To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin remains in a lull since reaching its all-time high last week, consolidating between $116K and $120K. This has given altcoins the space to shine, with Ethereum holding dominance through an eight-day green streak, though it's now battling to keep that streak alive. Over the last 24 hours, the spotlight has shifted to Solana, which is up over 8% on the day, its biggest move in nearly a month and leading the broader market.

Ethereum's underlying strength continues to build. Institutional backing is ramping up, with Ethereum ETFs seeing more than $3.1 billion in inflows in a single day. Adding to the bullish sentiment, new SEC Chair Paul Atkins has stated that “ETH is not a security.” That’s a significant shift, especially following the regulatory ambiguity under Gensler. While price action has cooled slightly in the past 24 hours, the trend remains intact. A move back above $4,000 seems likely in the coming weeks, with potential for a retest of all-time highs to follow.

In a headline-making move, Trump Media & Technology Group has confirmed it has added Bitcoin to its books, buying $2 billion worth overnight. The market responded swiftly, sending Trump Media stock up more than 6% on the news.

Elsewhere, the Fed finds itself under growing scrutiny. Treasury Secretary Bessent has called for a review of the entire Federal Reserve, while Congresswoman Anna Paulina Luna has filed a criminal referral against Jerome Powell with the DOJ. Powell is scheduled to speak tonight, and markets will be watching closely for any signals on rate cuts or responses to the mounting political pressure.

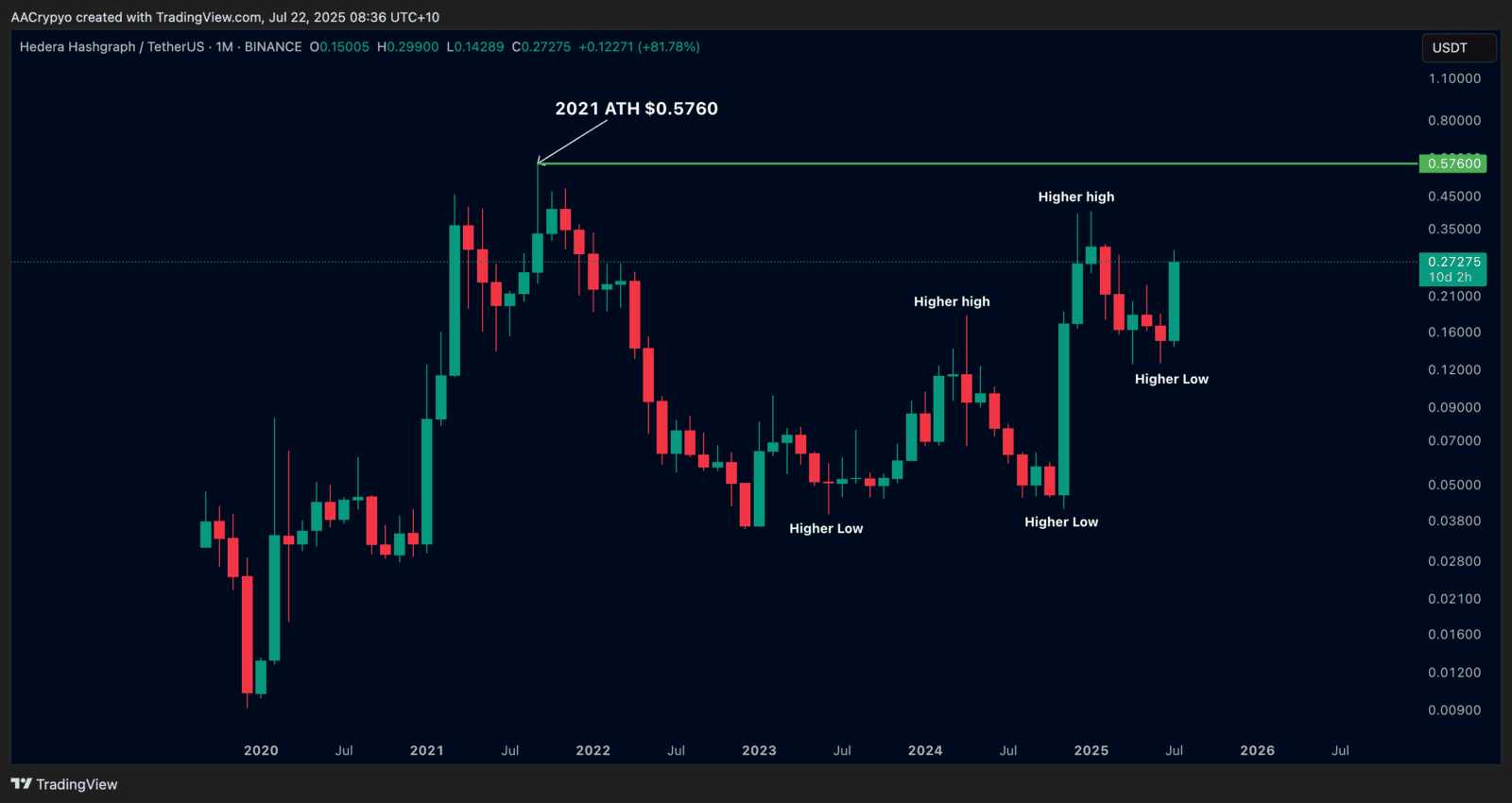

Stormrake Spotlight: Hedera (HBAR) ($0.272)

Stormrake Spotlight: Hedera (HBAR) ($0.272)