Bitcoin is showing the first signs of life that we’ve seen in a while, finally starting to base out with higher lows and small pushes to the upside. Gold on the other hand - no surprises here as it printed yet another all time high price sitting at $3635 on the daily close. Silver is still hovering around the $41 range, likely waiting to see if Gold and sustain this move higher over coming days before deciding if it wants to continue the rally short-term; however bulls are in control for now so don’t fade the trend just yet.

NASDAQ’s announcement that it has filed with the U.S. SEC to allow tokenised trading of stocks and ETFs spurred a positivity in the last few hours. The NASDAQ rose about 1.5% on the news, giving market confidence to investors that it’s incorporating Web 3.0 elements into it’s security offerings. Truly a paradigm shift that old-heads in this space have dreamt about for well over a decade. The pendulum has swung the other way for good and there’s no going back. If this get’s approved; you can expect a large move in the Crypto space to solidify the narrative shift.

U.S. Indices are largely still rangebound over the last few weeks, signaling to the market that while long-term trend remains risk-on; market participants are also likely waiting for more confirmation surrounding economic data to decide on which direction a broader move is going to take place. Yesterday did close as another green day, albeit with small gains of < 1% for the S&P500 and NASDAQ. CPI data later in the week will be the main focus, until then - expect more market chop and indecision from short-term traders and scalpers.

For the Bitcoin to bottom sooner rather than later around these prices, we’ll need to it keep basing out with Higher Lows. Small pullbacks in price are healthy and needed, however we need to see it creating a “stair-case” effect on smaller timeframes before pushes higher to ensure it has a solid foundation. If this can sustain over the coming days and survive the pending CPI data and volatility that’s sure to follow-suit, then it’s far more likely we see prices keep on creeping higher. If Alt coins keep outperforming during this time, then that’s also further confirmation you’re definitely in the later stages of a bull run.

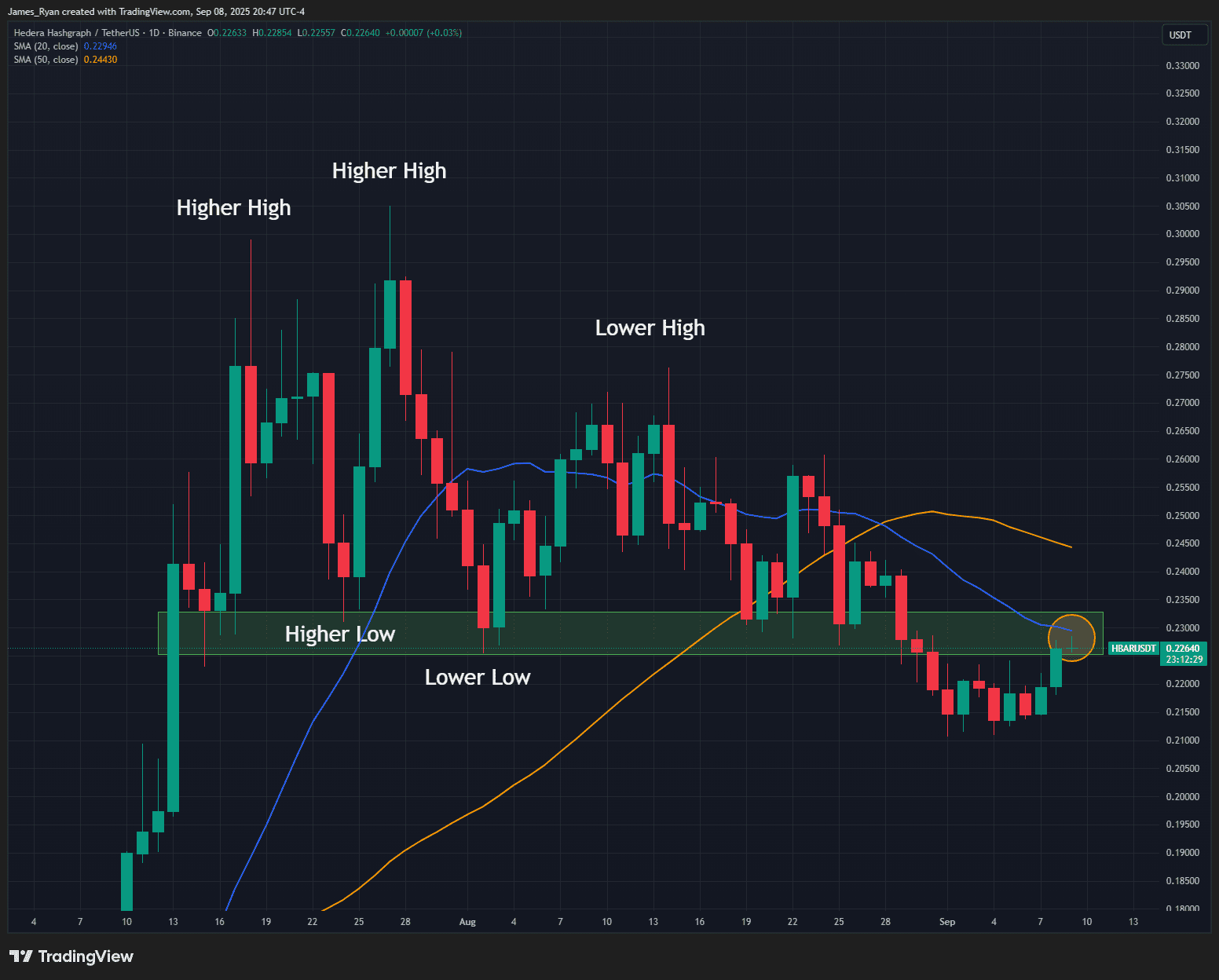

Stormrake Spotlight: Hedera (HBAR) ($0.226)