To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Another entry into the mini series, and arguably the most crucial and probable case for Bitcoin reaching the anticipated seven figure mark, is currency debasement and its eventual transition into the new global reserve currency.

Yesterday we discussed Bitcoin in comparison to gold and silver, highlighting how undervalued it remains relative to both on a market capitalisation basis. That framework alone provides a clear pathway to seven figures and beyond. But the real driver is not simply matching gold’s valuation. It is Bitcoin fulfilling its intended role as money.

Bitcoin was labelled “digital gold” early in its life. That narrative helped adoption. It gave traditional investors a familiar comparison. But Bitcoin’s end goal was never just to be a safe haven asset. It was built to be a monetary system.

Why Investors Bought Bitcoin Early

Many long term Bitcoin holders did not buy based on hype cycles. They bought based on structural understanding.

The same reasoning that drives investors to accumulate physical bullion applies here. A lack of trust in fiat currencies and the institutions controlling them. A desire for monetary sovereignty. Protection against debasement.

Over the last 12 months this shift has accelerated.

The current global reserve currency, the US Dollar, continues to weaken against nearly every asset. Whether through persistent money printing, fiscal expansion, or foreign exchange interventions, the purchasing power of the dollar continues to erode. Even when not officially framed as devaluation, policies such as yen intervention indirectly weaken the dollar as capital flows adjust.

This is not new to Morning Notes. We have repeatedly covered the structural fragility of the US Dollar.

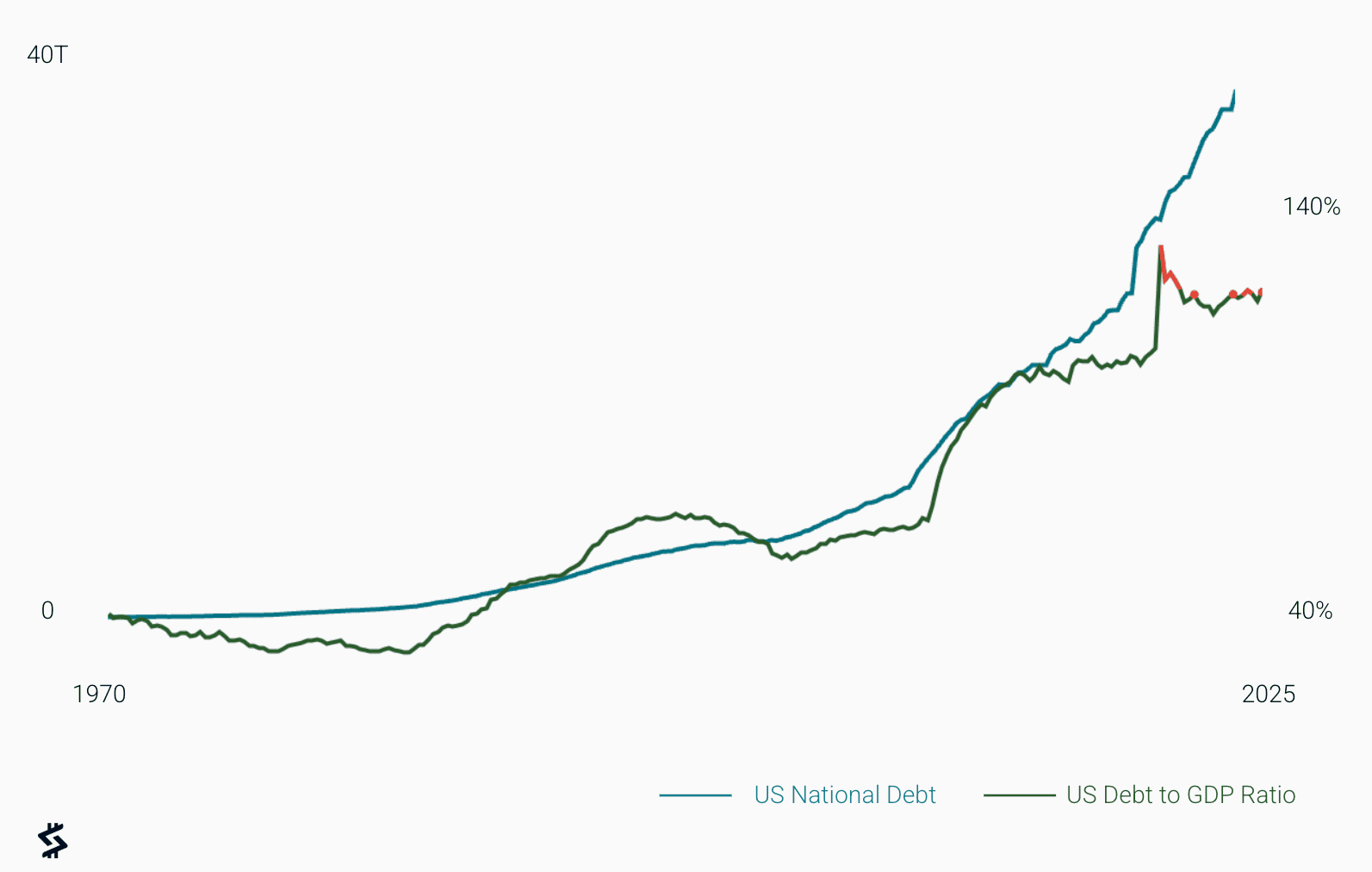

US national debt now stands at approximately $38.5 trillion and is projected to reach around $59 trillion within the next decade. Debt to GDP has surpassed 120%, a level that historically signals the beginning of reserve currency stress.

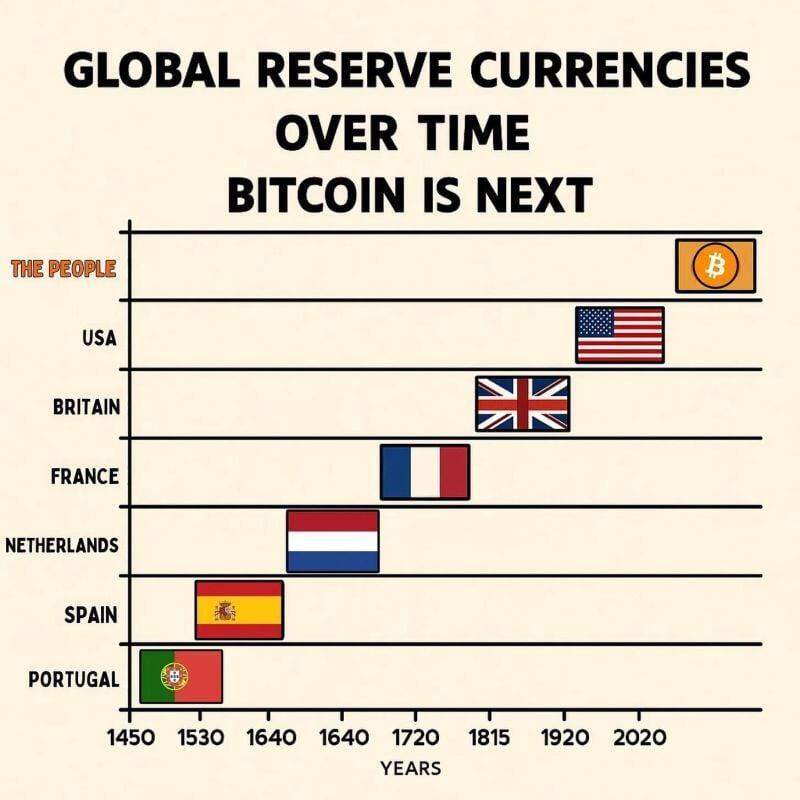

History provides precedent.

When the British Empire lost its global dominance, the Pound had exceeded a debt to GDP ratio of over 250%. It did not collapse into hyperinflation, but it did lose reserve status. Power transitioned. A new currency replaced it.

Reserve currencies do not fail overnight. They slowly lose trust.

The Changing World Order

Ray Dalio’s “Changing World Order” outlines how empires rise, peak under excessive debt burdens, and eventually decline as new powers emerge. The Dutch Guilder gave way to the Pound. The Pound gave way to the US Dollar following World War Two.

Today we see similar warning signs.

The US is carrying unprecedented debt levels. Geopolitical tensions are rising. BRICS nations are actively discussing alternatives to dollar settlement.

None of these individually end the dollar’s dominance. But collectively, they signal structural pressure.

The world does not tolerate an unstable reserve currency indefinitely.

What Replaces the Dollar?

If confidence continues to decline, what steps in?

It is unlikely to be gold or silver. Both have already played their role in prior monetary systems and have since solidified their roles as safe haven assets and strategic reserves.

It is also unlikely to be another centralised fiat currency. Replacing one debt based system with another does not resolve the core issue of trust and debasement.

Which leaves one clear candidate.

Bitcoin.

Bitcoin is decentralised. It has a fixed supply of 21 million. Its monetary policy cannot be altered. It is borderless and digitally native. It does not rely on the fiscal discipline of any government.

For the first time in history, there exists a monetary asset that is not tied to a sovereign balance sheet.

The Path to a Seven Figure Bitcoin

If Bitcoin fulfils this role and becomes the neutral global reserve asset, its valuation framework shifts entirely.

It would no longer be priced as a speculative risk asset. It would be priced as the base layer of the global monetary system.

In that scenario, a seven figure valuation is not speculative enthusiasm. It is a logical outcome of capital reallocating from weakening fiat systems into a fixed supply monetary asset.

This transition would not occur overnight. Reserve currency shifts unfold over decades. But the conditions that historically precede these transitions are already present.

Excessive sovereign debt. Currency debasement. Rising geopolitical tensions. Growing distrust in institutions.

All roads in monetary history eventually lead to a reset.

If Bitcoin becomes the asset that anchors the next system, the pathway to seven figures is not just possible. It becomes structurally grounded.

And that is why this case remains the most important within the series.

Stormrake Spotlight: Pax Gold (PAXG) ($5,077)

Stormrake Spotlight: Pax Gold (PAXG) ($5,077)