To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It was a tall order for the bulls over the weekend, but they could not stop the bears from confirming a classic bear market signal.

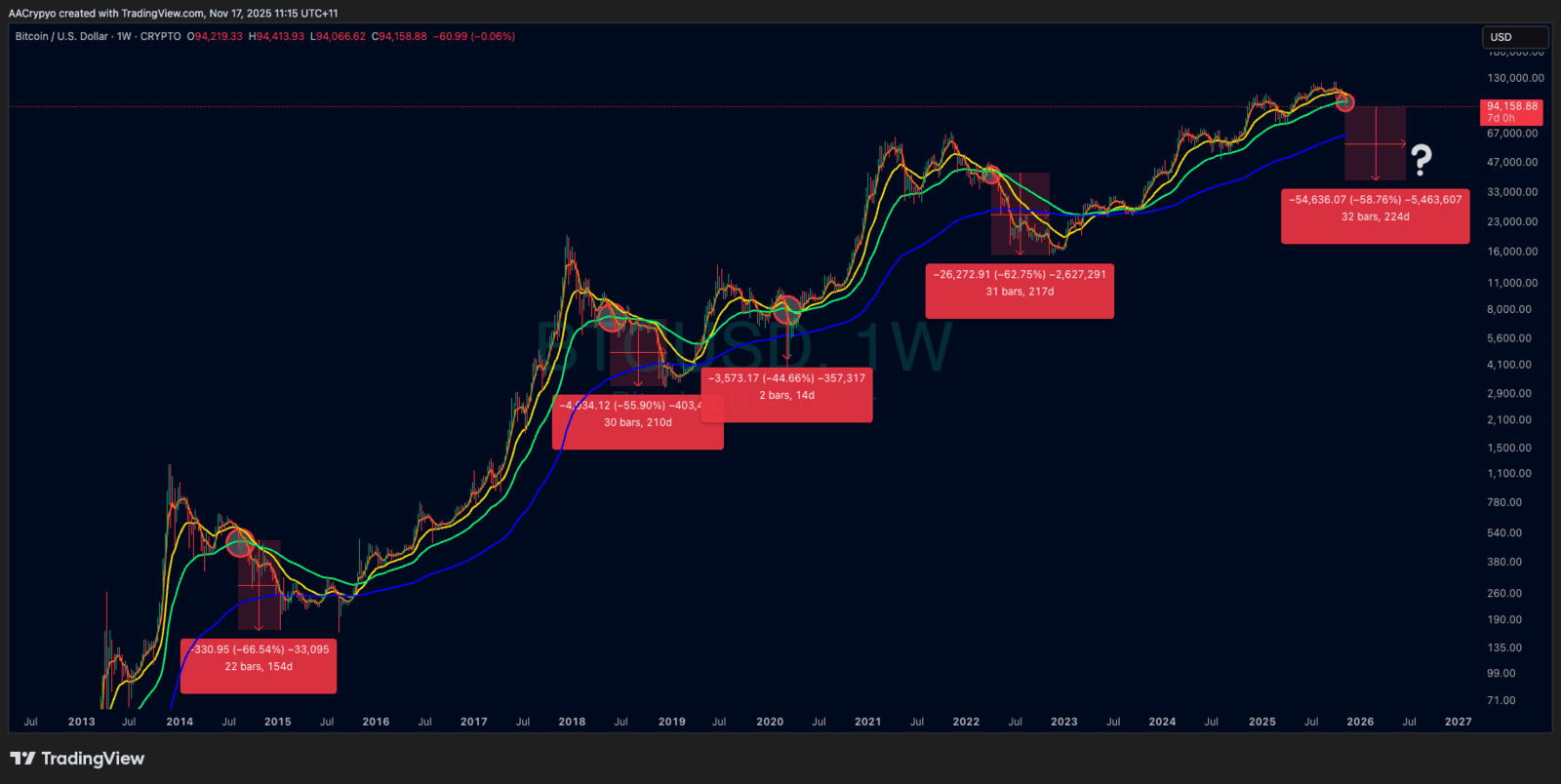

We have mentioned it a few times before. The weekly Bitcoin exponential moving averages, particularly the 55EMA, continue to play a major role in shaping market structure. Last week, we pointed out a bounce from this level and highlighted its importance. In Saturday’s morning note, we said Bitcoin had fallen below it and needed to reclaim $99,000. It was a major test that the bulls ultimately failed.

Bitcoin has now closed below the 55EMA on the weekly chart for the first time since September 2023, when the market was beginning to recover from the previous bear cycle. The last time this happened while still in a bullish posture, meaning the 21EMA remained above the 55EMA, was in April 2022. That breakdown preceded a larger decline that eventually took Bitcoin to $15,000 later that year.