To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Markets have continued to push higher following the ceasefire, but the resolution has not come without criticism, particularly from Donald Trump. The US President voiced his disapproval of both Israel and Iran in his usual blunt style.

The ceasefire agreement gave each side a window to de-escalate. Israel had until the 24th hour and Iran until the 12th hour to halt attacks. In theory, this meant a full stop to hostilities beyond those deadlines. However, despite agreeing to the terms, both parties continued to launch strikes. The situation escalated to the point where Trump took to Truth Social, urging Israel: “DO NOT DROP THOSE BOMBS,” even telling them to turn their planes around, stating that any further strike would be a violation. He later suggested they would conduct a “friendly plane wave” to Iran.

But his dissatisfaction did not stop there. In a short interview clip now circulating online, Trump summed up the chaos in his own words:

‘They don’t know what the … they’re doing'.

A colourful summary, but regardless of opinions, the war now appears to be behind us and the markets are responding accordingly. The S&P500 just closed its strongest day since 21 February and is now less than 1% away from its all-time high. The Nasdaq is even closer, sitting just 0.30% from the record it set earlier this year.

While Bitcoin has not matched the momentum of equities, it remains green and bullish. It is up nearly 8% from the lows seen just two days ago, though still underperforming the S&P and Nasdaq over the last 24 hours.

The broader market has clearly moved away from the risk-off sentiment. Gold is down over 3% in just over a week and crude oil has plunged to $65, losing 15% in two days. That kind of price action reflects a major capital rotation. Typically, when transitioning back into a risk-on environment, money first flows from defensive assets into traditional risk assets like equities, before rotating into more ‘speculative’ markets such as Bitcoin and altcoins.

We have already seen the first phase of this rotation, with capital moving out of gold and oil and into the S&P and Nasdaq. If that trend continues, it is only a matter of time before capital flows into the crypto space, pushing Bitcoin back toward all-time highs and dragging altcoins along with it.

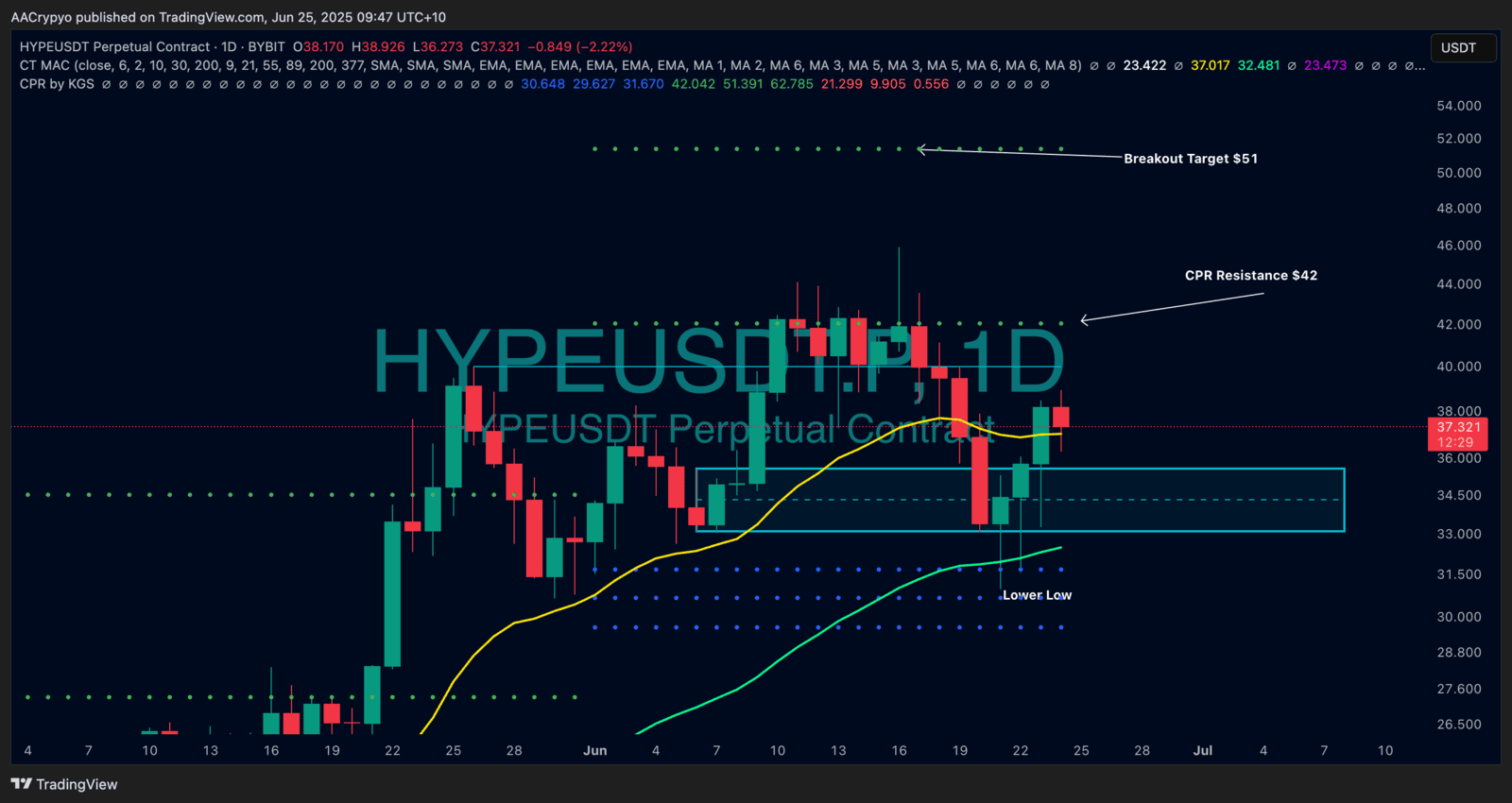

Stormrake Spotlight: Hyperliquid (HYPE) ($37.34)

Stormrake Spotlight: Hyperliquid (HYPE) ($37.34)