To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It’s a frustrating time for Bitcoin. When traditional markets rally, Bitcoin struggles to keep up, underperforming as investors wait for a shift in risk sentiment. But when traditional markets fall, Bitcoin follows and suffers even more. Overnight, BTC dropped over 1.5% and is now trading below $109K, while some altcoins fell 10% or more.

The meeting between Presidents Trump and Xi appeared to be a success. Trump confirmed he will visit China, with Xi set to visit the US. As expected, the 100% tariffs on China have been shelved, and a one-year trade deal was agreed on covering rare earths and critical minerals. Despite the positive headlines, market reaction was muted.

Overnight, major indices pulled back following mixed earnings from the Magnificent Seven. Meta dropped 11.3% and Microsoft fell 2.9% after disappointing results, overshadowing Alphabet’s 2.9% gain. Tesla lost nearly 5%, while Amazon rallied 11% and Apple moved higher after hours. Given these few stocks make up a large portion of the S&P 500’s market cap, the uneven results and fragile risk appetite weighed on broader market sentiment. Both the S&P 500 and Nasdaq posted their worst session in three weeks.

Markets continued to lean risk-off after Powell’s hawkish comments. The US dollar and treasury yields climbed, and gold saw its first strong green day in over a week, rising more than 2%.

As we enter November, it’s worth revisiting the historical trend. Over the last 14 years, Bitcoin has averaged 40.5% growth during November, with nine of those years closing green. Smart money is accumulating during these windows of underperformance and correction ahead of what has historically been the most bullish month of the year.

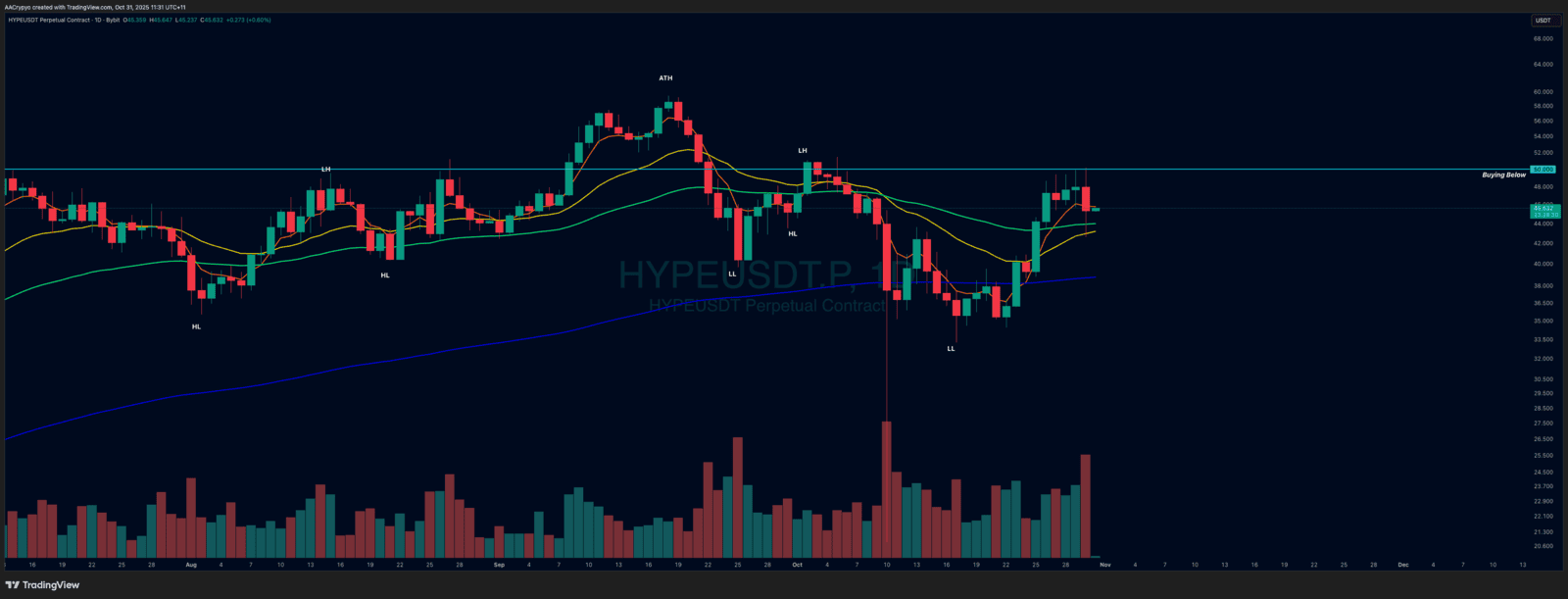

Stormrake Spotlight: Hyperliquid (HYPE) ($45.50)

Stormrake Spotlight: Hyperliquid (HYPE) ($45.50)