To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

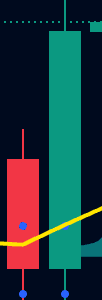

The risk-on flows we’ve been talking about — and patiently waiting for — have finally found their way back into the crypto space. Traditional indices had another bullish day and, for what feels like the first time in weeks, that risk appetite has spilled into digital assets too, with bullish engulfing candles appearing across nearly every major cryptocurrency.

Note: a bullish engulfing pattern is a green (bullish) candle that closes higher than the previous day’s opening price, effectively ‘engulfing’ the prior day’s red (bearish) candle. It’s a classic signal that momentum is shifting.