For nearly a decade and a half, silver had been in what many considered a suppressed bear market, largely due to price manipulation by major players like JP Morgan. It’s no secret that markets are influenced by institutions with the size and reach to shift sentiment and structure to benefit their books. Silver has long been the poster child for this kind of manipulation.

In 2020, JP Morgan agreed to pay over $920 million in fines to resolve charges tied to fraud schemes in the precious metals and US Treasuries markets. This included spoofing and other deceptive trading practices. But to understand the full picture, we need to go back over a decade to when the bank first inherited its short position in silver.

Timeline: JP Morgan and the Silver Price Suppression:

2008 Global Financial Crisis: Bear Stearns collapses under the weight of the crisis. The bank held a massive short position in silver. JP Morgan takes over its books, inheriting that short.

Post-2008: JP Morgan’s precious metals desk engages in widespread spoofing, placing and cancelling large orders to manipulate price action across tens of thousands of trades.

November 2009: Whistleblowers alert the Commodity Futures Trading Commission (CFTC) to potential silver price manipulation linked to JP Morgan.

2009–2010: Reports emerge detailing JP Morgan’s unusually large short positions and suggest a pattern of systematic efforts to cap silver prices.

2011: Silver hits its all-time high before entering a prolonged 14-year bear market.

2020: JP Morgan is fined $920 million for market manipulation. Two of the bank’s traders are sent to prison.

2025: The bank closes its short positions on silver and flips long. This pivot coincides with a breakout to new all-time highs and the start of a major bull run.

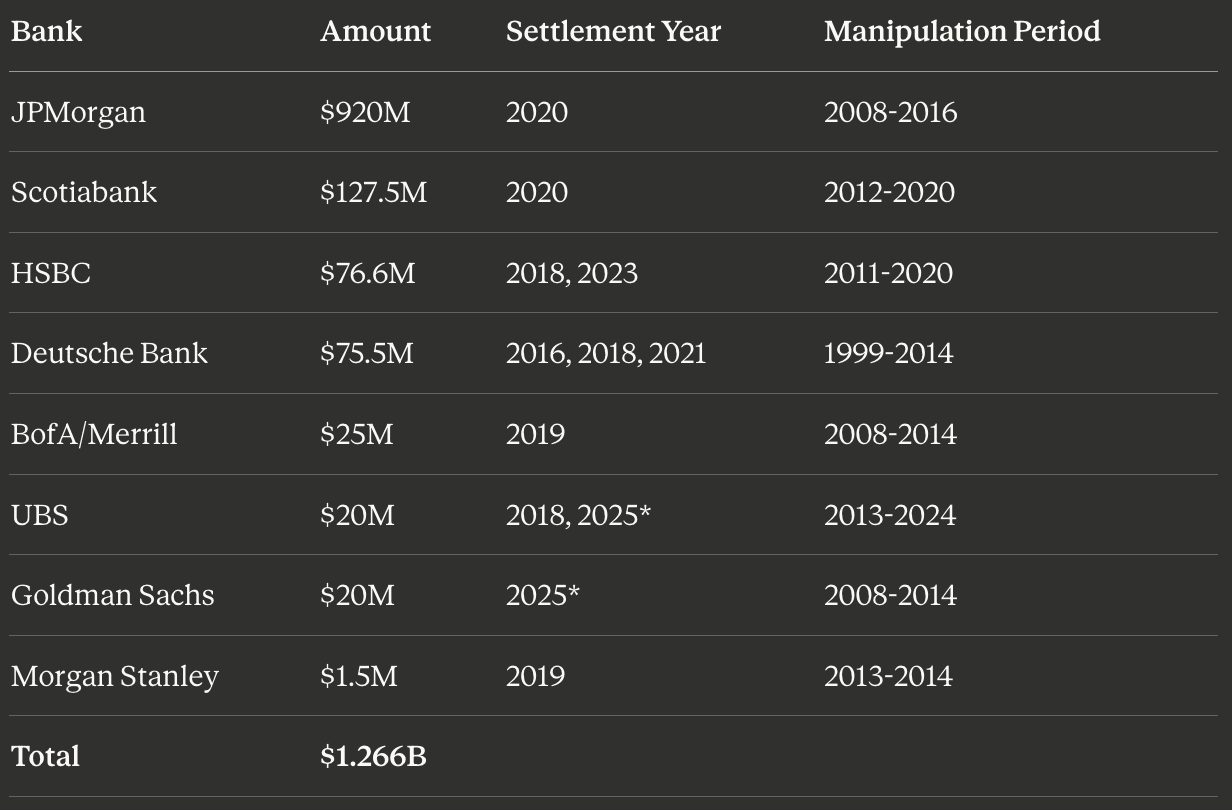

JP Morgan wasn’t the only institution accused of manipulating silver prices. Scotiabank, Deutsche Bank, HSBC, Bank of America, UBS, Goldman Sachs and Morgan Stanley were also fined for similar conduct in the precious metals markets.

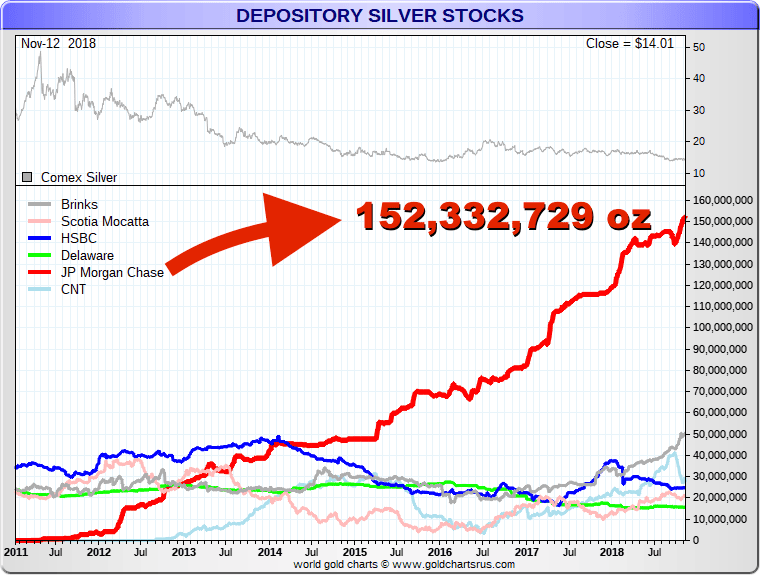

What’s more revealing is what the chart above shows: JP Morgan’s silver depository holdings (marked in red) growing steadily during the same period they were shorting silver. This suggests that while the bank was suppressing paper prices, it was quietly accumulating physical metal at a discount. A long-term arbitrage that ultimately paid off.

Between June and October 2025, JP Morgan reportedly closed its entire 200-million-ounce paper short and simultaneously went long. The bank is now believed to hold the largest private physical silver reserve in history, estimated at over 750 million ounces. That just so happens to line up with silver’s explosive move higher.

Since August 2025, silver is up more than 125% in less than six months, with 90% of that move occurring since the start of Q4 2025. When an asset is actively suppressed by one of the largest investment banks in the world, it will struggle to perform. When that suppression ends, the lid comes off.

Now the question is: is the same happening to Bitcoin?

We’ve shown you the context and how easily major assets can be manipulated by institutional players. We’re not here to push conspiracies, but over the coming days, we’ll release a Morning Note exploring whether Bitcoin is facing a similar structure of suppression, following its October capitulation and the liquidation of major players. We’ll look at whether the books of these liquidated entities are being absorbed by bigger fish, just like Bear Stearns and JP Morgan post-GFC.

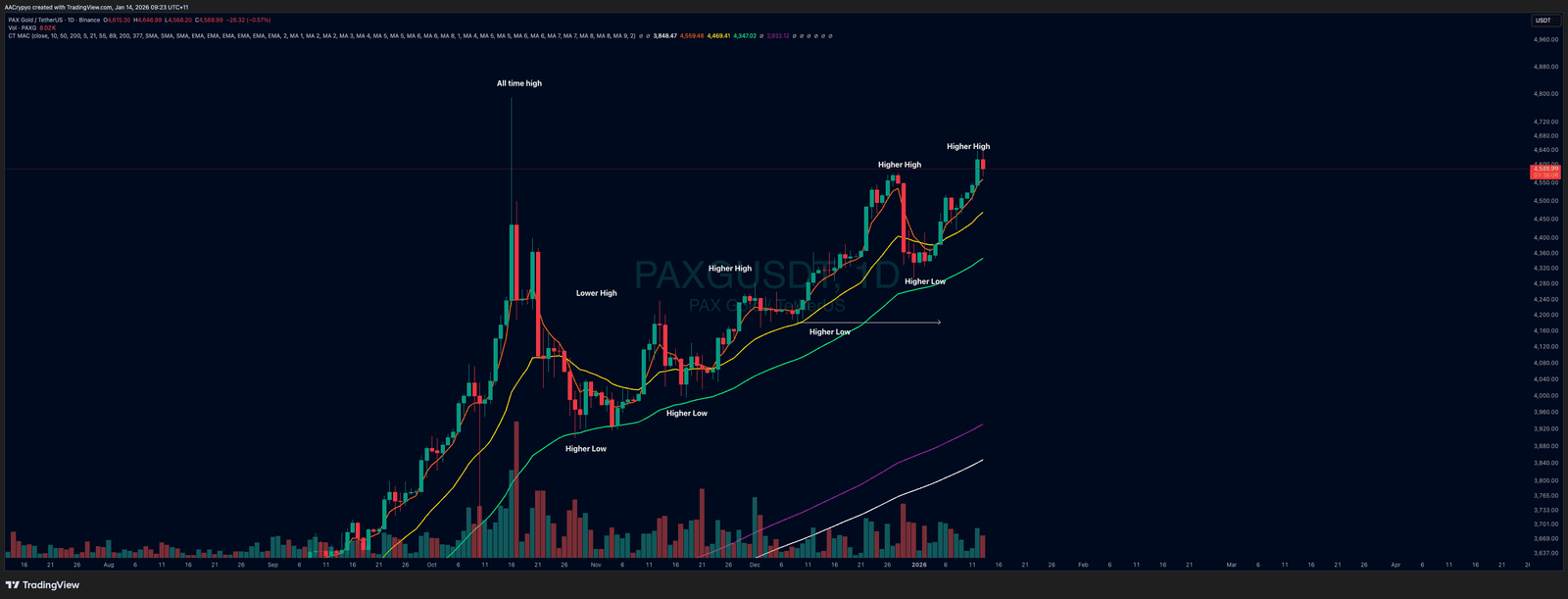

Stormrake Spotlight: Pax Gold (PAXG) ($4,588)