To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

A smidge of volatility for Bitcoin, but it has ended up right where it started yesterday, still hovering around $108K. With US markets closed for the holiday, it was expected to be a quiet session for crypto, and that held true. There were no major announcements from the crypto space or the broader macro landscape that moved the needle.

Altcoins, however, were not as fortunate. Most continued their pullbacks, with losses of over 3% while Bitcoin remained flat. This highlights the vulnerability and bearish tilt currently weighing on the crypto market. Sentiment still leans cautious, with the Fear and Greed Index sitting at 46, reflecting a slightly fearful reading.

Even though traditional markets were closed overnight, last week painted a clear picture through price action in two key assets: gold and silver.

Gold has been leading the charge, notching a week-long green streak and gaining 3% over the last seven days. It now sits just 0.7% away from printing a new all-time high. Silver has joined the rally as well, up over 5% in the past five days, marking its highest level since 2011. The move in both metals signals a clear shift toward risk aversion and gives insight into where broader market confidence currently lies.

The key question now is whether Bitcoin will follow gold as a more defensive asset and push higher, or continue to drift under the weight of bearish sentiment.

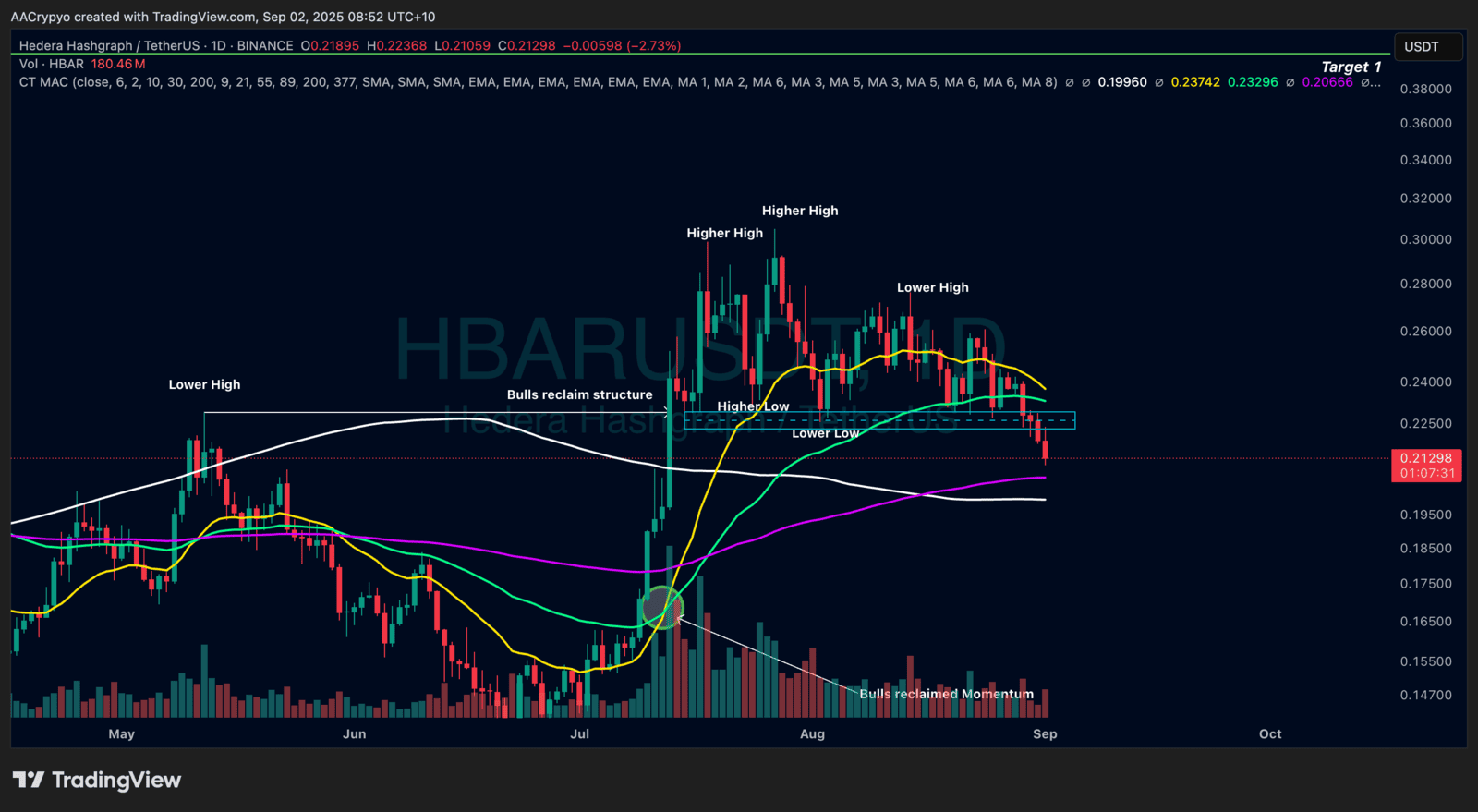

Stormrake Spotlight: Hedera (HBAR) ($0.212)

Stormrake Spotlight: Hedera (HBAR) ($0.212)