To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It was a rough weekend for Bitcoin and an even harsher one for altcoins. Saturday brought a continuation of the bearish price action, compounded by further escalations in US-Russia tensions.

The bears had already seized control, driving Bitcoin below $114K. Pressure intensified as Trump’s threats of expanded sanctions were largely dismissed, with Indian officials announcing on Saturday night that they would continue buying Russian gas despite US warnings. This dragged Bitcoin back to $112K, the previous all-time high and a key pullback level we highlighted in our July Rake Review. Altcoins fell even harder, cementing bearish dominance across the market. Spot holders are feeling the pain, but leveraged traders were hit the hardest, with over $1 billion in liquidations over the weekend, 90% of which were long positions. Another costly reminder of the risks of leverage.

Even the strongest altcoins have seen deep retracements, with some tipping into correction territory. Market leaders like Solana, Hyperliquid and Sui, which were driving momentum over the last month, have each corrected over 20% in recent weeks. By comparison, Bitcoin is down just 8% from its July all-time high. It is a sharp reminder that even during altseason, bull market corrections tend to punish altcoins far more than Bitcoin.

Sunday offered a brief reprieve as many altcoins managed to reclaim Saturday’s losses, with most engulfing the prior day’s red candles. Yet, the bears still hold the upper hand while Bitcoin trades around $114k. We now enter what could be a volatile week, with geopolitical tensions dominating investor sentiment. Markets remain on edge, knowing a single statement from Trump could trigger fresh uncertainty.

Stick to your plan, maintain your long-term conviction and view these pullbacks and altcoin corrections as opportunities to accumulate discounted positions.

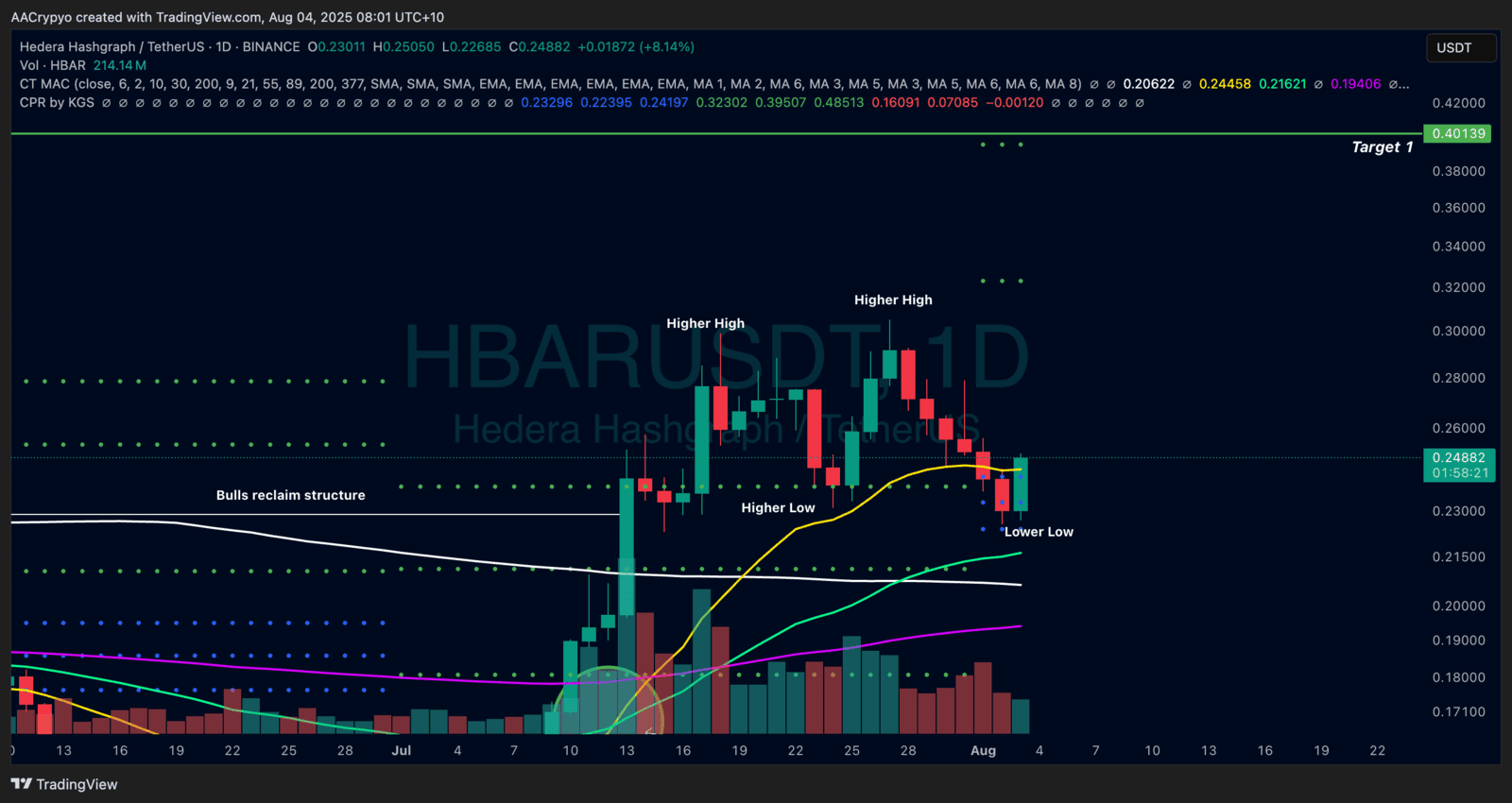

Stormrake Spotlight: Hedera (HBAR) ($0.248)

Stormrake Spotlight: Hedera (HBAR) ($0.248)