To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin is slowly picking up. While it has not been the most explosive or volatile day, price is back above $112K and continues its crawl in the right direction. Still, the spotlight is not on crypto or traditional risk-on markets. It is on the precious metals: gold and silver.

Gold has printed another green day and a fresh all-time high, making it eight consecutive bullish sessions and a gain of nearly 6%. Silver is following closely, up nearly 7% over six straight green days. The rest of the market is taking a backseat to the strength of the metals, which says a lot about where broader sentiment is right now.

With gold and silver viewed as more risk-off assets, flows are shifting in that direction rather than continuing into equities or crypto. But Bitcoin is still grinding higher, and sentiment is improving. The Fear and Greed Index has now crossed into greed territory with a reading of 55 and climbing, which is a positive sign for bulls.

A strong macro signal for risk-on assets came from Fed Governor Waller overnight. He said he supports multiple interest rate cuts in the coming months. The first cut is all but confirmed in less than two weeks, with a 97% probability of a 25 basis point move. If that plays out, we should expect at least one or two more cuts in the final Fed meetings of the year, which would significantly support risk-on markets.

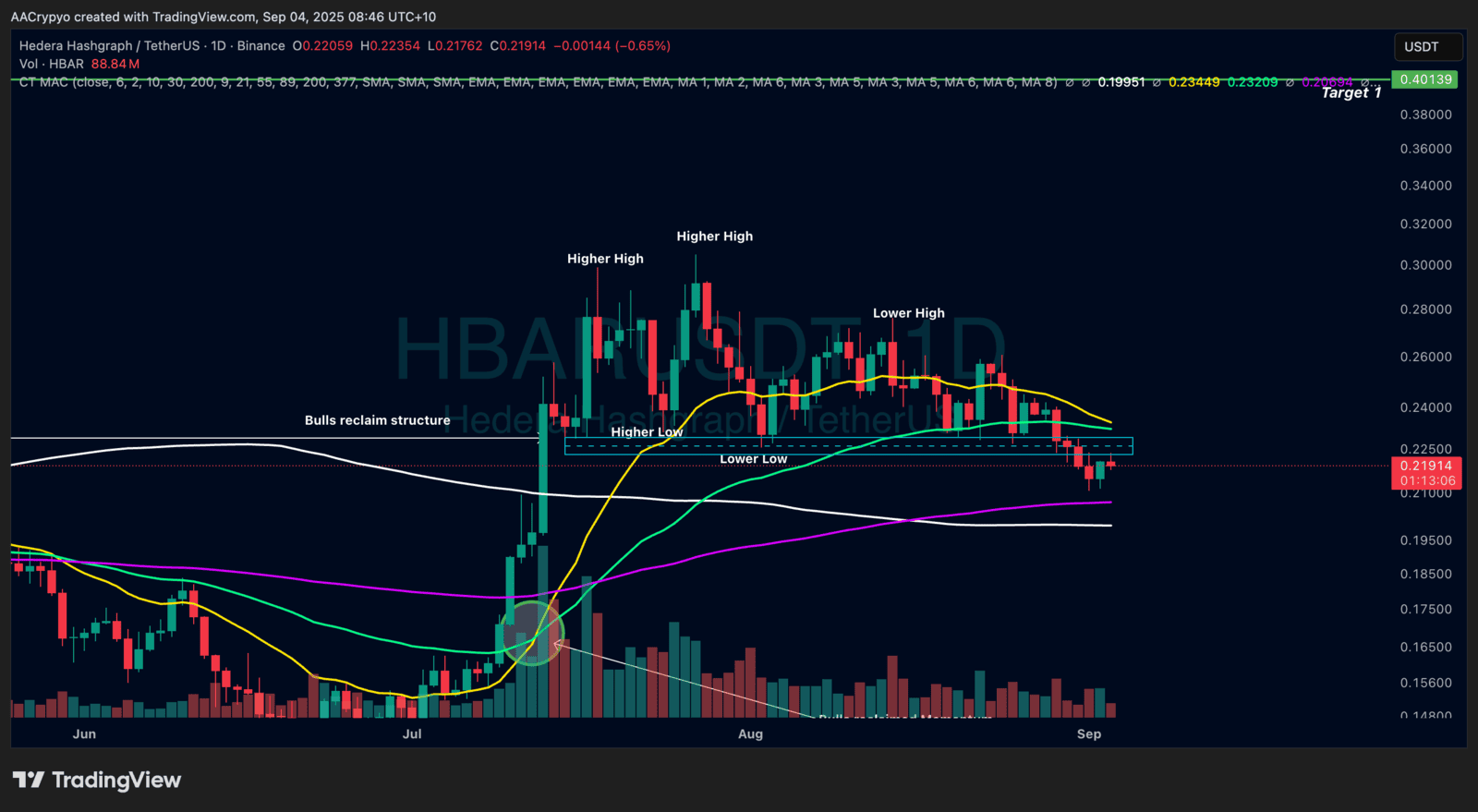

Stormrake Spotlight: Hedera (HBAR) ($0.219)

Stormrake Spotlight: Hedera (HBAR) ($0.219)