Bitcoin gave us a nice push higher yesterday, however in early hours of trading this morning it’s started struggling yet again at the $113K price resistance. Gold kept up momentum yesterday to reach a local peak of $3,674, however it closed the day in the red giving back most of the day’s gains. With Silver still sideways waiting for a clearer direction, getting a small pullback and re-accumulation in precious metals here with looming macro-data uncertainty wouldn’t be out of the question.

Trump’s Truth Social gained some notable traction with a recent post overnight sharply criticising Federal Reserve Chair Jerome Powell and the central bank’s broader independence. Trump argued that if the Fed had followed his policy recommendations back in early 2021, rates would have risen sooner and the current economic environment would look very different. He labeled the Fed “broken” and outdated, accusing Powell of incompetence for relying on lagging data and rigid frameworks.

Trump’s dismissal surrounding the position of the Fed’s independence is suggesting that protecting the institution’s autonomy means little if its policies are misguided. To bolster his critique, Trump cited market analysts Jay Hatfield and Greg Faranello, both of whom echoed the view that Powell was late to raise rates and is now dragging his feet in cutting them. Their commentary pointed to expectations of steep rate reductions ahead, possibly in the range of 50 to 100 basis points. The S&P500 and NASDAQ both closed in the green for the day in response with modest gains again < 1%, although the indices are ultimately still rangebound for the time being.

Bitcoin Bulls keep getting punished on these attempted moves higher on smaller timeframes. It’s clear that exhaustion is setting in, but the uncertainty surrounding the pending macro-data surely isn’t helping either. If selling keeps picking up momentum over the following days, it’s more likely current support won’t hold - alternatively; if we can hold major price support with the CPI and PPI over the coming days and ride out the volatility without losing too much ground, a solid relief rally might just be in order.

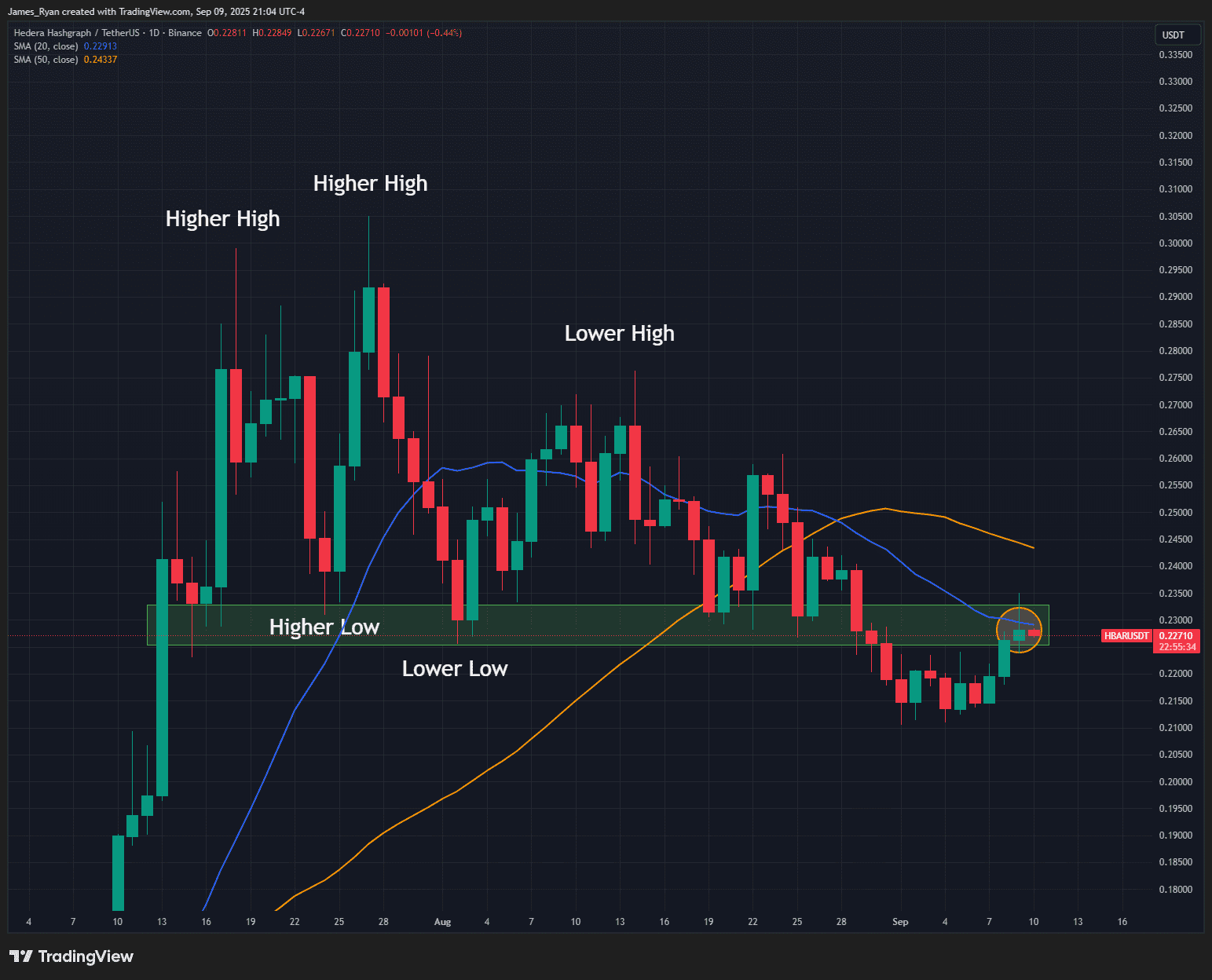

Stormrake Spotlight: Hedera (HBAR) ($0.227)