To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Following Israel’s strikes on Tehran, Iran has retaliated with missile attacks of its own, some of which penetrated the Iron Dome and struck Tel Aviv. With both nations refusing to de-escalate, tensions are intensifying. For now, the major global powers—the US, China, and Russia—have stated they will not get directly involved.

Markets remain firmly in risk-off mode, driven by fear of further escalation. On Polymarket, the odds of a nuclear weapon being detonated in 2025 have surged from 13% to 23% in just two days—a stark reflection of the deteriorating sentiment in the wake of the Middle East conflict.

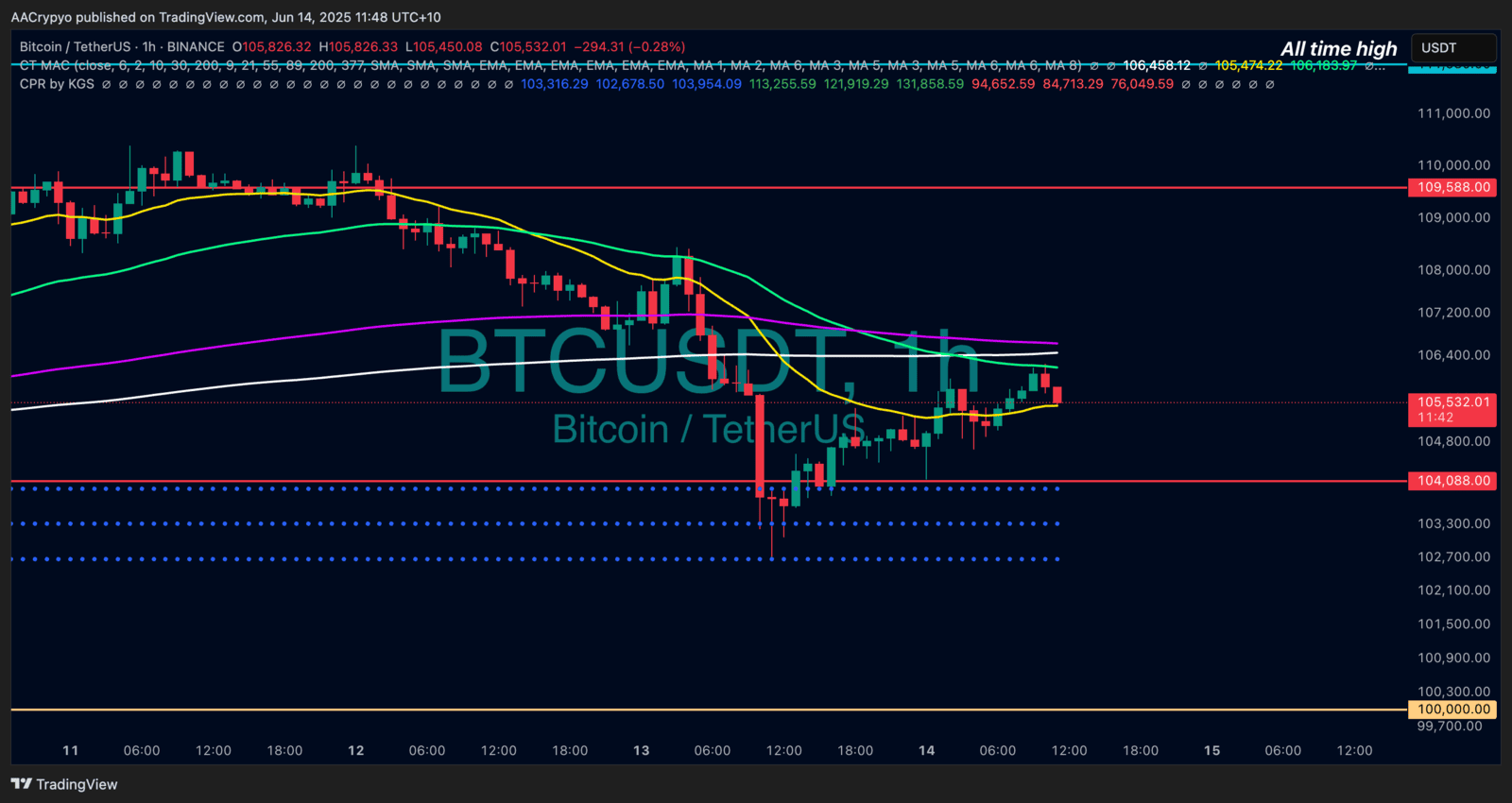

Bitcoin’s Fear & Greed Index has dipped to 63, though still technically in ‘greed’ territory. Broader markets echoed the unease: risk-on markets like the Nasdaq and S&P 500 pulled back, while Gold and Oil rallied strongly. Interestingly, Bitcoin defied the trend, recovering from an intraday drop of nearly 3% to close green on the day.

The Bigger Picture

While this conflict shows no signs of abating in the near term and remains the key driver of market movements, it’s important to remember that geopolitical shocks are not new to markets. Historically, while initial sell-offs occur, seasoned investors use such fear-driven dislocations as opportunities. Bitcoin has weathered similar storms—and emerged stronger.

Stay focused. Stay convicted. When fear dominates, accumulation favours the brave.

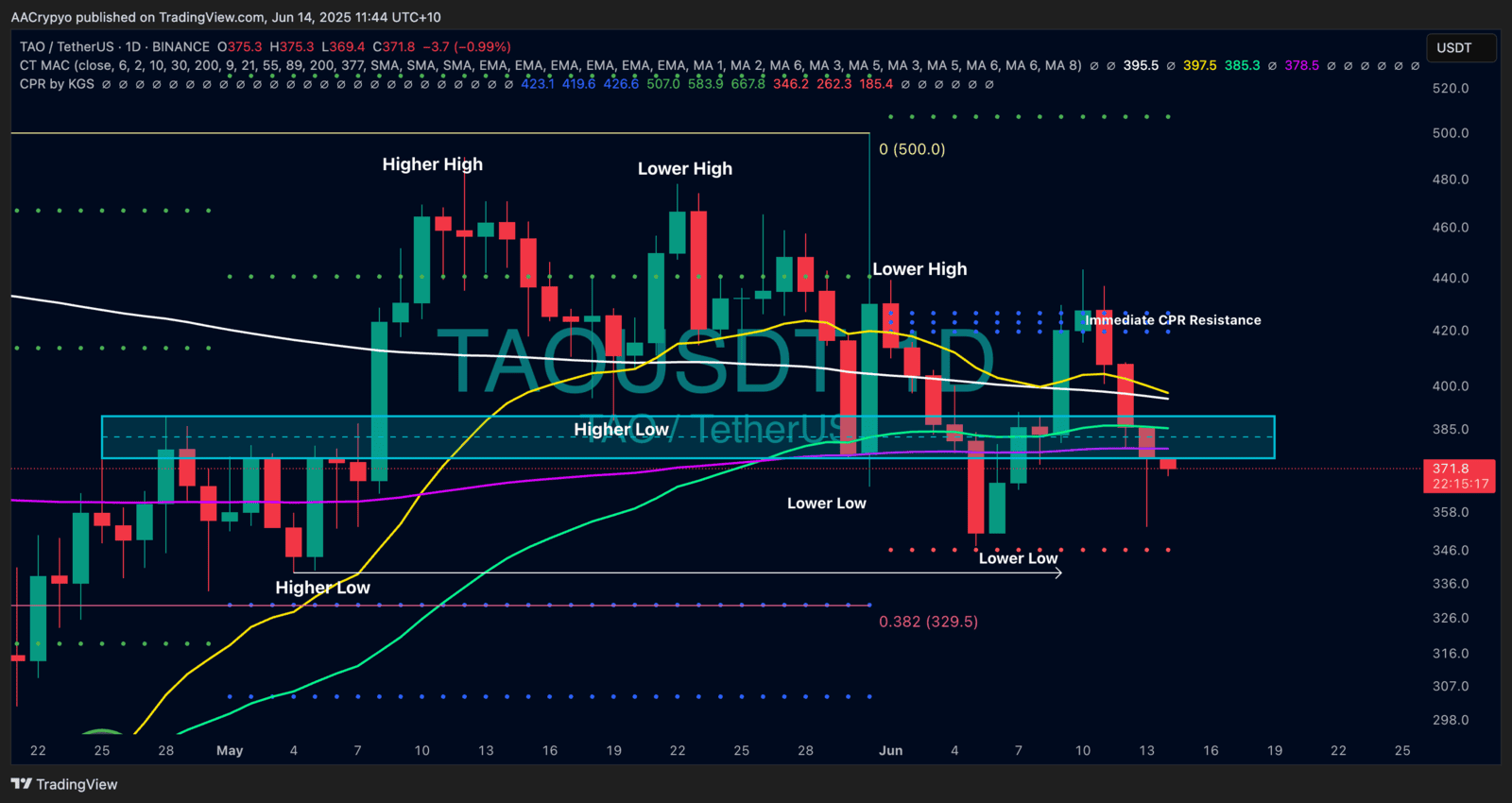

Stormrake Spotlight: Bittensor (TAO) ($371)

Stormrake Spotlight: Bittensor (TAO) ($371)

TAO closed the session down 2.45%, in line with broader altcoin weakness, after facing an intraday drawdown of over 8%. Encouragingly, the daily low held above the previous lower low. If this marks a higher low, the bullish structure remains intact, and the next leg up could be imminent. However, TAO will continue to mirror altcoin sentiment—currently tethered to Bitcoin’s macro-driven price path.

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action: