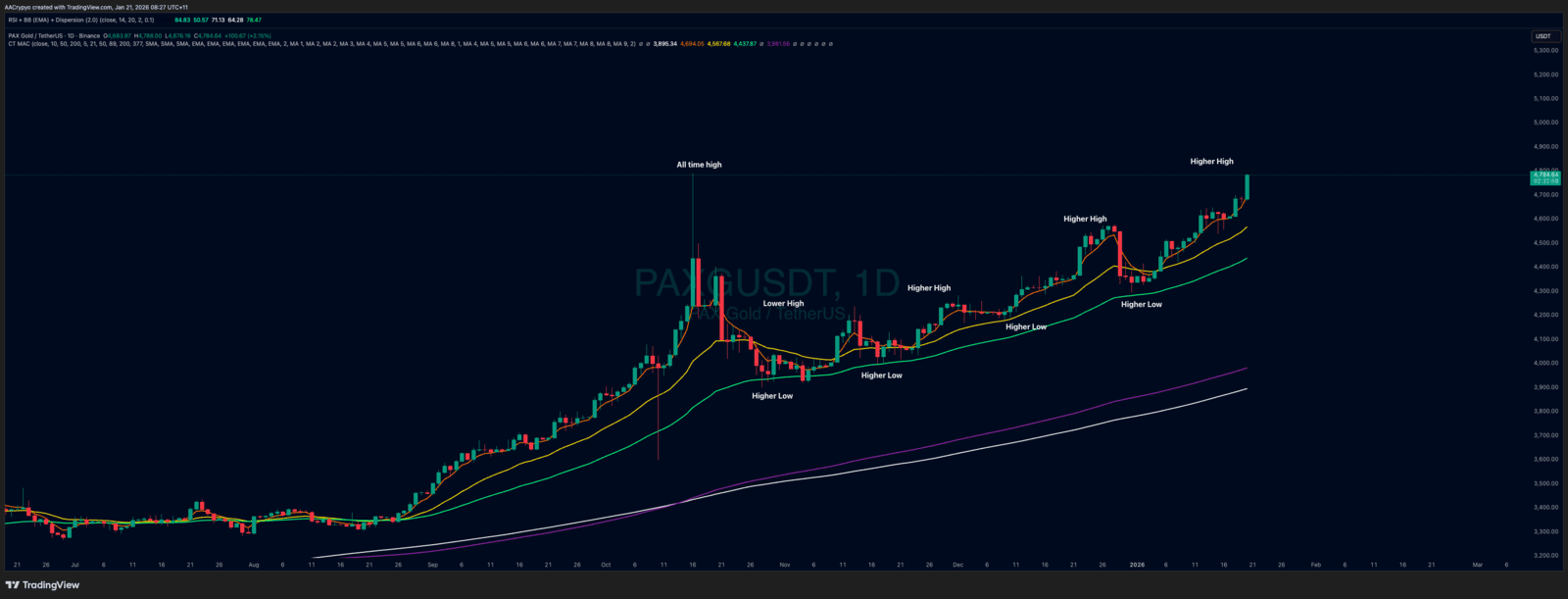

Stormrake Spotlight: Pax Gold (PAXG) ($4,784)

Stormrake Spotlight: Pax Gold (PAXG) ($4,784)