To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The US session treated Bitcoin well overnight, with price climbing back above $104.5K in a near 6% turnaround from its low below $99K. The question now is whether this marks a genuine recovery or just a relief rally before bears reassert control.

First, let’s zoom out and look at the broader markets. The S&P 500 was up just 0.37%, its best day since 27 October, helped by strong earnings. Gold bounced just over 1% but remains below $4,000 per ounce, continuing to move sideways and consolidate after its recent correction. The US dollar, which broke its August high and reached the highest level since May, now looks set to post its first red day after a five-day green streak.

So while legacy markets had a decent day, there has been no material shift in sentiment. Risk appetite remains muted, driven by uncertainty around a potential US government shutdown and persistent bubble concerns. Overall sentiment remains in extreme fear, although the S&P 500 Fear & Greed index ticked up one point to 24 whilst Bitcoin’s fear and greed reading has left the extreme fear region and moved up to 27.

In crypto, Bitcoin’s bounce has been a welcome move but bears still have control. Selling pressure remains and Bitcoin’s drop below $100K triggered over $1.6 billion in long liquidations. Many altcoins are up 5% or more on the day, and a few stronger names posted double-digit gains, but most are still trading lower than they were over the weekend. This is not the start of a breakout.

Until Bitcoin can reverse more of the recent drop and reclaim the $112K level, the bears remain in the driver’s seat. That said, these kinds of corrections present rare opportunities to accumulate both Bitcoin and altcoins. This is typical bull market behaviour. Corrections are sharp and fast, and by the time sentiment turns, Bitcoin is already trading higher. Do not try to outsmart the market by waiting for lower. More often than not, those who wait end up buying much higher.

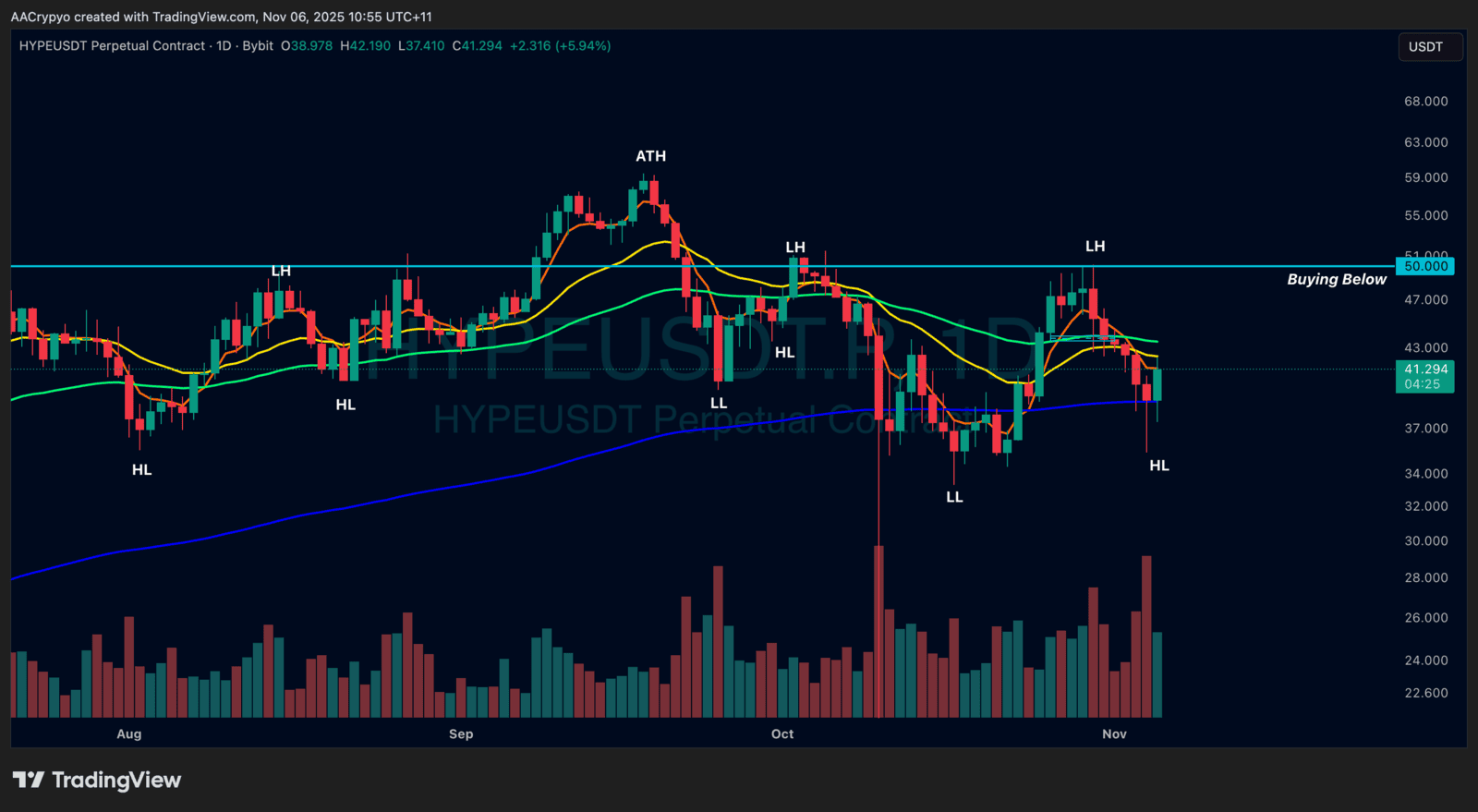

Stormrake Spotlight: Hyperliquid (HYPE) ($41.29)

Stormrake Spotlight: Hyperliquid (HYPE) ($41.29)