To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The bullishness and buying pressure remain relentless. It’s a great time to be in risk-on assets and we’re only just getting started. Bulls are in full control across all major markets. Bitcoin has extended its bullish momentum and continues to push higher, while the S&P 500 has notched yet another all-time high at 6,656, joined by the Nasdaq in setting new records.

Following the S&P 500's record, the official White House X account posted a statement with an image of Trump raising his fist, captioned: "rallies to high." Trump followed up with a comment of his own: “stocks will do much better as time goes by.”

Risk-on flows are clear. Gold and silver have both pulled back slightly from recent highs, down 2% and 3% respectively, after a strong run, but these are minor moves in the context of their broader uptrend. Precious metals remain two of the year’s strongest performers.

Meanwhile, Bitcoin’s steady climb has been somewhat overshadowed by a breakout in altcoins. Top performers today include NEAR, up over 15%, AVAX up nearly 10%, and BNB setting a fresh all-time high above $1,000. Solana continues to impress, now above $250 and less than 20% from its all-time high set earlier this year.

We are in altseason. TOTAL2, the total crypto market cap excluding Bitcoin, has just hit an all-time high. The altseason index, which tracks the performance of the top 50 coins against Bitcoin, currently shows that 82% of them have outperformed BTC over the past 90 days.

This is shaping up to be the blowoff top altseason many have been anticipating. With key bullish catalysts still ahead in the back half of the year, smart money continues to accumulate high-conviction coins on pullbacks. Others may want to consider doing the same.

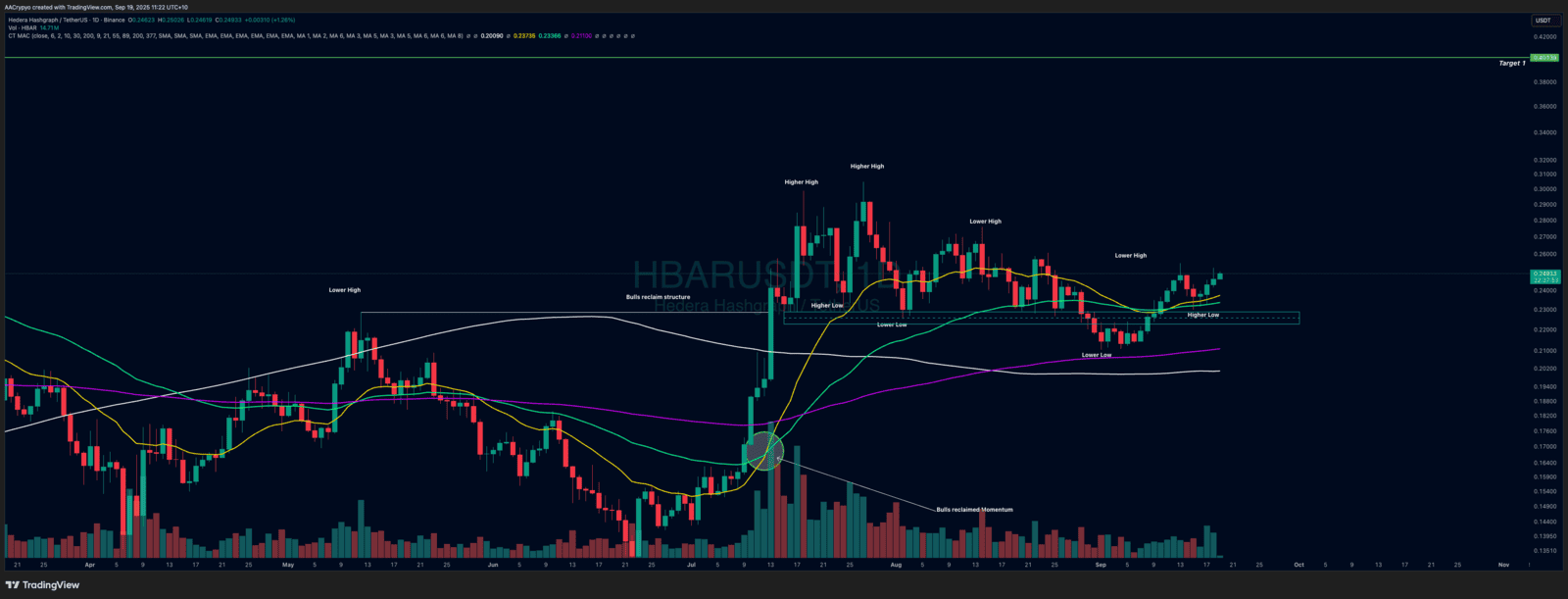

Stormrake Spotlight: Hedera (HBAR) ($0.249)

Stormrake Spotlight: Hedera (HBAR) ($0.249)