To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Leverage and derivatives are not new concepts to markets or trade, yet they continue to haunt investors. Derivatives date back to Ancient Greece, when you could purchase options on olive harvests and deliveries. Over time, they evolved further during the Tulip Mania of the 16th and 17th centuries, followed by Japan establishing an organised futures market to hedge rice trades in the 18th century. The concept was adopted in America in the 19th century and has only accelerated since.

Now, it’s safe to say it has evolved too far, to the point where you can leverage your sh*tcoins to trade silver futures on a decentralised crypto exchange.

What started as a way to hedge spot positions has turned into a tool for market makers and institutions to manipulate price, taking advantage of everyday traders and leaving them licking their wounds while the manipulators walk away with the profits.

Deleveraging events and liquidation cascades are not uncommon, especially not in crypto. In fact, Bitcoin and the broader crypto market are still recovering from the biggest liquidation event in history back on October 10. You would think investors had learned something by now. Those in the traditional space are more than familiar with liquidation events too. When markets experience rapid crashes or spikes with no news, it’s often the result of forced liquidations and deleveraging.

Unfortunately, many refuse to learn. They chase quick gains or try to make back previous losses. That is exactly what we saw overnight. No major news. No groundbreaking catalyst. Yet every market fell, regardless of whether they were risk-on or risk-off.

In a single hour, gold lost nearly 6% and at one point was down close to 8%, wiping out over $3 trillion in market cap. Silver closed that same hour down more than 8%, and at its worst was nearing a double-digit percentage loss, wiping out $760 billion in market cap. Traditional risk-on assets followed, the S&P 500 lost over 1.5% and the Nasdaq fell nearly 2.5%. Bitcoin was not immune either, falling nearly 2.5% in just one hour.

The signs were there. We had already covered the fact that Binance and other exchanges had jumped on the trend, listing futures markets for leveraged silver and gold trading. It’s a classic move, lure more retail traders into leveraged positions. With both traditional CFDs and now crypto exchanges offering leverage on metals, the build-up was obvious. And this is the result.

This is yet another reminder that leverage is not for the average investor. Spot buyers remain intact and now have the opportunity to accumulate quality assets at discounted prices.

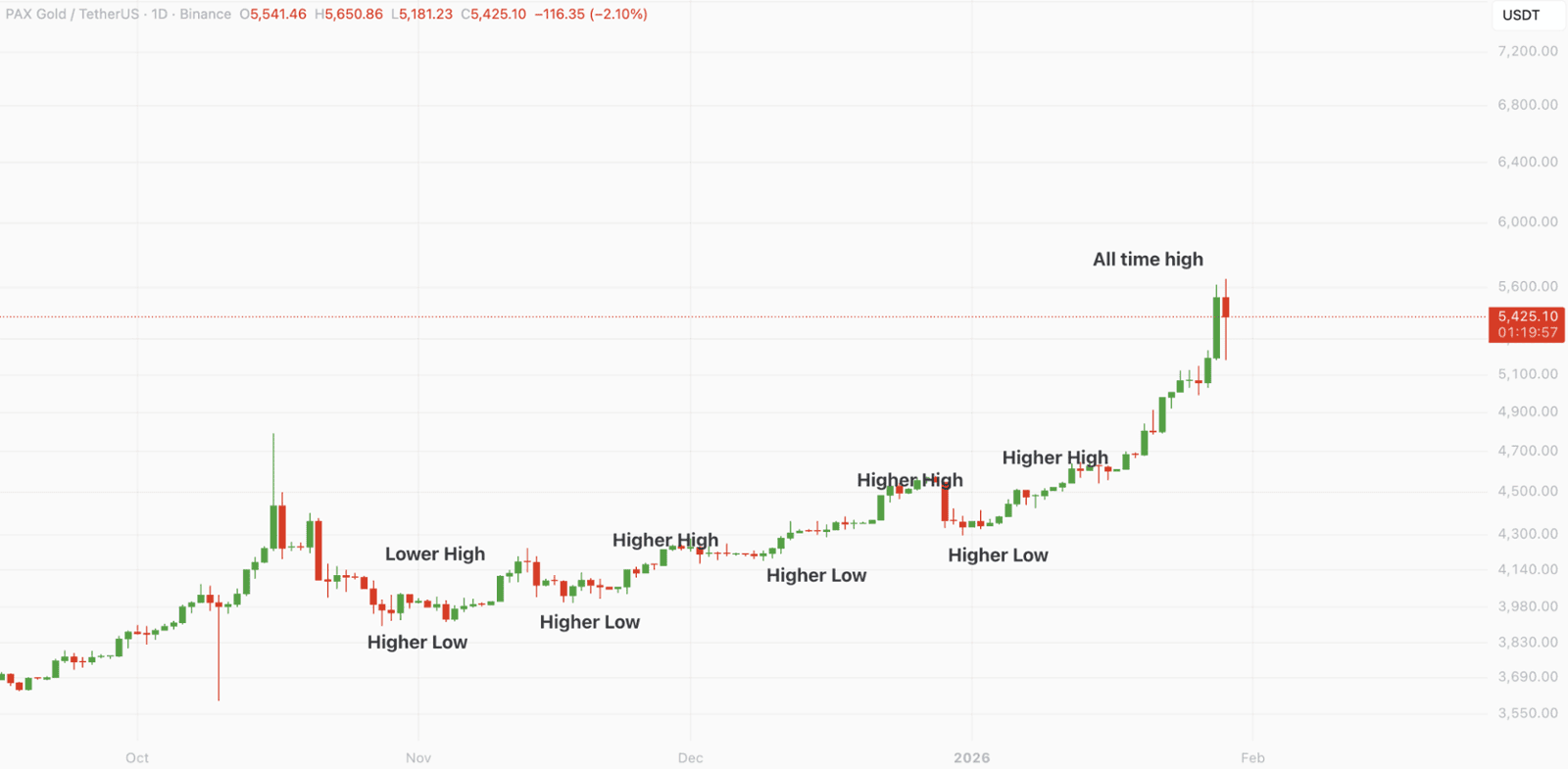

Stormrake Spotlight: Pax Gold (PAXG) ($5,447)

Stormrake Spotlight: Pax Gold (PAXG) ($5,447)