To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

As expected, the market saw a slight pullback after two strong days following the liquidation event. Yesterday, we highlighted that Bitcoin had struggled to break $116K and was likely due for a pullback, but a healthy one. That’s exactly what we got. Bitcoin dipped to a low of $110K while altcoins were down around 10%, wiping out Monday’s gains. However, a strong US session brought a modest recovery across the crypto market, with Bitcoin now trading back above $113K. It’s still down on the day, but a decent bounce nonetheless. Major alts like Ethereum and Solana, which had approached 9% drawdowns, are now down less than 3% over the last 24 hours.

It was a healthy and much-needed pullback. The market had gone straight from $102K to $116K with no real selling, so exhaustion was building and a correction was due. This sets the stage perfectly for Bitcoin to now make a renewed push towards higher prices following the flush.

The US session was volatile. Traditional indices opened lower before recovering intraday, although the S&P 500 briefly lost $450 billion in market cap in just seven minutes. This was triggered by a social media post from President Trump, who threatened to begin domestic cooking oil production. The comment rattled markets and weighed heavily on the final half hour of trading, with the session closing negative.

Meanwhile, strength in precious metals continues. Gold extended its historic run, setting another all-time high as it edges closer to $4,200 an ounce. Silver also touched a new high just shy of $54 before pulling back.

Despite Bitcoin’s weakness since Friday, we remain bullish. The macro catalysts continue to support the bulls. We’re halfway through October, a month that has already seen all-time highs and historic liquidations. Bitcoin is currently down just 1.20% for the month, with plenty of time for a new high to be set. Market structure remains intact, and the setup is still there for another bullish leg.

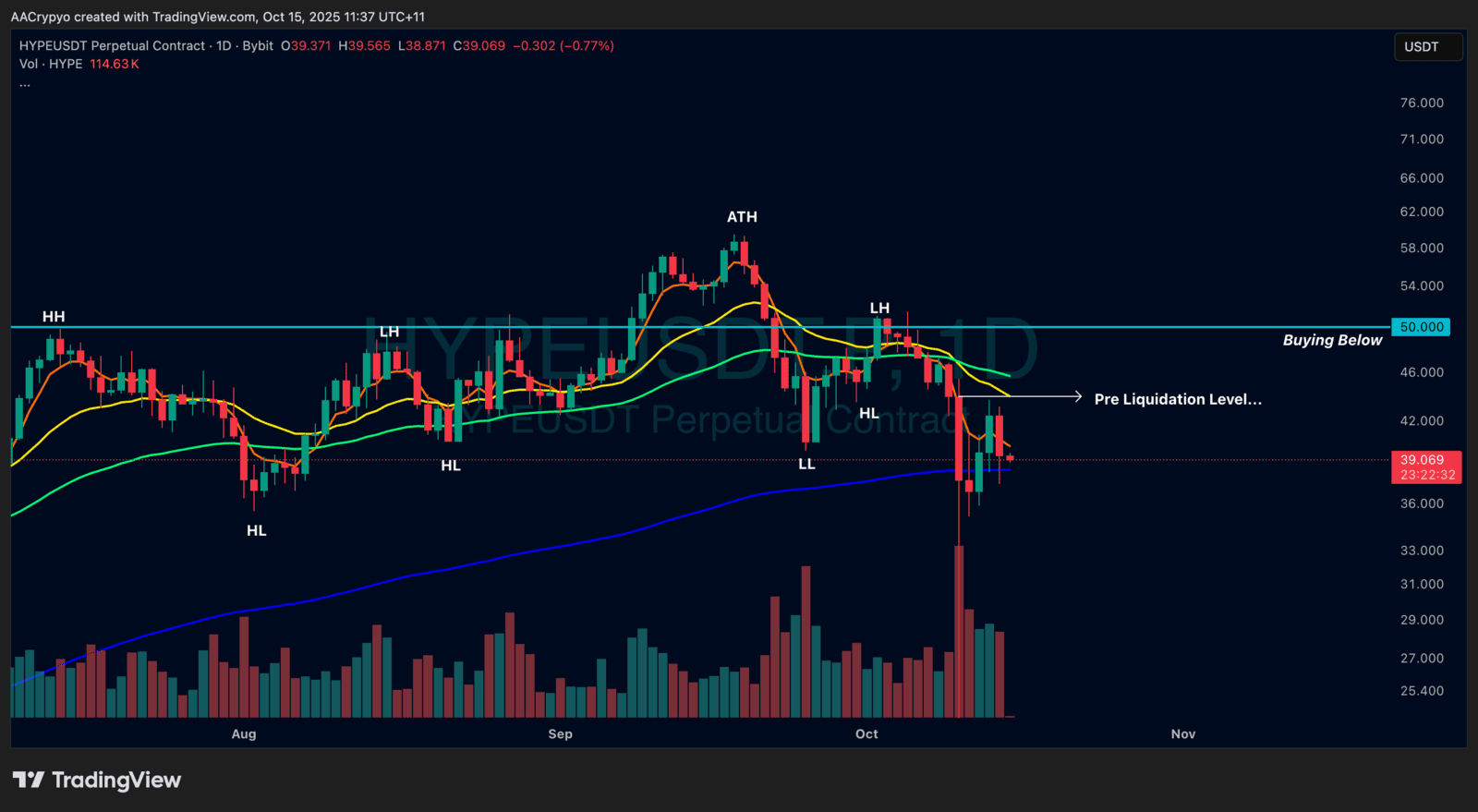

Stormrake Spotlight: Hyperliquid (HYPE) ($39.05)

Stormrake Spotlight: Hyperliquid (HYPE) ($39.05)