To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin was in the midst of a bullish breakout, blasting through the top of its consolidation range and printing a new higher high, flipping the structure decisively back in favour of the bulls. Momentum was building, with BTC reclaiming $109K and clocking over 3% intraday gains, until geopolitical tensions stepped in.

A post just hours ago by US President Donald Trump on Truth Social urged everyone to evacuate Tehran. Since then, markets have sharply reversed. Bitcoin is now down over 2%, Ethereum nearly 5%, while S&P 500 and Nasdaq futures have both pulled back. Meanwhile, traditional risk-off assets like gold and crude oil have bounced. The ambiguity around the post, whether it's a warning, threat, or sign of imminent military action, has left investors on edge.

Sentiment Improves Despite Pullback

Despite the dip, market sentiment has actually improved. Bitcoin’s breakout has pushed the Fear & Greed Index up 7 points to 68, deep into greed territory. And while the fog of war may get thicker, Bitcoin has a resilient history during moments of global stress.

Let’s take a look at how Bitcoin has performed during some of the most volatile macro events over the past five years:

US-Iran Escalation (Jan 3 2020): BTC 10D return +12%, 60D return +20%

COVID Outbreak (Mar 11 2020): BTC 10D return -25%, 60D return +21%

2020 US election challenges (Nov 3 2020): BTC 10D return +19%, 60D return +131%

Russia invasion of Ukraine (Feb 24 2022): BTC 10D return -6%, 60D return +15%

US regional banking crisis (Mar 9 2023): BTC 10D return +25%, 60D return +32%

Yen carry trade unwinding (Aug 5 2024): BTC 10D return +/- 0%, 60D return +3%

Each of these events triggered immediate volatility, yet Bitcoin ultimately rebounded, often sharply, within 60 days. That’s not to say history will repeat, but if the structure holds and bulls stay in control, any pullbacks should just result in further opportunities for accumulation.

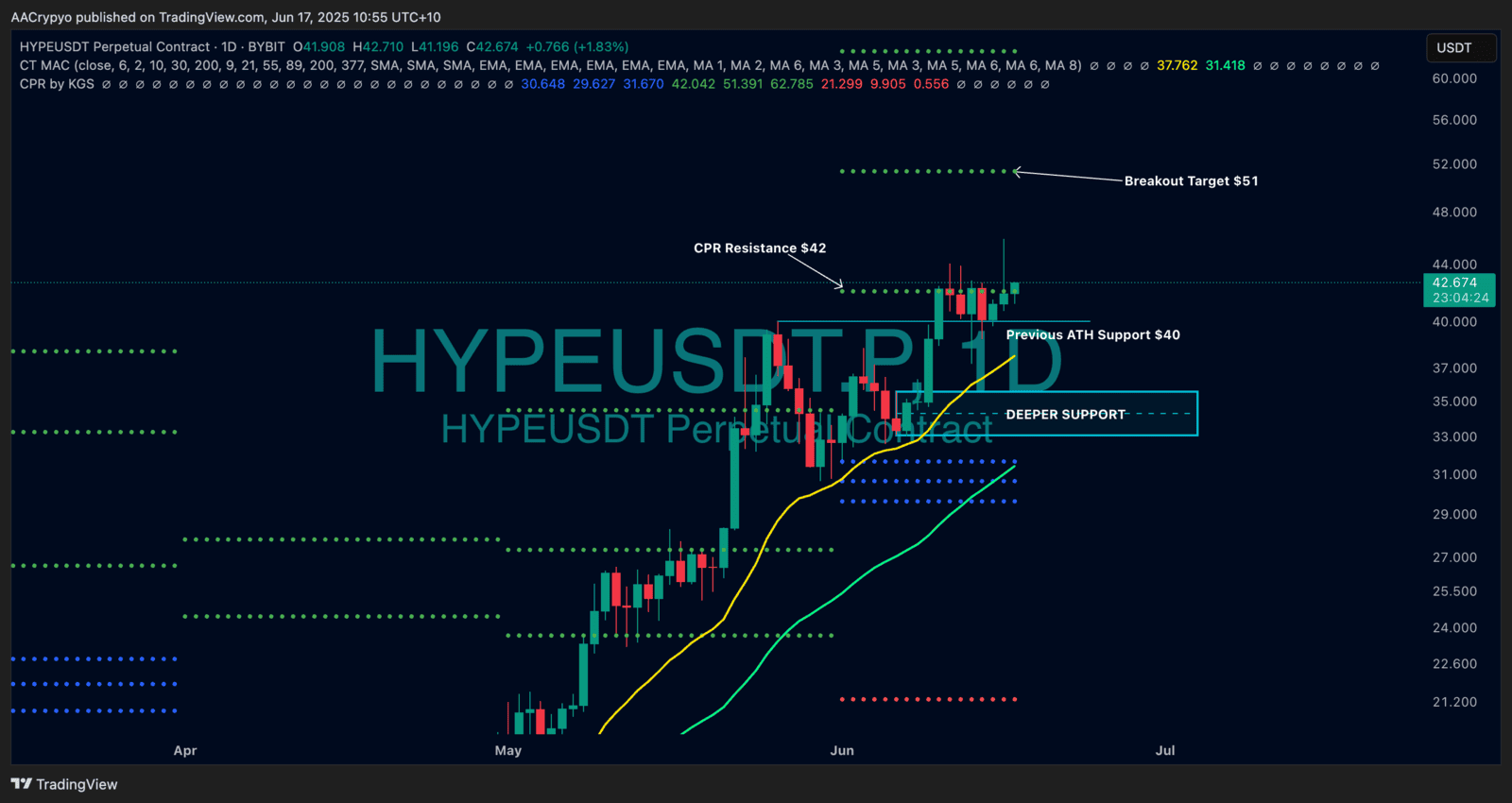

Stormrake Spotlight: Hyperliquid (HYPE) ($42.67)

Stormrake Spotlight: Hyperliquid (HYPE) ($42.67)

Source: