To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The past 24 hours have been a ride for Bitcoin and the broader crypto markets. Bitcoin finally broke out, reclaiming $106K with conviction. Altcoins followed suit — the screen was green. But it was short-lived. As the clock struck midnight, the market turned. Bitcoin dropped nearly 2% within the hour, then continued to cascade for several hours, hitting a low of $102.3K — a sharp 4% reversal from the local high in just nine hours.

Why? More geopolitical drama — this time, from Russia.

Kremlin spokesman Dmitry Peskov issued a stark warning to the West, stating: “Those who are speaking about (killing Khamenei), they should keep it in mind. They will open Pandora’s box.” He also called any regime change in Iran “unacceptable.” These comments followed US statements suggesting a decision will be made in the next two weeks on whether to get directly involved in the ongoing conflict. Trump, for his part, has already mentioned that Khamenei “only remains alive because Trump is letting him.” Peskov went further, acknowledging the growing risk of escalation: “The situation is extremely tense and is dangerous not only for the region but globally.”

With major powers teetering on the edge of direct involvement, markets are growing increasingly cautious. Risk-off assets surged following Peskov’s remarks and will likely continue to find support. Meanwhile, risk-on assets like crypto remain on edge — they only need the faintest spark to sell off further.

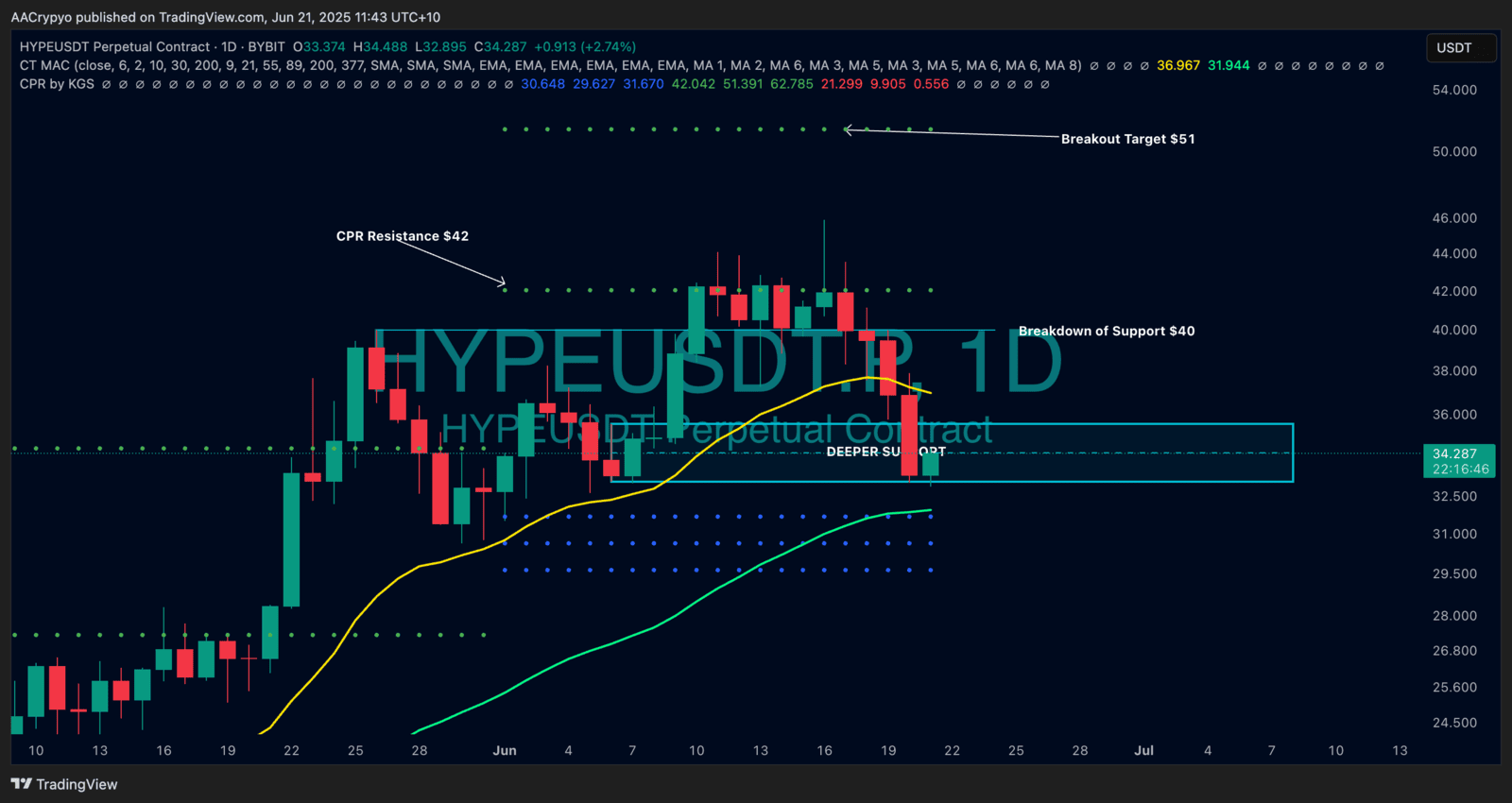

Stormrake Spotlight: Hyperliquid (HYPE) ($34.26)

Stormrake Spotlight: Hyperliquid (HYPE) ($34.26)