To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Geopolitical tensions are once again steering market direction. From shifting tariff dynamics to intensifying conflict in the Middle East, risk-off sentiment is dominating.

JUST IN: Israel has launched strikes on Tehran. This development had been brewing for the last 48 hours, with tensions between the two nations rising sharply. A response was expected—Trump even confirmed that US personnel were being repositioned across the region ahead of the action.

J.P. Morgan reported that if a full-scale conflict unfolds, oil could surge to $120 per barrel, pushing US CPI inflation back toward 5%—a scenario that could reignite the rate hike conversation. While Trump has made energy cost control a key priority in curbing inflation, such a spike in oil would undo much of that progress and rattle risk assets across the board.

With retaliation from Iran likely on the horizon, safe haven assets are climbing. Oil is up nearly 4% on the hour, and over 10% for the week. Gold has surged past $3,400, as capital flows defensively.

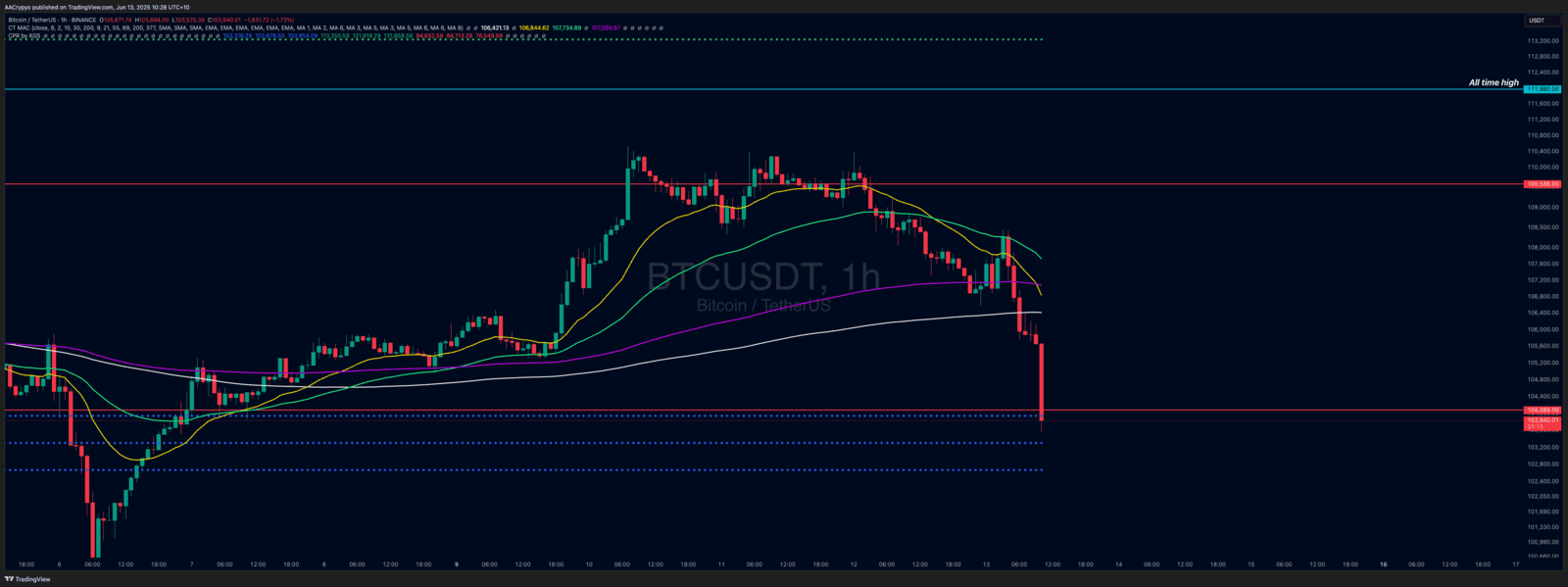

In contrast, Bitcoin is taking a hit—down nearly 2% in the past hour, now trading below $104,000. Altcoins are bleeding even more. In these environments, Bitcoin dominance tends to rise as capital consolidates into the relative safety of BTC while sidelining altcoins.

While these pullbacks can be uncomfortable, it’s worth remembering this isn’t Bitcoin’s first brush with geopolitical risk. Historically, these moments of fear have provided long-term buying opportunities. The macro trend remains bullish—but in the short term, noise is back in control.

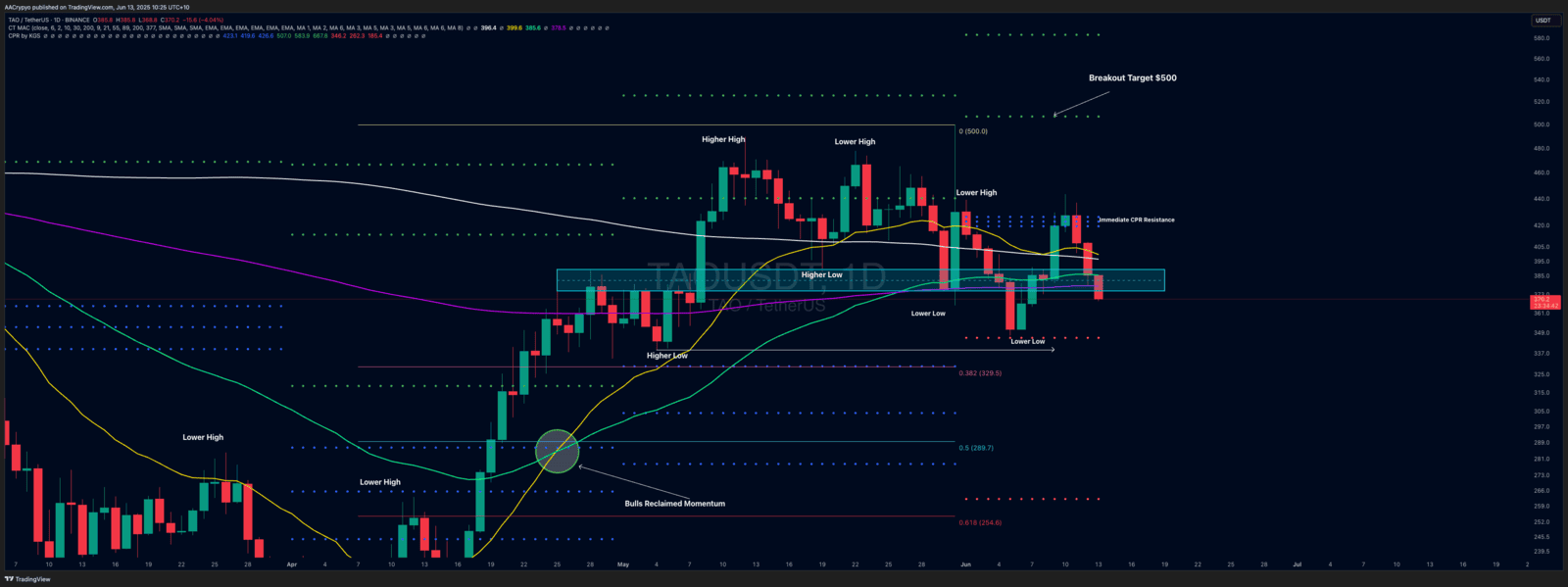

Stormrake Spotlight: Bittensor (TAO) ($370)

Stormrake Spotlight: Bittensor (TAO) ($370)

TAO is suffering alongside the broader market, down nearly 4% since 10am (27 minutes ago at the time of writing). It's now approaching a critical lower low; if that level fails, the bearish structure remains intact. Bulls need to see a hold here to keep any bullish scenario alive.

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action: