To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

A failed rally following dovish employment data has seen Bitcoin revisit the lows that threaten the broader bullish structure. The key level of $112K, which we’ve been highlighting, along with the previous higher low, is now under pressure.

It has been a poor week for risk-on assets across the board. The Nasdaq is on track for its largest weekly loss since Trump’s 'Liberation Day' tariffs in early April, while the S&P 500 is also heading for a red week. Meanwhile, the US dollar has strengthened, reflecting the shift towards a risk-off environment. Fear and greed readings for both Bitcoin and the S&P 500 have dropped back into neutral after sitting firmly in greed just a week ago.

Unemployment data gave some temporary relief in what has been a tough week for crypto. In the longer term, it could add bullish fuel, particularly through its influence on the Federal Reserve’s upcoming rate decision. Employment remains one of the Fed’s two core mandates. Overnight data showed jobless claims coming in higher than forecast, suggesting a potentially cooling labour market, which often prompts the Fed to cut rates in an effort to stimulate economic activity.

Bitcoin fell over 1.5% yesterday and is now down nearly 10% from the all-time high it set last week. However, the key level is still holding. If the overnight low just above $112K does prove to be the bottom, then the longer-term bullish structure remains intact and a fresh leg higher toward new all-time highs could follow in the coming weeks.

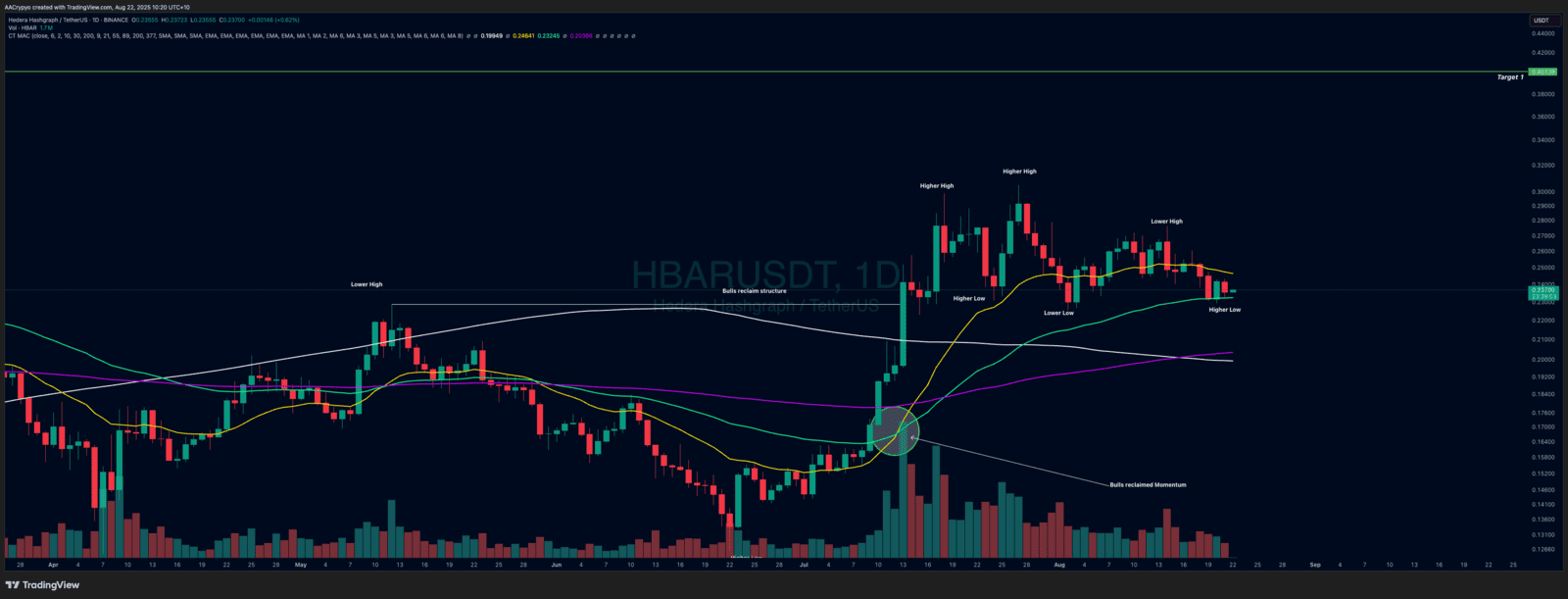

Stormrake Spotlight: Hedera (HBAR) ($0.237)

Stormrake Spotlight: Hedera (HBAR) ($0.237)