To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

On Saturday, the US struck three nuclear sites in Iran, effectively confirming its direct involvement in the Israel-Iran war. Trump had previously warned that a decision would be made within two weeks on whether to intervene. Combine that with Israeli Prime Minister Netanyahu urging the US to get involved, and he’s now got his wish. Tel Aviv’s stock market jumped 5.2% on the news of the attack, as investors viewed US involvement as a bullish signal for regional stability and Israel’s security outlook.

In a press conference following the strikes, Trump suggested the attacks could pave the way for peace, claiming it may now be easier to reach a deal with Iran. before ending with a final threat: “Peace or tragedy for Iran.”

Markets reacted sharply. Bitcoin dropped back to $100K on the announcement, with altcoins turning even deeper red. Sentiment slipped back into fear territory as investors waited to see whether Iran would retaliate. Safe to say they have not backed down. Missiles continue to be launched into Israel, and Iranian officials have warned the US: “Americans should expect greater damage and blows than ever before.”

Following the initial drop, Bitcoin managed to stabilise and consolidate above $102K. That was until late last night, when Iran approved the closure of the Strait of Hormuz in response to the US strikes. Roughly 20% of the world’s oil supply moves through this key waterway. Bitcoin immediately sold off, dropping below $100K for the first time since May 8, hitting a low of $98K. Altcoins corrected even harder.

Outside the majors, most altcoins are either approaching or already below their April lows. For context, Bitcoin was at $75K when alts were last at these levels. This highlights just how weak altcoins are in the current market, even while Bitcoin battles to stay above $100K. Bitcoin dominance has now risen to nearly 66%, its highest level since January 2021.

Although BTC’s bounce from $98K has lifted sentiment back into neutral territory, the market remains extremely nervous.

The US has now gone to China for assistance in preventing the closure of the Strait, though it is unlikely their plea will be met with much enthusiasm. China and Iran are allies, and China has consistently backed Iran in recent years.

With war-related uncertainty dominating sentiment, no one truly knows what is coming next. Further retaliation from Iran, possible involvement from Russia or China — the future is unclear. But smart money will likely use this period of conflict as an opportunity to accumulate undervalued altcoins and continue buying Bitcoin.

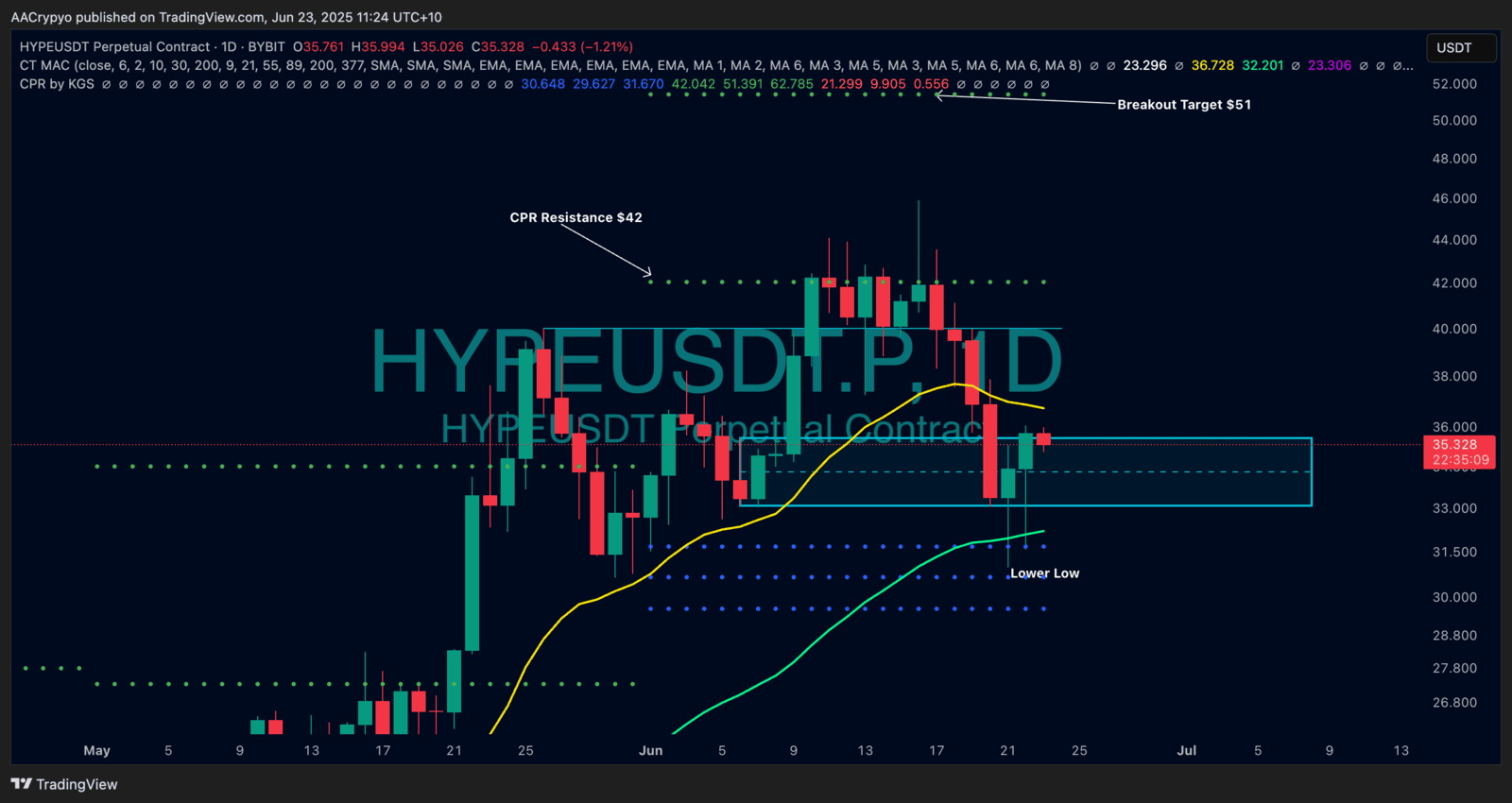

Stormrake Spotlight: Hyperliquid (HYPE) ($35.30)

Stormrake Spotlight: Hyperliquid (HYPE) ($35.30)