To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Initially when the US Government shutdown began, investors were not fazed. Markets continued to push higher and several indices hit fresh all time highs. Bitcoin eventually joined them and printed a marginal new all time high too.

But a deeper issue is now becoming apparent. The shutdown has entered its ninth day and we are heading into quarterly earnings season in traditional markets without any economic data. There are growing concerns over the quality of data once the Government does reopen, especially considering the issues we have already seen with data releases throughout the year.

As a result, risk on markets are beginning to teeter. Both the S&P 500 and Nasdaq closed red on the day but remain within touching distance of their all time highs. However, much of the pain was felt in the crypto market. Bitcoin saw a volatile 24 hours, with a range of nearly 3.5% from daily high to low. It was less than 2% from a new all time high before falling below $120K. Around $700 million in leveraged positions were wiped out, with the majority being long. Bitcoin has since recovered slightly and is down just 1.5% on the day. Altcoins were hit harder, most falling 3% to 4% or more.

We have been reiterating that a pullback is healthy. Yes, we did not get the breakout to new highs we were hoping for yesterday and short term control has shifted to the bears. But even a retest of $118K would not be a concern within the broader structure.

While risk off sentiment is creeping back in, yesterday saw an unusual divergence in the metals. Gold retraced 2% from its all time high, but silver continued higher and broke through $51, printing its first new all time high since 2011. A strong result for those with silver exposure in their portfolio.

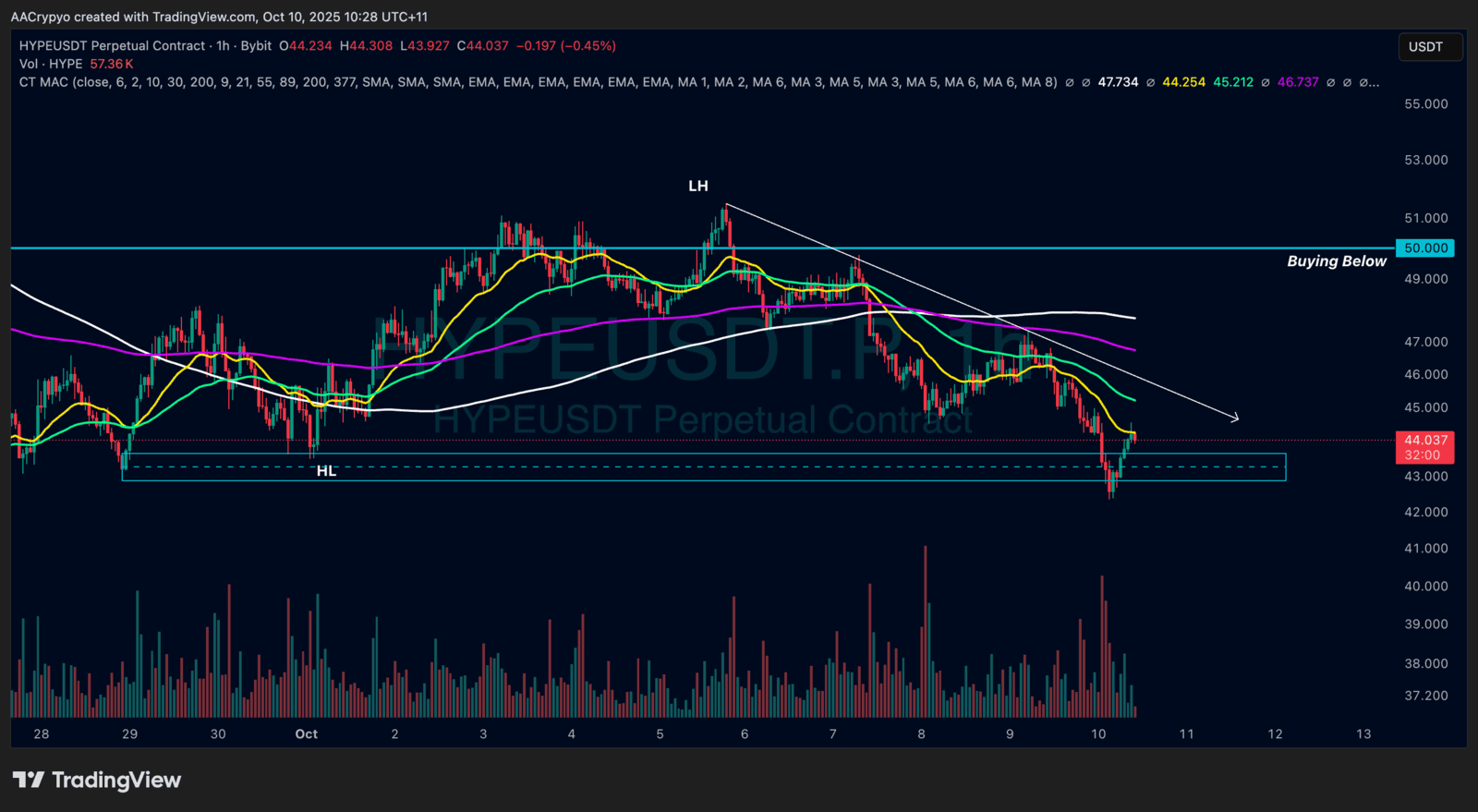

Stormrake Spotlight: Hyperliquid (HYPE) ($44.04)

Stormrake Spotlight: Hyperliquid (HYPE) ($44.04)