To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

To provide some context on this mini series, All Roads Lead to Rome, when the Roman Empire was at its peak and controlled much of the known world, roads were built to move goods and people towards the epicentre of the empire, Rome itself. Those roads also connected every controlled region back to that centre of power. Fast forward to the modern day and the European road network still reflects this idea. Travel far enough on certain routes and the likelihood is you end up in Rome.

The analogy here is Bitcoin. There are many possible future outcomes, but an increasing number of paths appear to converge on the same destination. Not certainty, not prediction, but a growing body of analysis that points towards Bitcoin reaching seven figures if it continues evolving into a global monetary asset.

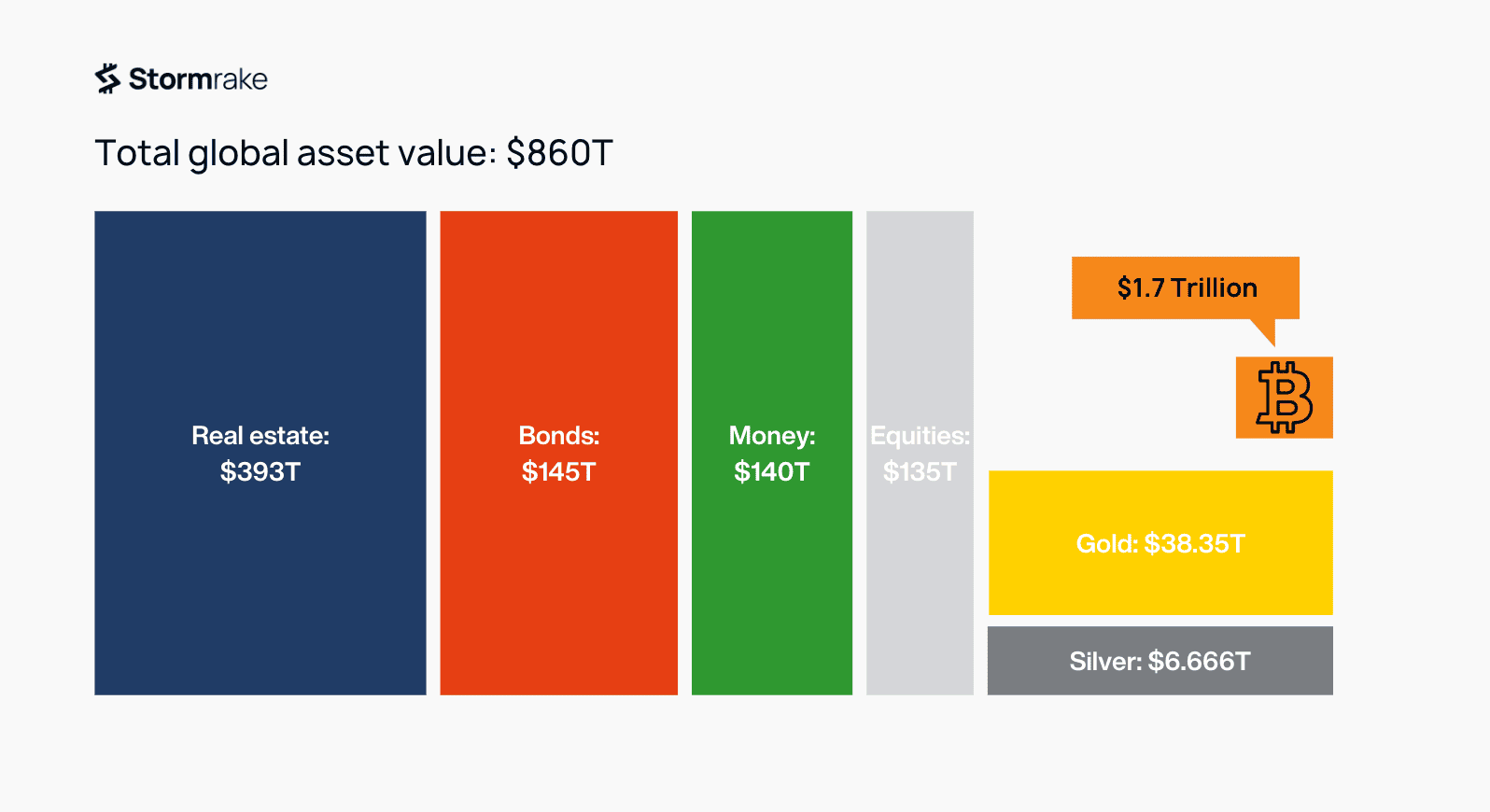

Yesterday we covered the broader framework of this series. Today’s focus is Bitcoin in comparison to other macro asset classes. When people first encounter Bitcoin at $70,000 per coin, many dismiss it immediately as being too expensive, often comparing it to gold at around $5,000 per ounce. This is a common misunderstanding among newer market participants. The nominal price of an asset tells you very little on its own. Market capitalisation is the more meaningful metric.

Market cap is calculated by multiplying the price of an asset by its circulating supply. In Bitcoin’s case, that supply is capped at 21 million coins. That hard limit is a defining feature of the network and plays a central role in any discussion around valuation.

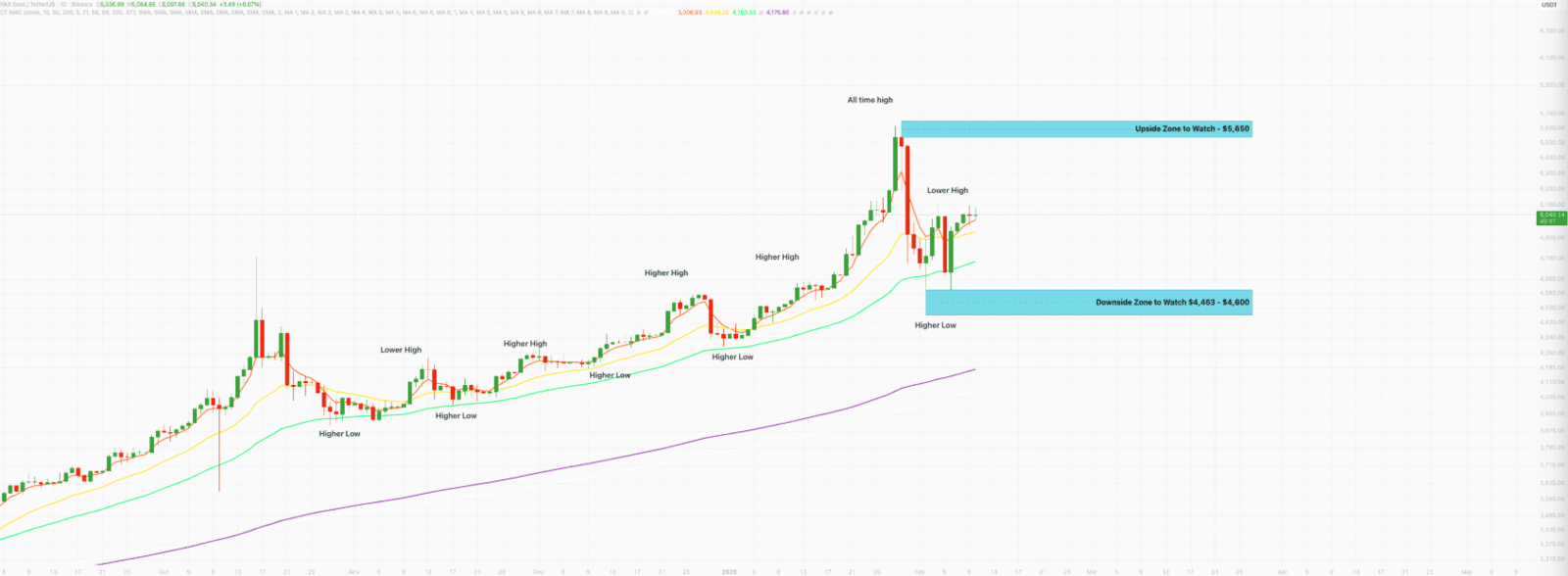

At present, gold has an estimated market capitalisation of approximately $38.35 trillion. Silver sits around $6.666 trillion. Bitcoin, by comparison, is still relatively small at roughly $1.7 trillion. This gap is important. It highlights not only how much larger gold and silver are as asset classes, but also why Bitcoin exhibits higher volatility. It takes far less capital to move the price of a smaller asset. This dynamic was clearly visible in 2023 and 2024, when Bitcoin price more than tripled as institutional participation began, particularly through spot ETFs.

Bitcoin’s $1.7 trillion market cap is often overlooked because the price per coin feels high. In reality, it underlines how early this asset still is. Bitcoin has existed for around 15 years, while gold and silver have served as assets for thousands. Today’s discussion is not about price targets, but about understanding Bitcoin’s potential through the lens of market capitalisation.

There are market participants who believe Bitcoin could eventually surpass both gold and silver by market cap. Some of these arguments centre on Bitcoin gradually taking on a similar role as a long term store of value or monetary hedge. Our approach over recent months, as reflected in the Morning Notes, has been slightly different, focusing on relative positioning rather than replacement narratives.

For the sake of this exercise, assume Bitcoin is priced at $70,000, giving it a market cap of roughly $1.7 trillion. If Bitcoin were to match silver’s current market cap of $6.666 trillion, the implied price would be approximately $275,000 per coin. Many consider this a conservative scenario in the context of a multi decade adoption curve, though it remains a hypothetical framework rather than a forecast.

This naturally leads to the next question. At $1 million per Bitcoin, what does the market cap look like? At that level, Bitcoin’s market capitalisation would be around $24.3 trillion. That figure would still sit below gold’s current estimated market cap today. Framed this way, the $1 million discussion becomes less about headline price and more about relative scale within the global asset landscape.

Bitcoin’s core design positions it as a form of money rather than a traditional investment vehicle. Discussions around its role as a global reserve asset remain theoretical, but they form part of the broader analytical landscape. Yesterday we explored a technical upgrade narrative. Today has been about market capitalisation. With further editions still to come, the recurring theme is clear. An increasing number of analytical roads appear to point in the same direction.

All roads may not guarantee Rome, but it is becoming harder to ignore how many of them lead there. In this case, Rome is the idea of Bitcoin reaching seven figures…

Stormrake Spotlight: Pax Gold (PAXG) ($5,040)

Stormrake Spotlight: Pax Gold (PAXG) ($5,040)