Bitcoin continues it’s move higher making local Higher Highs, now setting it’s sights on $117K - demonstrating Risk-on appetite is back. Gold has started getting some bullish momentum too along with the broader markets. Whilst closing out the day at $3,634, it’s apparent it’s accumulating here and likely anticipating a larger move higher. Silver as we stated yesterday was playing catch-up, and that’s exactly what it did. Accumulating higher and closing at a local peak of $42.19, it’s strength is undeniable now. We’re looking to see Silver start breaking major decade-long resistance sooner rather-than-later along with broader markets fully rotating to Risk-on assets in the coming months ahead.

U.S. Indices have continued their move higher as the leaders of the pack. Whilst the S&P500 might’ve technically closed the day in red at 6,584; the way in which price is moving makes clear that it only went sideways for the day because of the previous day’s breakout pump. This is healthy and means on smaller timeframes whilst short-term profit taking is happening, buyers keep coming in to ensure another sustained pullback here doesn’t take place. We expect it to keep moving higher, and with a stronger focus now on Risk-on assets, the Tech stocks that comprise the NASDAQ solidified this rotation - closing the day in the green at 24,096, yet another All Time High price.

The FED’s Meeting is less than 5 days away now, and markets continue to keep pricing in the high likely-hood of a rate cut, giving relief to the markets and a strong narrative that despite a weakening labor market, the FED are willing to commit to a pivot on their multi-year hawkish policy stance and give the people what they want. Odds of a 25 basis-point cut keep rising, today sitting at > 93%.

Bitcoin continues to make local Higher Highs as well, along with the rest of Risk-on assets, demonstrating the expected capital-flow is taking place. Not only is Bitcoin looking strong again, but Alt coins are really soaking up the buying volume over night, with the TOTAL 2 Market cap (All Cryptocurrency, excluding BTC) finally getting a juicy pump and making a technical All Time High. This simply means that all of Crypto that isn’t BTC is seeing significant buying volume come in now. Some of you know this as the enigmatic “Alt Season” and if this is the beginning stages of it - in typical “textbook” fashion, it’s right on time.

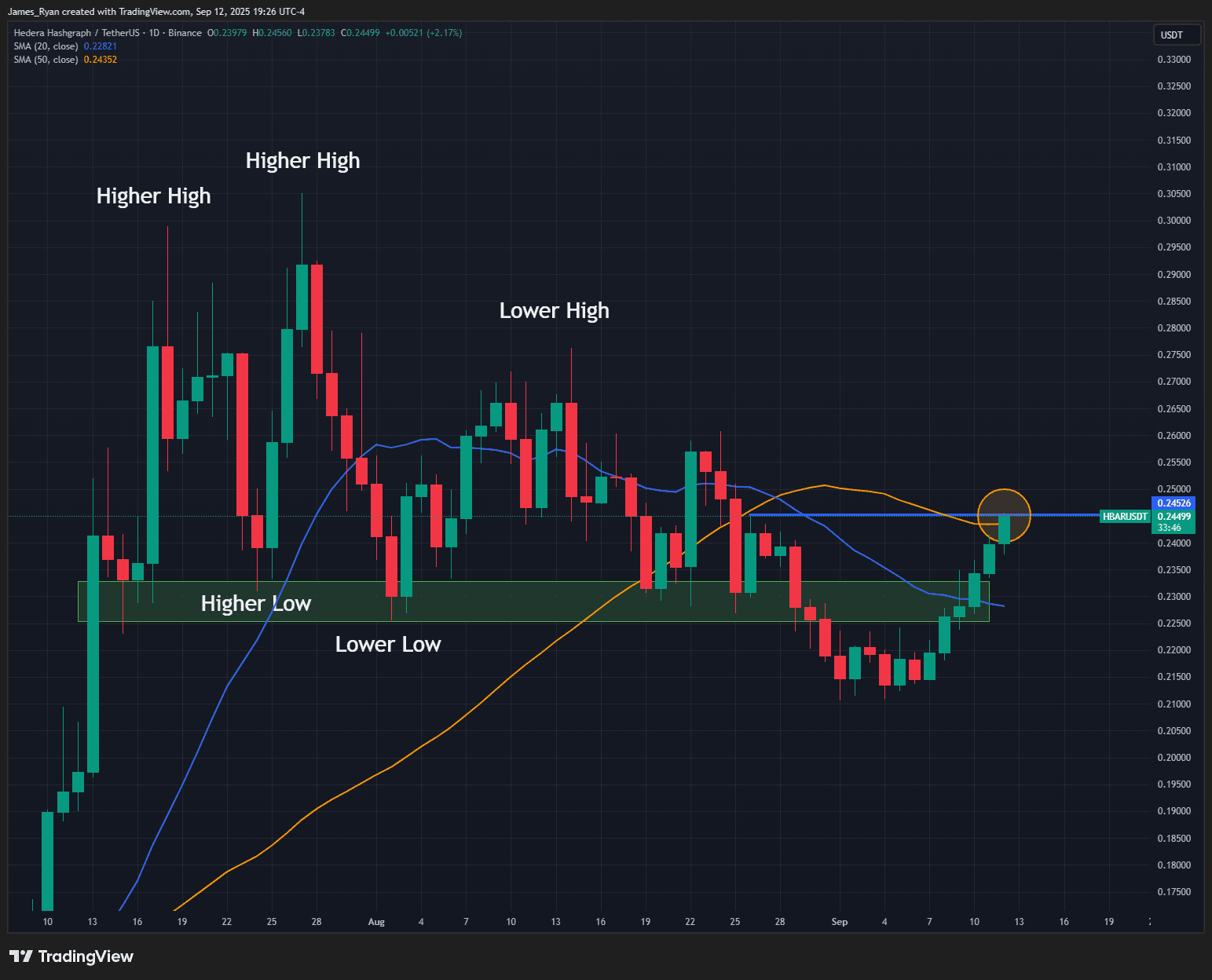

Stormrake Spotlight: Hedera (HBAR) ($0.245)