To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Just days after the largest sale of Bitcoin in history, bulls have regained control as BTC retests the top of its consolidation range.

Last year, Bitcoin dropped over 15% in just a few weeks as Germany unloaded 50,000 BTC. At the time, fear dominated the market, and many called for significantly lower prices. Fast forward less than 12 months, and we've just witnessed the sale of 80,000 BTC met with remarkable resilience. The market remained steady, absorbed the selling pressure within the day, and continued pushing higher. It's a strong signal of Bitcoin’s accelerating maturity as an asset class.

With the Liberation Day tariffs due to go live on August 1st, the final days of July were expected to bring heightened negotiations. After months of back and forth between two of the world’s biggest powers, the United States and the European Union, no deal had been reached, stoking fears of a trade war. That changed overnight.

The US and EU have now come to terms: all EU products entering the US will be subject to a 15% tariff, and in return, the EU has agreed to increase purchases of US military equipment and energy. Markets welcomed the clarity. Risk-on assets rallied, with Bitcoin moving higher and the S&P 500 opening above 6,400 for the first time in history.

Bitcoin remains within its range, but with bullish momentum building, a breakout appears imminent. If we see a push through resistance, a retest of the all-time high at $123K is firmly on the table.

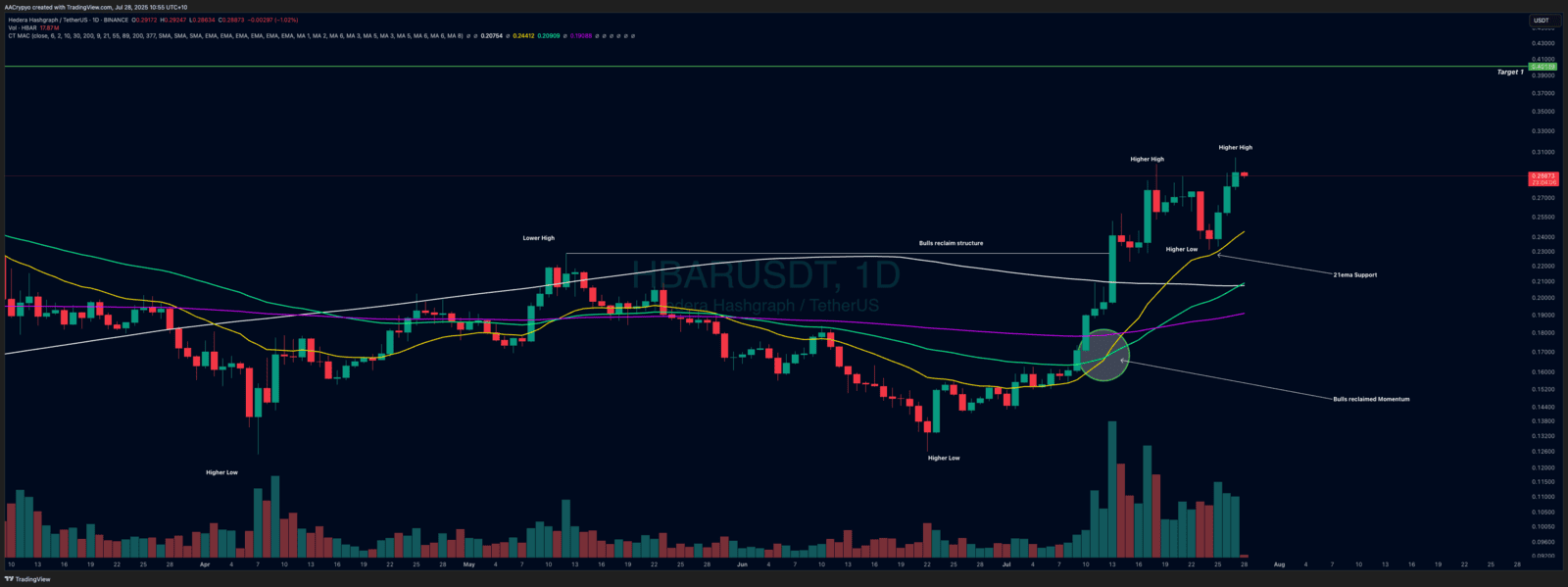

Stormrake Spotlight: Hedera (HBAR) ($0.288)

Stormrake Spotlight: Hedera (HBAR) ($0.288)