Bitcoin initially took well to the news of lower than expected NFP Data, however this rally like most rallies since August 14th was short-lived. Gold on the other hand continues to act as a safe-haven hedge, printing fresh all-time highs again with a strong daily close, along with Silver still largely following in tandem. With Silver now hitting strong Monthly resistance at $41, we’ll need to pay close attention to see if any price pullback here is short-lived before pushing higher and trying to takeout the 2011 All Time Highs; or perhaps a somewhat steeper correction may be needed first before trying to break the $50 mark.

Similar to Bitcoin, both the S&P500 and NASDAQ initially took well to the news of weak US Job data, however those gains we’re quickly given back to the market - and then some. Both indices respectively took a 1.37% and 1.67% hit in the trading hours that followed after the news broke, although both are still holding price support levels and are seeing a modest bounce as of this moment despite the weekend sell-off. Markets ultimately remain uncertain with this type of volatility, with no clear short-term trend direction for the time being.

While Tariff uncertainty keeps rocking the boat, the good news is that the U.S. and Japan has come to an agreement on automotive imports. Trump signed an Executive Order over the weekend to reduce imports to 15%, cementing the July agreement between both parties. In return, Japan has committed to investing $550 Billion in the U.S. economy further solidifying cooperation between the two nations.

If price can keep the momentum up without giving too many of the intra-day gains away, it’s possible that the Risk-on rotation could be back, although moves higher need to see the bulls follow-through with continued buying in order to confirm a trend reversal back up in the short-term. Macro data keeps pointing to a FED rate cut mid-September; ultimately being a good thing for Risk-on assets long term. Until then, we’re looking for a clean and sustained push higher to boost market confidence short-term so that we can see a positive-sentiment momentum shift to get those juicy late-cycle pumps.

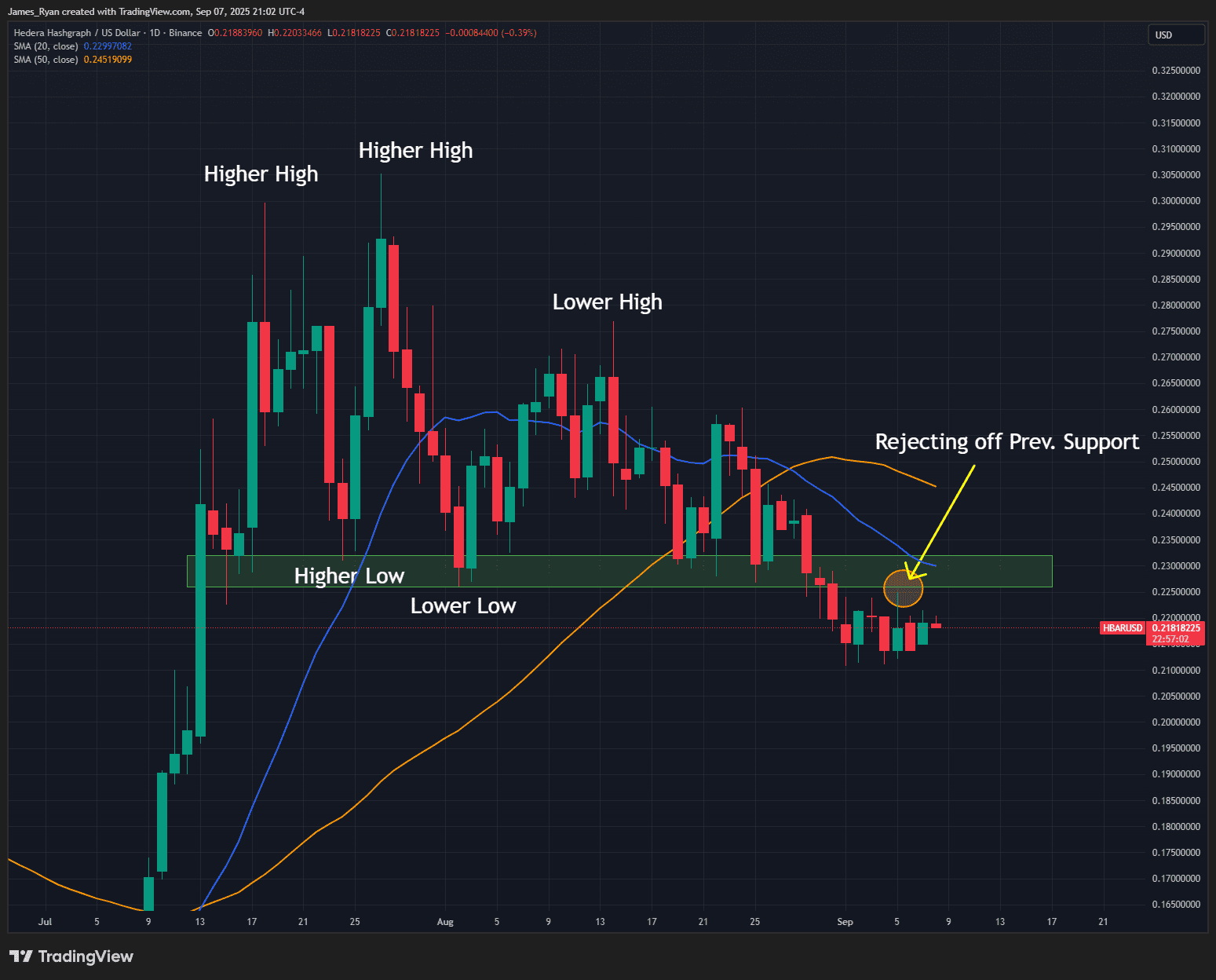

Stormrake Spotlight: Hedera (HBAR) ($0.218)