To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Just last week, following the release of the FOMC meeting minutes from last month’s interest rate decision, market expectations flipped entirely. The probability of no rate cut in December surged to 67%. Today, the narrative has shifted again, with markets now pricing in an 84% chance of a 25 bps cut to close out the year.

Risk-on markets rallied overnight as US Treasury yields fell and expectations for a rate cut increased. The S&P500 and Nasdaq have both continued their recovery, with the S&P500 now trading above last week’s selloff levels. Alongside the drop in yields, the first PPI inflation data since September hit the market. Core PPI month-on-month came in below expectations, a sign that inflation may be cooling and further supporting the case for a December cut.

As we often see, risk-on flows tend to enter traditional markets first before filtering into the crypto space. Bitcoin has yet to catch the same bid as the indices. After an 11% weekend rally, bulls have stepped aside for now. Price action sits in a no man’s land with both bulls and bears taking a breather. Sentiment remains in extreme fear territory with a reading of 15, five points lower than yesterday, but the current posture stays cautiously bullish.

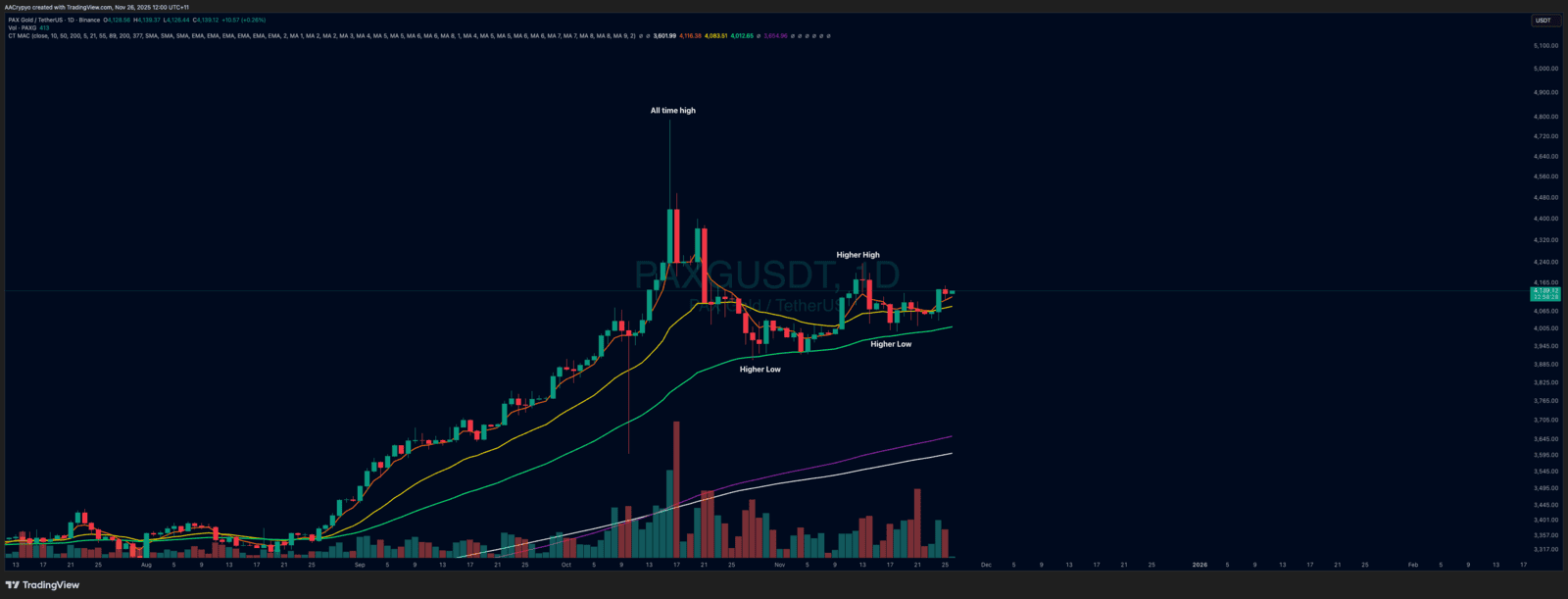

Stormrake Spotlight: Pax Gold (PAXG) ($4,139)

Stormrake Spotlight: Pax Gold (PAXG) ($4,139)