To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

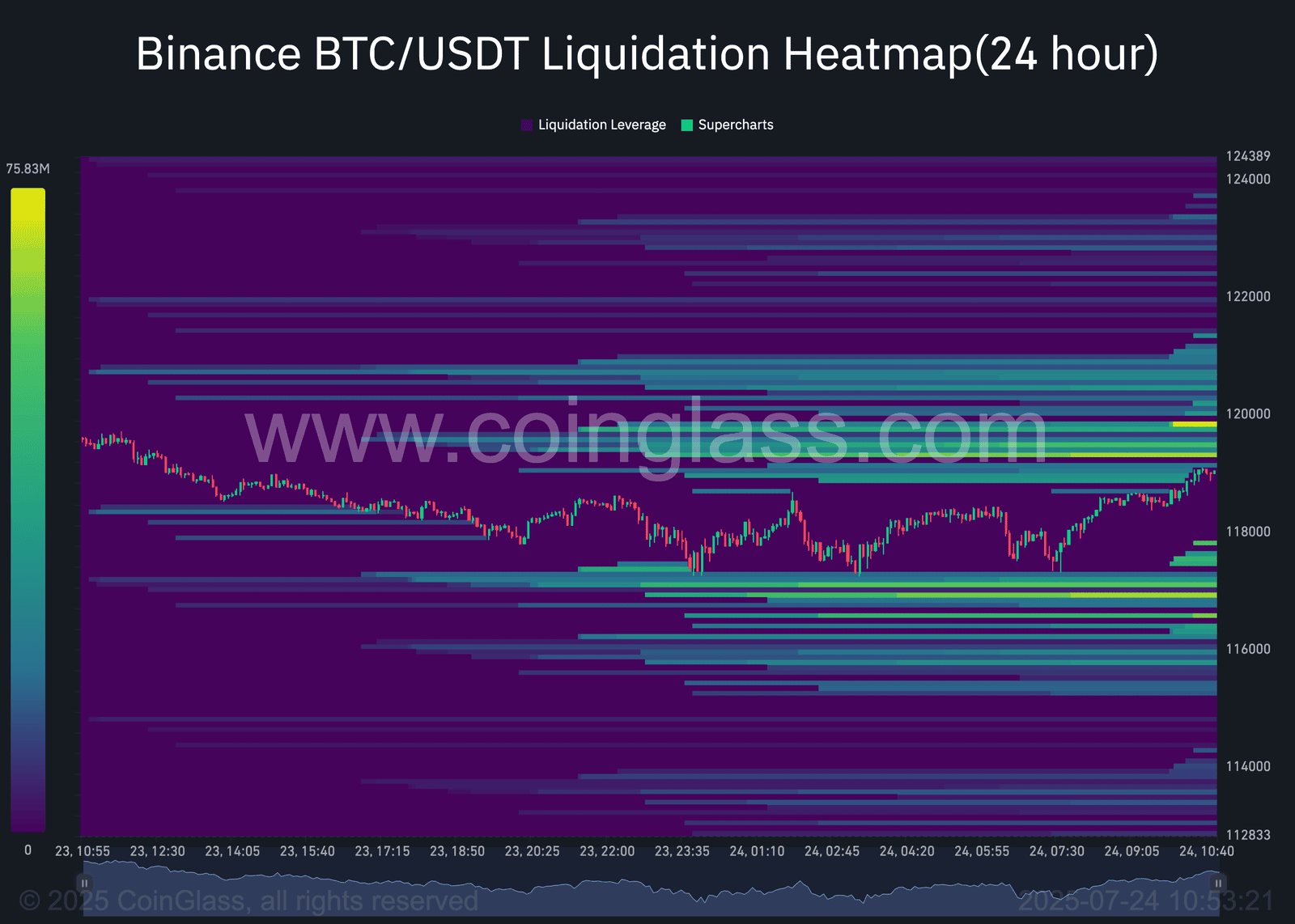

Bitcoin had the chance yesterday to break out of its current range and push back towards all-time highs, but the bears held firm, rejecting the move at $120K. This triggered a modest pullback across the market. Bitcoin slipped just 1% on the day, but altcoins bore the brunt: Ethereum dropped over 3%, Solana fell more than 8%, Hyperliquid lost over 5%, and Sui tumbled more than 7%.

Bitcoin dominance saw its largest daily increase since early March, while the total altcoin market cap fell nearly 5%, its steepest drop since the start of April. While the move was felt across the board, this is to be expected in the early stages of an altseason. There will be sessions where altcoins pull back harder than Bitcoin. These moments often present opportunities to accumulate leading altcoins at discounted levels. The broader trend remains bullish, and the coins showing strength during the uptrend are likely to lead again once the pullback subsides.

As for Bitcoin, it remains the top performer in the bigger picture. While altcoins may outperform briefly, Bitcoin is simply in a consolidation phase. Once it breaks out, expect it to return to the spotlight and make a strong move towards new all-time highs.