To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Saturday saw Bitcoin drop back to $80K for the first time since early April when Trump’s Liberation Day was hitting markets. Just two days later, Bitcoin has bounced back strongly, yet quietly, rising 10% from that weekend low.

The bounce was fuelled by smart money and dip buyers. This was not a short squeeze or a liquidation-driven rally. It was a clean spot move led by those taking advantage of the current market structure. Sellers are exhausted, which has left the door slightly open for bulls to reclaim some momentum.

That said, there is no debate over who is still in control. Despite the 10% bounce, bears remain firmly in charge. After Bitcoin briefly recovered to $88K, it was quickly sent back to $86K just two hours later. A sharp reminder from the bears of who still holds the upper hand.

This week is likely to be volatile. Bears have paused, bulls have begun to capitalise with a 10% move in two days. Beyond price swings, some key macro events are on the calendar. PPI inflation data is due, its first release since September before the government shutdown, along with fresh unemployment figures. Be ready for volatility and the opportunities that tend to follow.

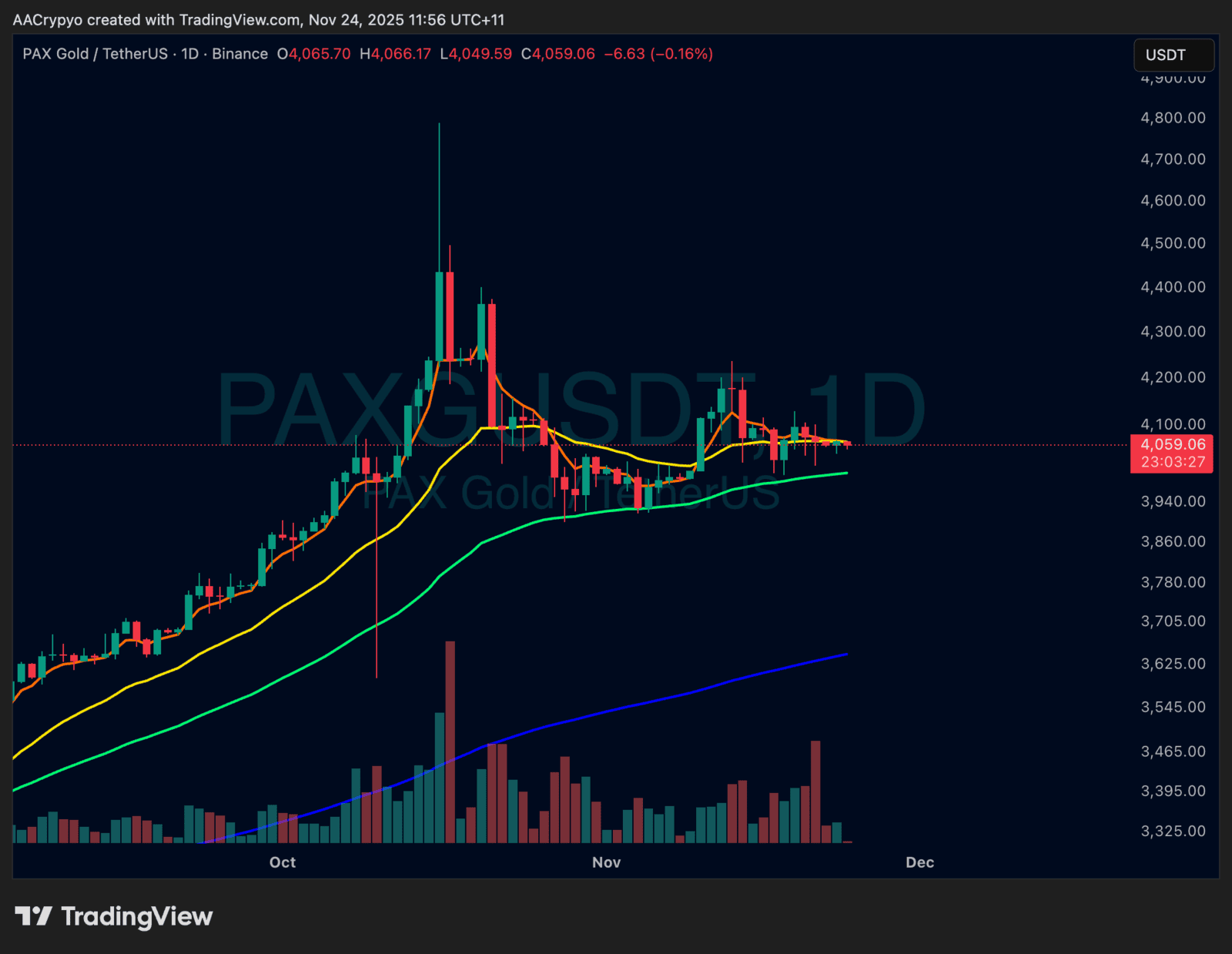

Stormrake Spotlight: Pax Gold (PAXG) ($4,059)

Stormrake Spotlight: Pax Gold (PAXG) ($4,059)