To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It’s tense. The bulls are spooked as the bears look to capitalise on the failed breakout rally. Investor sentiment remains shaky, with many still hesitant to re-enter. The past 72 hours have seen aggressive liquidations with little genuine spot activity. Price action has largely been manipulated to flush out overleveraged positions, which continue to dominate the market while sidelined spot holders stay out amid ongoing fear and uncertainty.

The current sentiment is fearful. It briefly dipped into extreme fear yesterday, with the Fear & Greed Index hitting 25, before ticking up slightly to 27 today, even as Bitcoin slipped lower over the past 24 hours. That decline dealt another blow to the bulls, resulting in a lower low and further strengthening the bears’ grip on the market.

While investors remain cautious on Bitcoin, gold has posted its third consecutive red day, extending its pullback to nearly 7% from its all-time high as profit-taking accelerates. Over the last two days, gold has shed $2.5 trillion in market cap, roughly equivalent to Bitcoin’s entire market cap, marking its worst 48-hour period since 2013. But this profit-taking is not flowing into crypto or other risk-on assets. Both the S&P 500 and Nasdaq also closed red, reflecting broad risk aversion across markets.

With the US government shutdown still in effect, the Bureau of Labor Statistics has been unable to publish key macro data, including unemployment figures. However, an exception has been made for this Friday, when CPI inflation data is set to be released just four days ahead of the Federal Reserve’s interest rate decision on the 29th. This print will be critical, giving the Fed a fresh data point instead of relying on outdated figures from September. Expect volatility tomorrow night, as markets have been running data-blind for weeks.

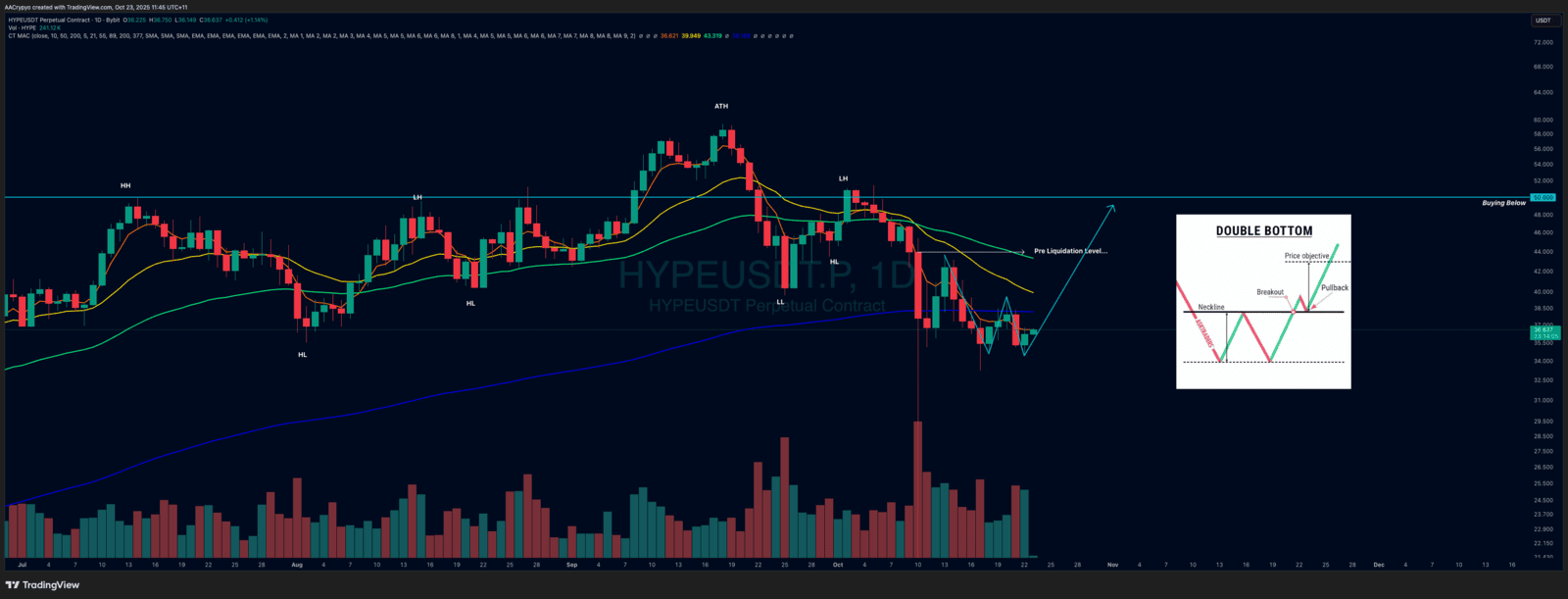

Stormrake Spotlight: Hyperliquid (HYPE) ($36.62)

Stormrake Spotlight: Hyperliquid (HYPE) ($36.62)