To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The bears have taken full control of Bitcoin as geopolitical tensions escalate. Earlier this week, we reported that Trump issued sanction and tariff threats to Putin and Russia if they did not agree to a ceasefire within the next week. This morning, Trump posted on Truth Social that he has ordered two nuclear submarines to Eastern Europe following “provocative statements” from Dmitry Medvedev, the former President of Russia and now Deputy Chairman of the Security Council.

This latest escalation has driven significant risk-off sentiment across global markets. Bitcoin has dropped back below $114k, and $1.11 trillion has been wiped off the US stock market today. Since Trump began his second term, we saw similar volatility during the brief Israel-Iran conflict. That war lasted just 12 days. Markets fell sharply on the first day but quickly recovered as the situation stabilised. Bulls are hoping for a repeat scenario in Eastern Europe: an initial sell-off followed by a swift resolution that allows prices to push higher again.

The move lower in Bitcoin is not only about geopolitics. US employment data released overnight came in worse than expected, with fewer jobs created than anticipated. This signals a slowing economy, much to Trump’s frustration. He claims the data is being manipulated to make his administration look weaker, pointing to a cooling labour market. On the other hand, the slowdown has boosted expectations that the Federal Reserve will cut rates at the September meeting. Just a few days ago, following Powell’s speech, markets were pricing in no cut. After this data, the probability of a 25bps cut in September has surged to around 80%.

While the bears are currently in control of Bitcoin and sentiment is subdued, history shows that markets often overreact in the short term to external shocks. For long-term investors, these periods tend to create strong buying opportunities.

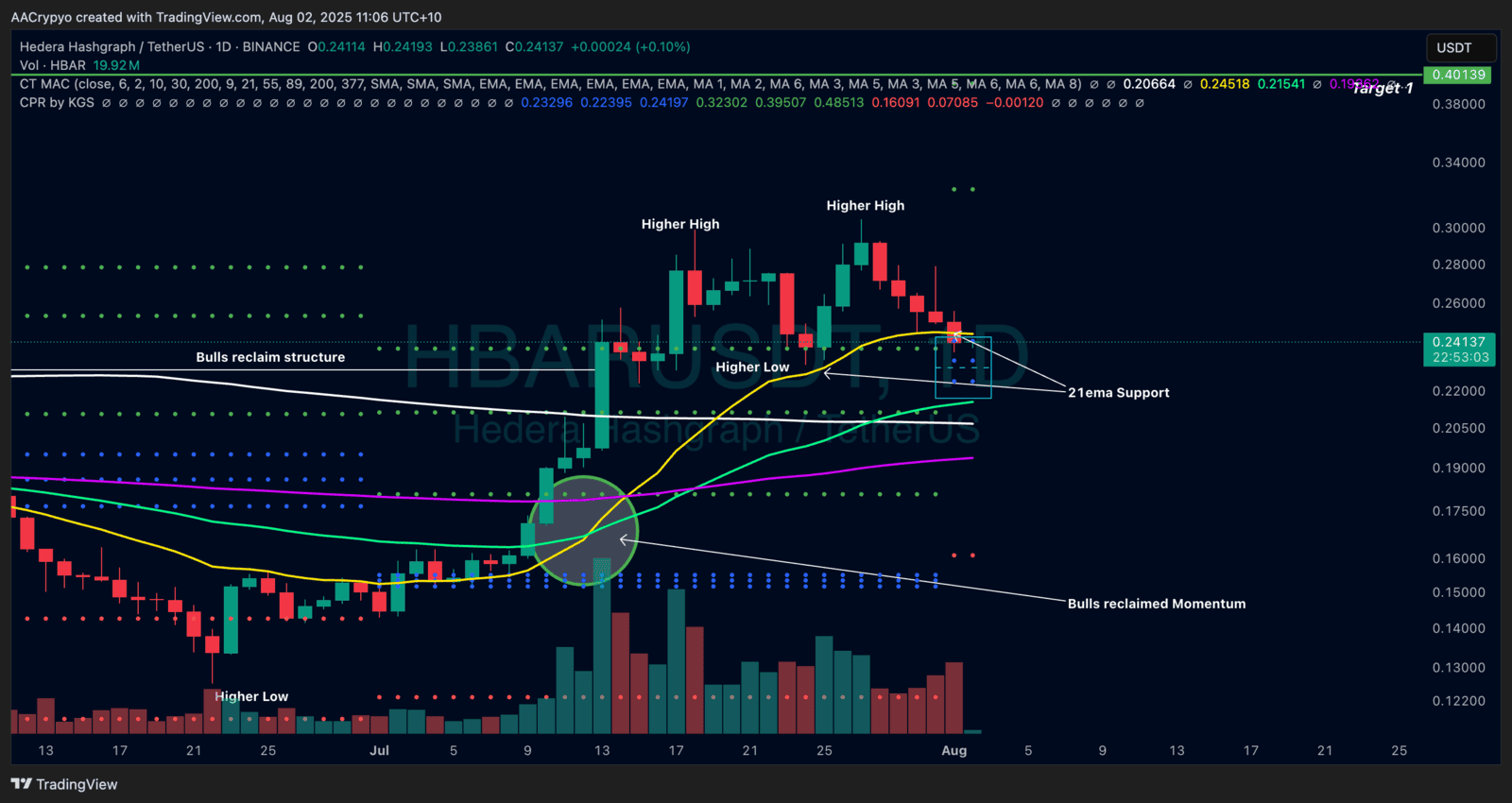

Stormrake Spotlight: Hedera (HBAR) ($0.241)

Stormrake Spotlight: Hedera (HBAR) ($0.241)