To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Ethereum has been the clear underperformer of this cycle—still down nearly 50% from its all-time high and nowhere near setting a new one. It hasn’t been able to sustain any meaningful bullish momentum throughout this entire run; every attempt has been met with renewed selling pressure, consistently dragging prices lower.

But for the first time this year, ETH is showing signs of life. After bottoming out at $1,380 in early April, Ethereum has nearly doubled in just eight weeks—significantly outperforming most other cryptocurrencies. This marks the first rally where ETH has managed to sustain and consolidate gains after a breakout, rather than reversing and resuming its downtrend.

This move has been fuelled by institutional demand. Over the past three days of ETF trading, Ethereum has consistently seen net inflows—while Bitcoin ETFs have recorded three consecutive days of outflows. Since May 16, every trading day has brought net inflows into the Ethereum ETF. In parallel, just yesterday it was reported that BlackRock had sold 1,250 BTC (worth $132.72 million) while purchasing 19,070.96 ETH (worth $48.4 million). This suggests that the rally is not just speculative—it’s backed by real institutional accumulation.

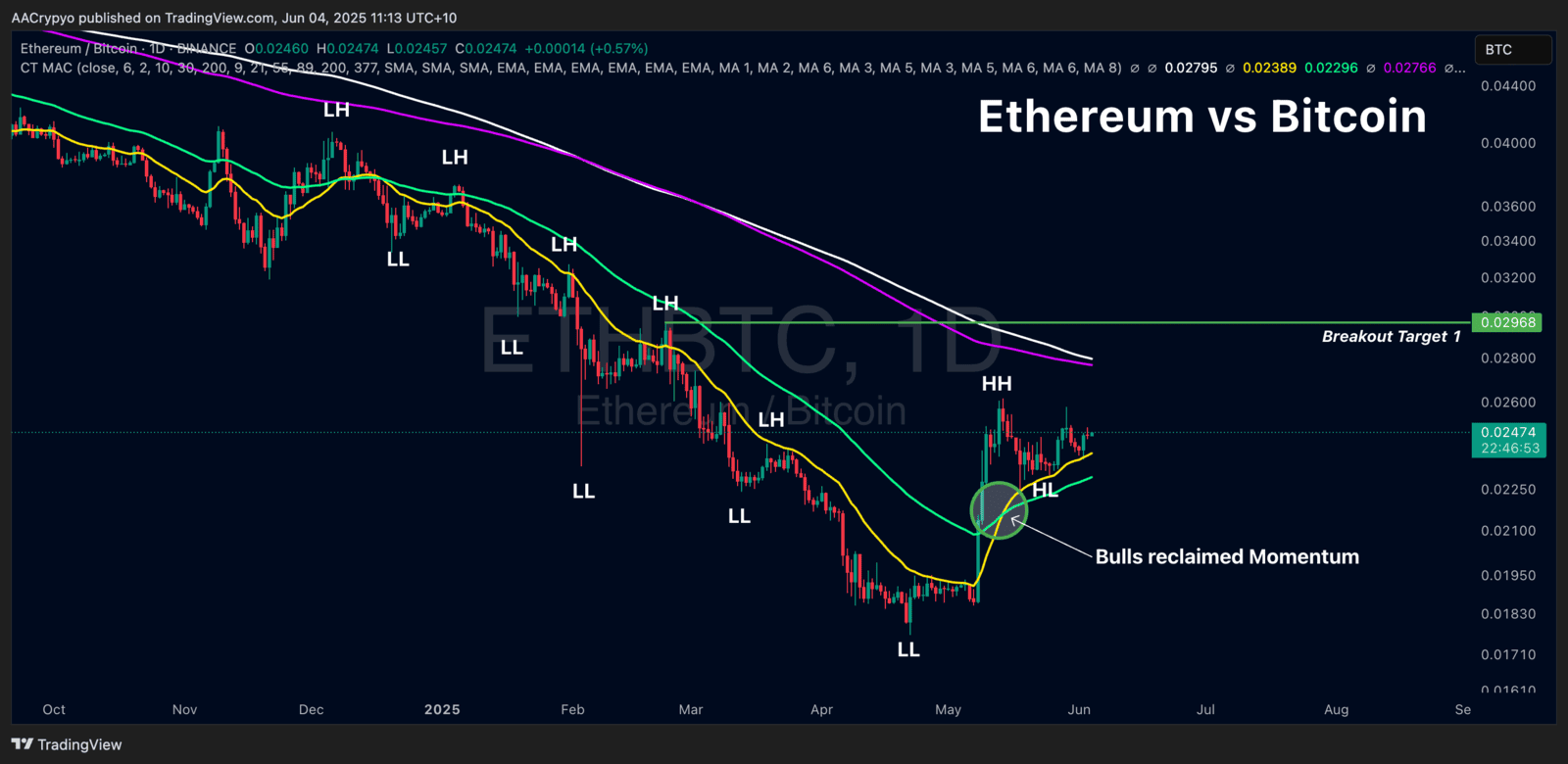

The chart above shows Ethereum finally breaking out against Bitcoin. ETH has been in a persistent downtrend relative to BTC since 2021 and hasn’t come close to revisiting its 2017 high of 0.15. While it’s unlikely ETH will return to those previous highs, this breakout is giving holders a much-needed sense of hope. The structure and momentum of ETHBTC have now flipped bullish, indicating that capital is beginning to rotate out of Bitcoin and into Ethereum.

Crucially, ETH is now consolidating above the breakout level—something that didn’t occur during previous rallies, which were swiftly rejected. If this consolidation holds, we could see ETHBTC push towards 0.029–0.03.

This doesn’t mean Bitcoin won’t continue its push toward new all-time highs. It simply suggests that, in the short term, Ethereum may outperform. Historically, this BTC-to-ETH rotation has signalled the start of altseason. It’s still early days—but keep an eye on the ETHBTC chart.

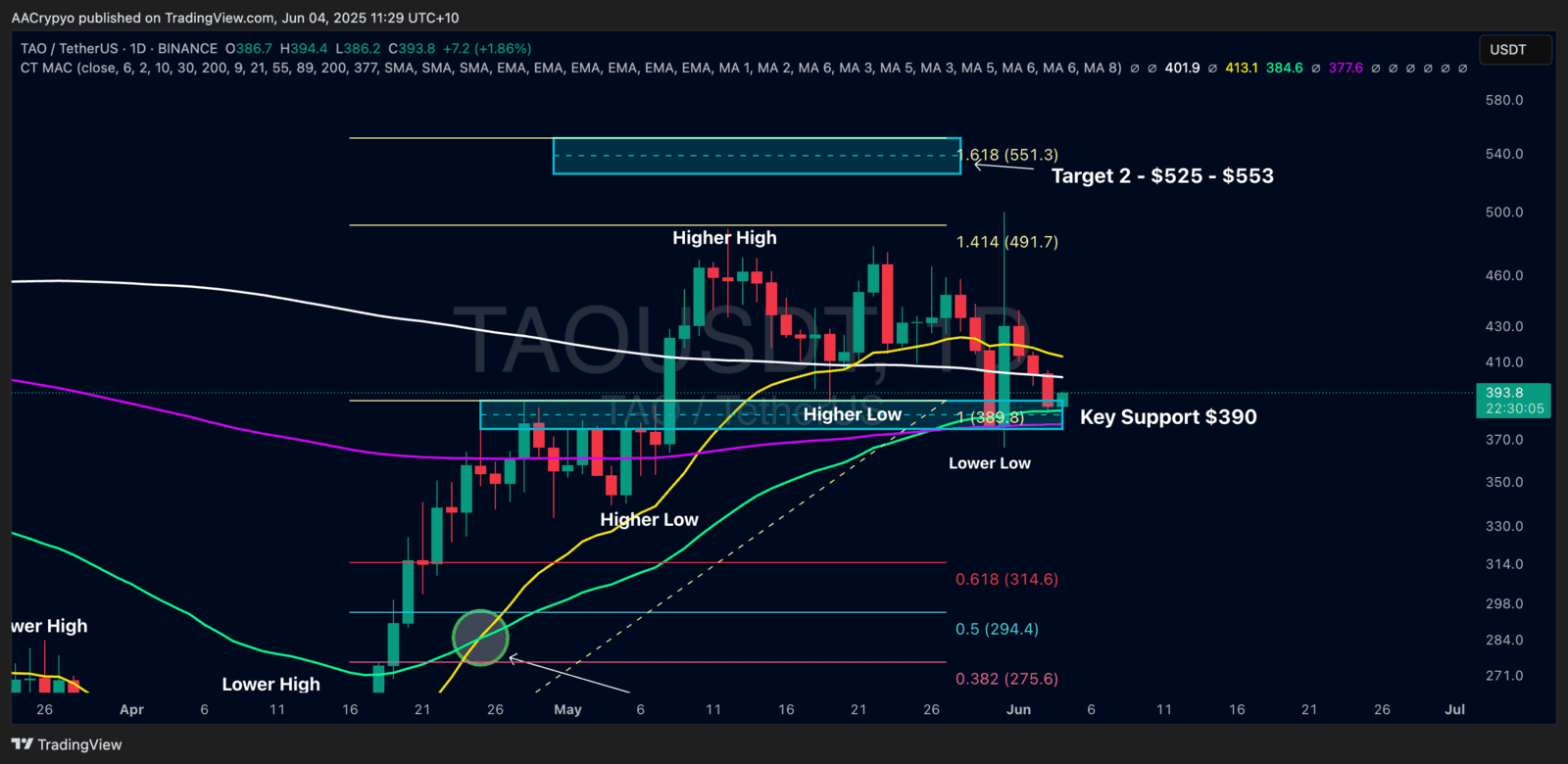

Stormrake Spotlight: Bittensor (TAO) ($393)

Stormrake Spotlight: Bittensor (TAO) ($393)

TAO has retraced back to the key support zone at $390 after failing to break above the 21EMA over the weekend. It has since bounced nearly 2% from this support and the 55EMA. This level is critical for bulls to defend—failure to hold it could lead to a bearish breakdown and further downside.

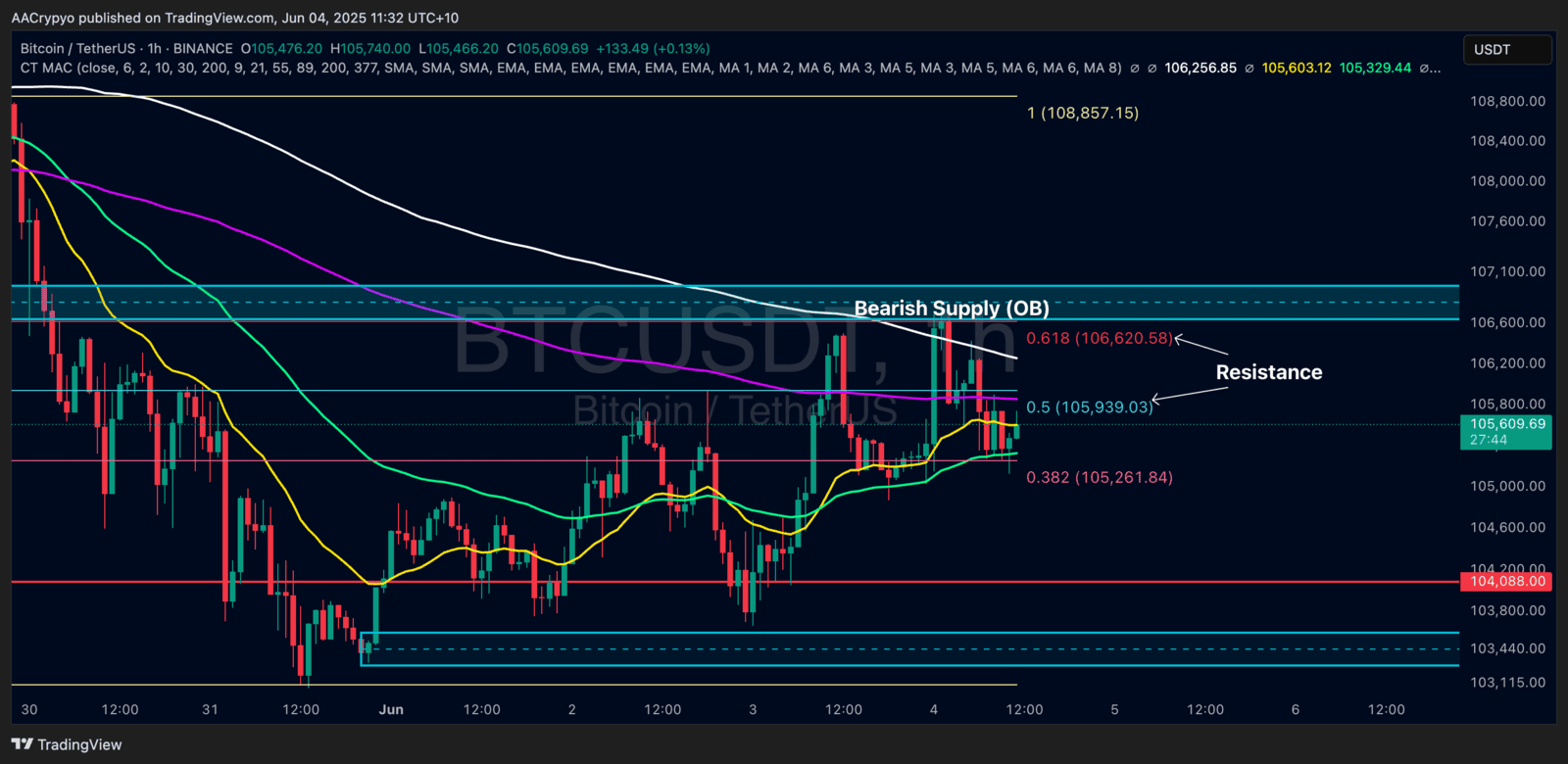

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action: