To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Yesterday was a tough one for crypto traders, with over $1.7 billion in leveraged positions wiped out. Around $1.6 billion of that came from long positions as Bitcoin broke lower following a weekend of sideways price action. It marked the largest single day of liquidations in over six months.

It was another reminder of the risks of trading with leverage. Meanwhile, spot holders are treating this forced liquidation event as an opportunity to accumulate Bitcoin and altcoins at more favourable prices.

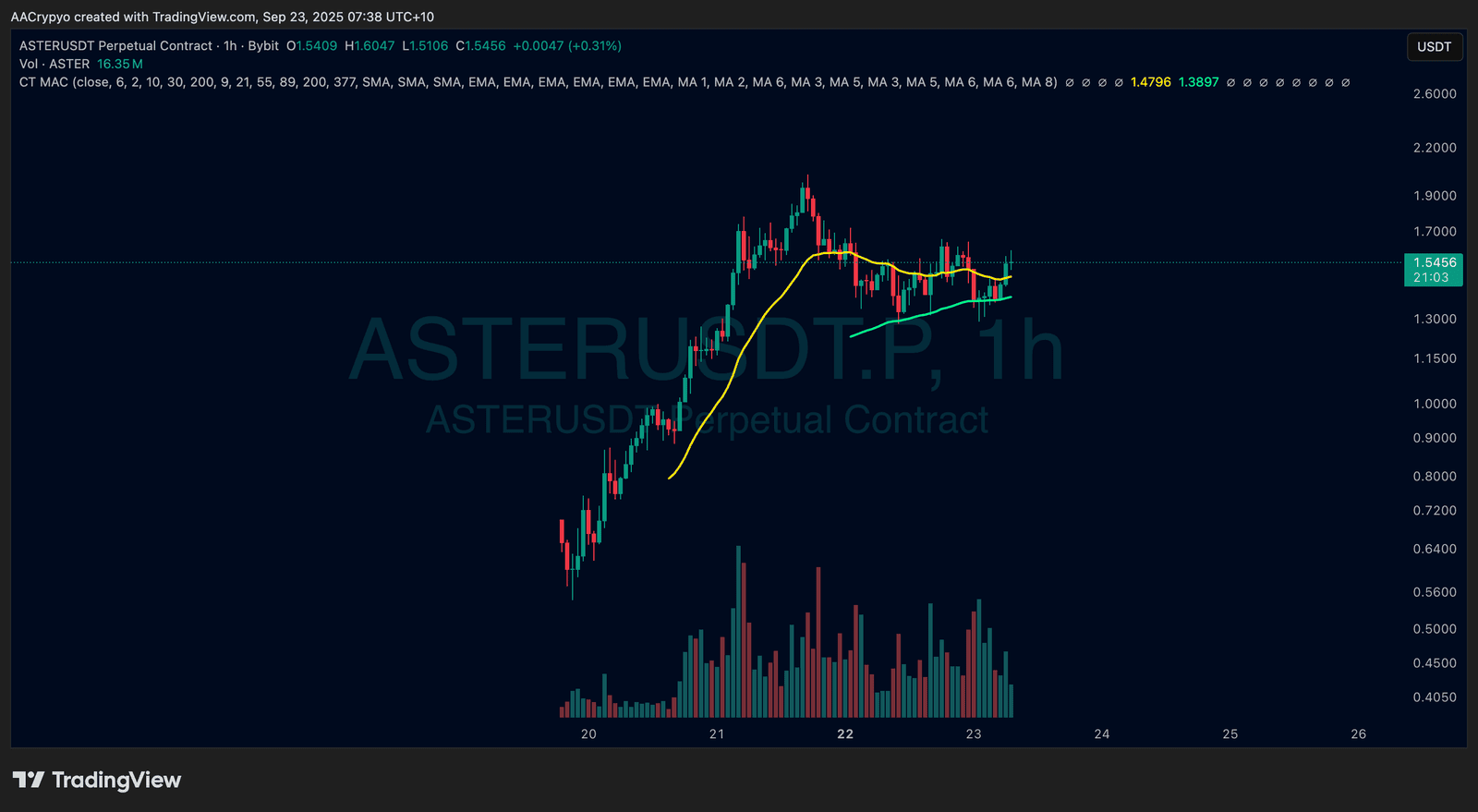

Bitcoin is now back below $113K after dropping more than 2% on the day. Altcoins and the major layer-1s saw deeper drawdowns. Ethereum and Solana both lost over 6%. BNB held up relatively well, falling less than 3%, largely thanks to strength in ASTER which continues to outperform. ASTER briefly turned red during the liquidation flush but quickly bounced, and is now up more than 20% from its intraday low.

This move highlights how a strong narrative can outperform the wider market even when everything else is heading lower. ASTER continues to lead and is showing clear relative strength.

Historically, these liquidation-driven selloffs during bull markets are short-lived. They tend to get bought up quickly, which has been the pattern throughout this cycle. With strong underlying momentum still in place, it is likely we see a return to pre-selloff levels sooner rather than later.

Stormrake Spotlight: Aster (ASTER) ($1.545)

Stormrake Spotlight: Aster (ASTER) ($1.545)