To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Yesterday we mentioned it was going to be a tall task for the bulls to reclaim Bitcoin and stop the bears from pushing it lower. They have stepped up with perfect timing, just as it looked like the bears were preparing to send the market into another leg down. Bitcoin is now back above $110K and altcoins have had a much-needed bounce after some extremely poor price action in recent weeks.

The bulls are building. With the CPI event tonight, a dovish reading should see bullish momentum carry into the weekend and give the bulls a real shot at ending October on a high. Currently down just 3.30% for the month, there is a strong chance we see another green October and a slim chance of potentially printing new all-time highs if everything lines up.

Gold printed a small green candle yesterday but the pullback looks to be continuing, with the new daily candle already shaping up to engulf yesterday’s gains. We can anticipate more downside pressure and a deeper retrace. Now that Bitcoin has rediscovered some bullish form, could we start to see some of the gold profit-taking rotate back into BTC?

The current gold to Bitcoin ratio sits at 27, meaning 27 ounces of gold are equivalent in value to one Bitcoin. This year’s peak was 40, just shy of the all-time high of 41 set last year and again in 2021. Just two days ago this ratio was at 25, its lowest since April, Liberation Day. This suggests Bitcoin is extremely undervalued when priced in gold. If we start to see a true rotation, this ratio could expand and potentially break the all-time high of 41. If it continues to rise as gold pulls back, it is a strong signal that smart money is moving into Bitcoin.

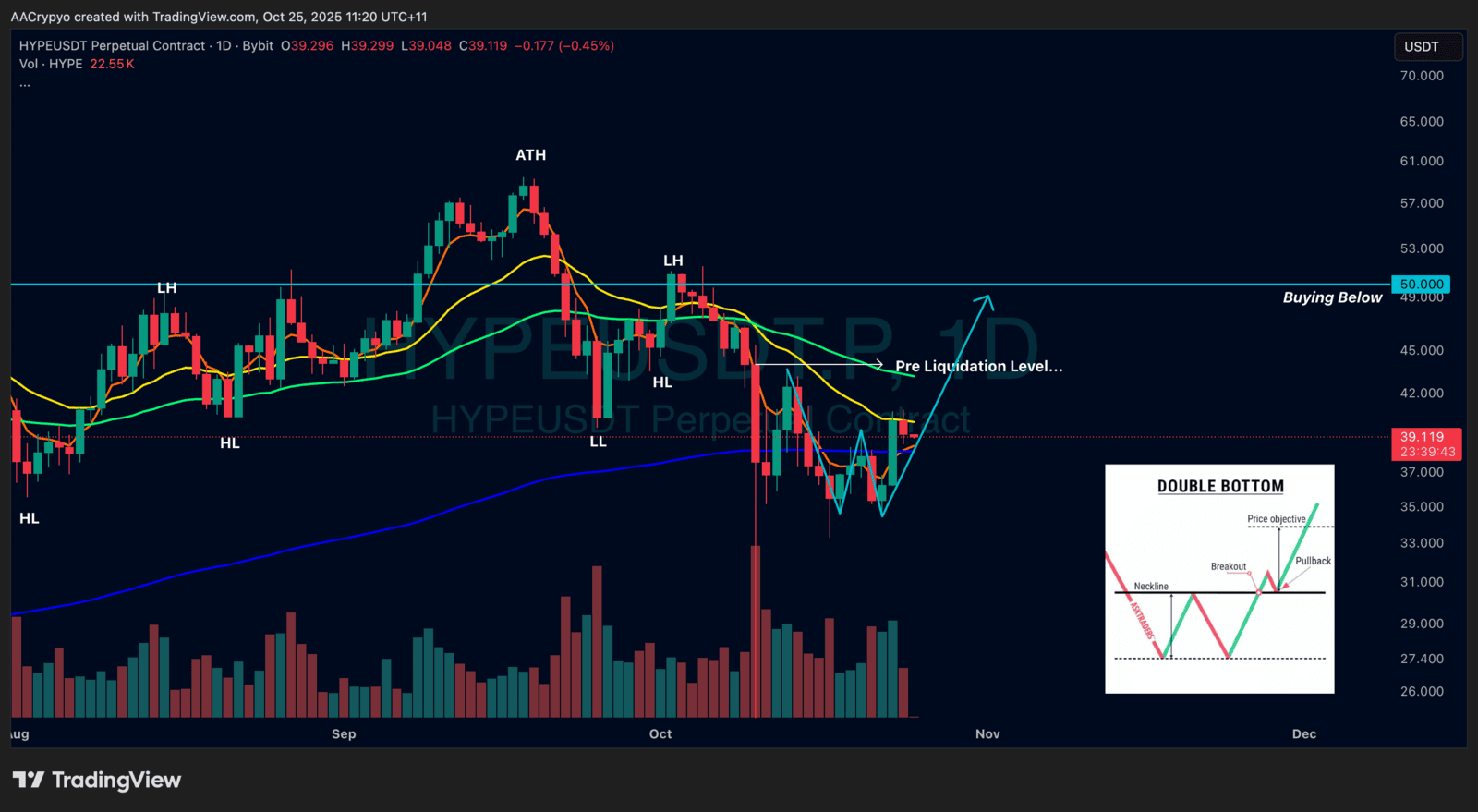

Stormrake Spotlight: Hyperliquid (HYPE) ($39.14)

Stormrake Spotlight: Hyperliquid (HYPE) ($39.14)