To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The bulls are quietly taking advantage of the bears’ exhaustion. With Bitcoin up over 11% in just a few days, attention is now turning to the key level at $88,888. After a strong overnight session, momentum is beginning to build, and while the broader picture remains bearish, the market is giving reasons to be cautiously optimistic.

It was a strong night across risk-on assets. The S&P 500 and Nasdaq both rallied after recording their lowest closes since September last week. That bullish US session gave Bitcoin the lift it needed to establish a base for a potential move higher. Even risk-off markets joined in, gold was up nearly 2% and silver rose close to 3%. Last week we highlighted how institutions had been selling everything, regardless of asset class, to unwind yen carry trades. Now we may be witnessing the early stages of those same institutions buying back in. Too early to confirm, but the signs are worth watching.

Cautiously bullish is the best way to frame current sentiment. Bitcoin found support at $80K, a drawdown of more than 35% from its all-time high. But the tone is shifting. The Fear and Greed Index has jumped from 11 to 20 in just a few days. It is still in extreme fear, but the direction is encouraging. Smart money is accumulating Bitcoin at discounted prices while the bears look increasingly fatigued. The aggressive selling that defined the last few weeks has paused for now. While the market is not out of danger, the bulls have done enough in recent sessions to open the door for a potential revisit of the $90K region this week.

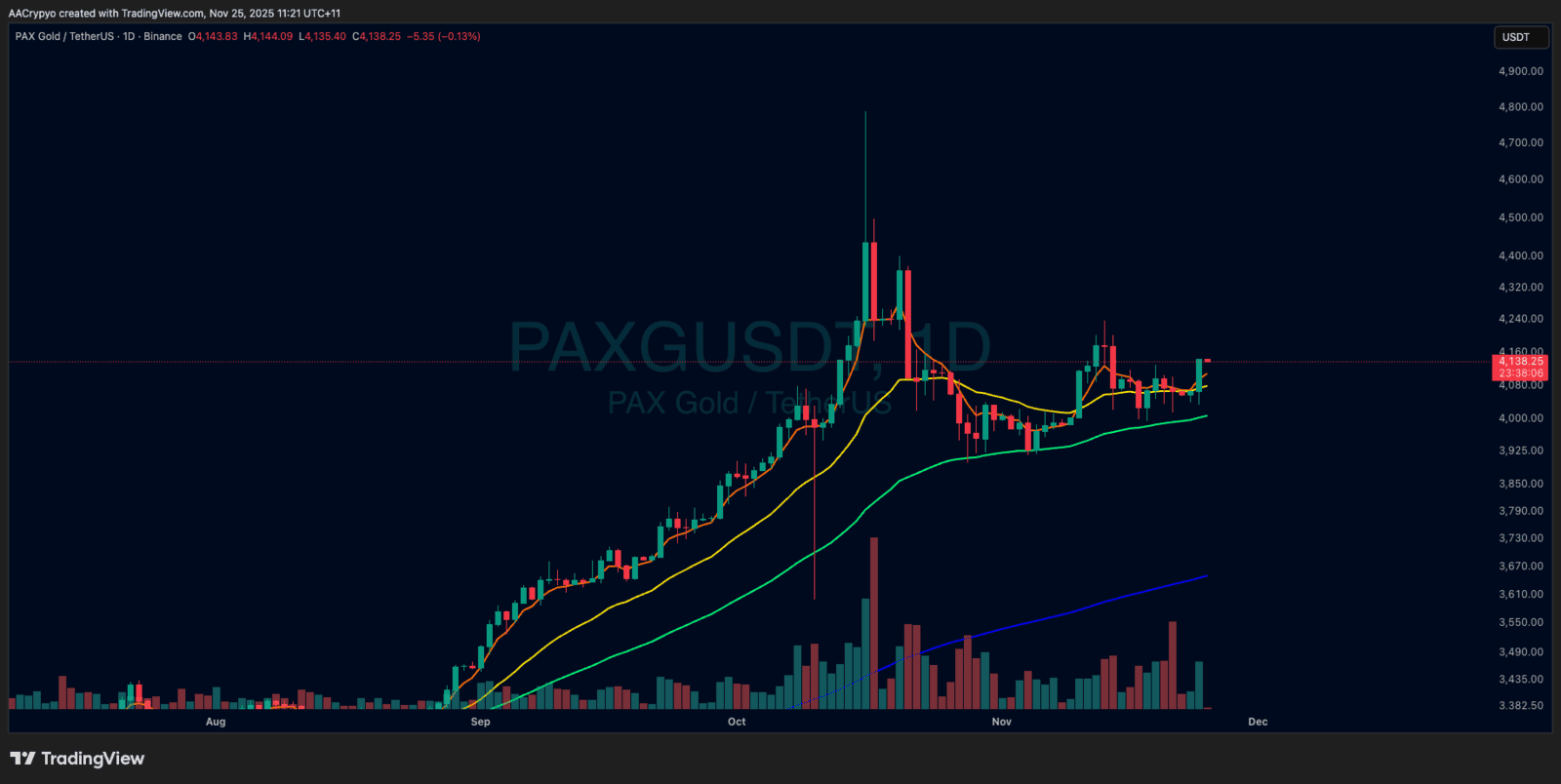

Stormrake Spotlight: Pax Gold (PAXG) ($4,138)

Stormrake Spotlight: Pax Gold (PAXG) ($4,138)