To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Risk on flows are reentering the space, boosted by growing hopes of rate cuts at the upcoming Fed meeting in a couple of weeks. Bitcoin has mirrored the broader risk appetite overnight, with the S&P 500 and Nasdaq pushing higher and now knocking on the door of fresh all time highs. While Bitcoin itself remains some distance from reclaiming its own ATH, the cautiously bullish tone is improving and optimism is gradually returning to the market.

Overnight, US unemployment claims came in lower than expected. As a result, Treasury yields have fallen and the US dollar has softened. This is a classic signal that rate cuts may be just around the corner, and it is fuelling the current bounce across risk assets.

Now back above $90K and up nearly 12% in just five days, bulls have capitalised on the recent pause in bearish momentum. While several metrics still suggest lower prices are possible, this macro driven recovery and the potential for rate cuts could provide enough fuel for bulls to push higher and begin invalidating some of the more extreme bearish signals. Time will tell.

Bitcoin has broken through the key battleground at $88,888 and now looks to flip the year back in favour of the bulls, aiming to turn green year to date once again. With rate cuts likely in under two weeks and the scheduled end of quantitative tightening in the US on 1 December, there is plenty of fuel left in the tank. The question now is can the bulls take it back or will the bears prove too strong.

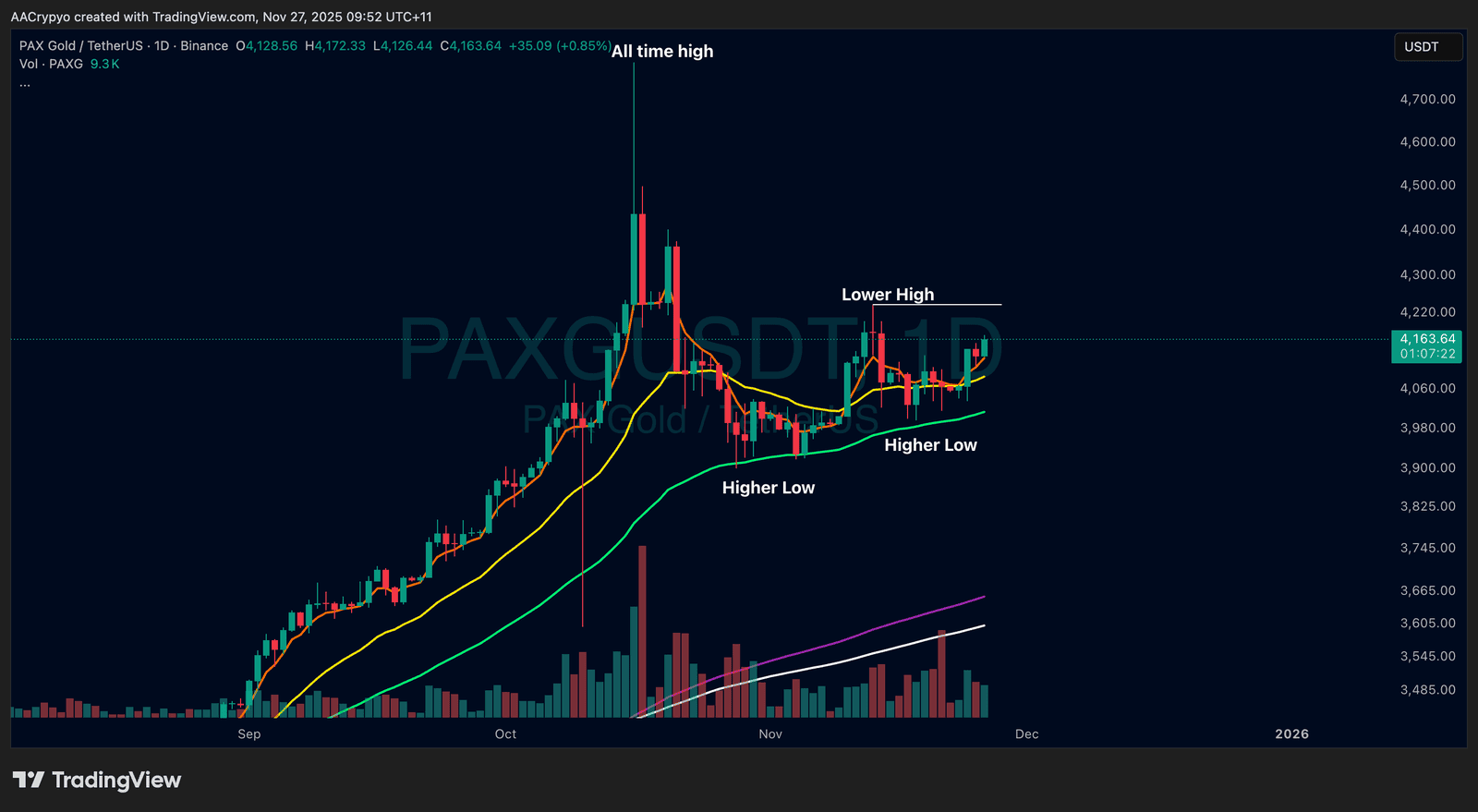

Stormrake Spotlight: Pax Gold (PAXG) ($4,163)

Stormrake Spotlight: Pax Gold (PAXG) ($4,163)